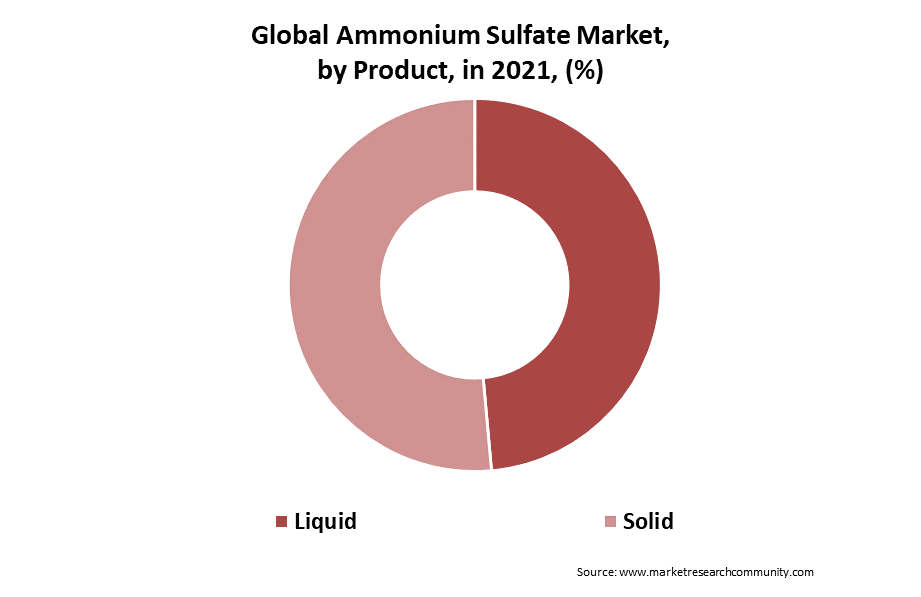

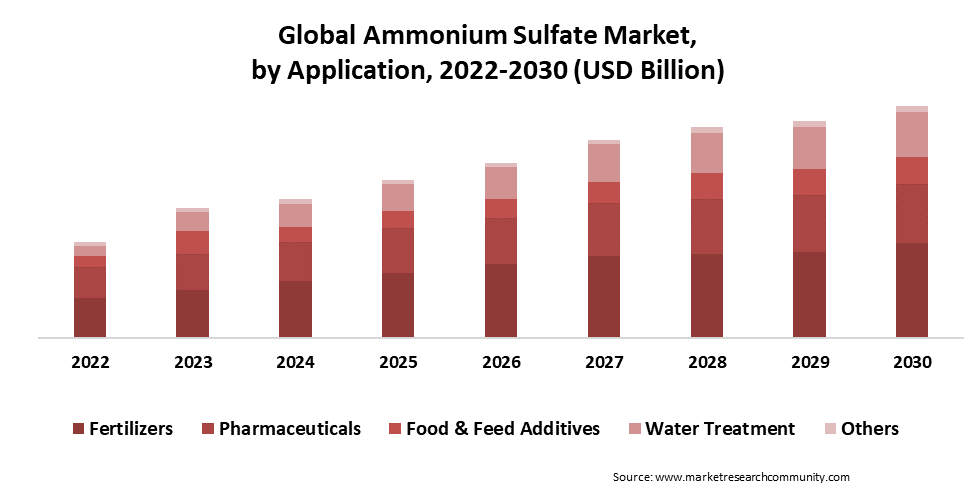

Ammonium Sulfate Market was valued at USD 2.69 Billion in 2021, registering a CAGR of 6.9% during the forecast period (2022-2030), and is projected to be worth USD 4.90 Billion by 2030. The growing demand for ammonium sulphate in the production of nitrogenous fertilisers, which are widely employed in the agricultural industry, can be ascribed to the market expansion. The need for solid ammonium sulphate dominates the market and need for its liquid counterpart is predicted to be driven by the demand for water treatment. Further, The demand for agrochemicals is projected to continue to rise due to the rising global population’s increased demand for food crops.

Ammonium Sulfate Market Dynamics:

An inorganic sulfate salt called ammonium sulfate is produced when sulfuric acid reacts with two equivalents of ammonia. It is a common fertilizer for alkaline soils because it is a high-melting (decomposes over 280°C) white solid that is particularly soluble in water (70.6 g/100 g water at 0°C; 103.8 g/100 g water at 100°C). It functions as fertilizer. Further, ammonium sulfate is both an inorganic sulfate salt and an ammonium salt.

Driver:

Consumption of goods used in fertilizers, which contain sulfur and nitrogen, is the main factor driving the global ammonium sulfate market. Due to its high pH, it is mostly utilized to lessen the acidity of alkaline soils. The product includes Sulphur and nitrogenous components; which plants utilize to make proteins. Additionally, nitrate-based fertilizers are not a good choice for flooded soils used for rice farming since they might cause denitrification and leaching.

Retraint:

The health of humans is considered to be jeopardized by ammonium sulphate. Due to inhalation of water droplets and dust, exposure to the product during production, and during transportation is expected to result in severe respiratory route infection. Prolonged skin contact may result in dermatitis, long-term eye and lung damage. These elements are expected to impede ammonium sulphate market expansion.

Opportunities:

The growing demand for ammonium sulfate in the production of nitrogenous fertilizers, which are widely employed in the agricultural industry, is expected to boost market expansion. The need for solid ammonium sulfate dominates the market and the need for a liquid counterpart is predicted to be driven by the demand for water treatment which is expected to create profitable opportunities for the ammonium sulfate market.

COVID-19 Analysis of Ammonium Sulfate Market:

The COVID-19 pandemic’s influence on public health and the biochip supply chain led to an imbalance in supply and demand. With assistance from academic institutions and biopharma businesses, product demand expanded. For instance, a team of scientists from The Czech Academy of Sciences (the CAS) created a device with a biochip to identify the COVID-19 virus in January 2022. The researchers claim that a biochip is equally accurate and as quick as a PCR test. It is anticipated that the use of biochip technology in a variety of applications will accelerate industrial growth.

Ammonium Sulfate Market Report Cover:

| Report Attributes | Report Details |

| Study Timeline | 2016-2030 |

| Market Size in 2030 (USD Billion) | 4.90 Billion |

| CAGR (2022-2030) | 6.9% |

| By Product | Solid, Liquid |

| By Application | Fertilizers, Pharmaceuticals, Food & Feed Additives, Water Treatment, Others |

| By geography | North America– (U.S., Canada, Mexico)

Europe- (Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe) Asia Pacific- (China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific) Latin America- (Brazil, Argentina, Chile, Rest of Latin America) The Middle East and Africa- (GCC, Turkey, Israel, Rest of MEA) |

| Key Players | BASF SE; Evonik Industries; Lanxess Corporation; Novux International; Sumitomo Chemical; Honeywell International |

Ammonium Sulfate Market Segment Analysis:

By Product

During the forecast period, with a sales share of more than 90.0% in 2021, the solid segment dominated the ammonium sulfate market. The reason for this is a rise in demand for the solid segment. As an organic sulfate salt, ammonium sulfate is typically recognized as a white, odorless solid. It readily dissolves in water but hasn’t been seen to do so in acetone or alcohol. Due to their capacity to improve the nutritional content and Sulphur shortage of alkaline soils, solid ammonium sulfate crystals are widely utilized as fertilizers in this environment. Since the solid or crystalline grade has a higher level of purity, it is projected that it will become more popular in the pharmaceutical sector.

By Application

The segment with the highest revenue share in 2021 with 70.0% was fertilizers in the ammonium sulfate market. Ammonium sulfate, includes both nitrogen and Sulphur, is used as a fertilizer for alkaline soils, which is why there is a demand for it. Over the projected period, rising fertilizer usage is anticipated among economies with a strong agricultural sector. The product decomposes in the soil to produce ammonia, Sulphur dioxide, nitrogen, and water. Plants employ nitrogen and ammonia to create amino acids, while Sulphur is necessary for metabolism.

Fertilizers, food and feed additives, medicines, and water treatment are a few major uses for ammonium sulfate. Since ammonium sulfate is a common ingredient in fertilizer production and is fundamentally used by all major nitrogenous fertilizer producers globally, fertilizers are the main factor driving the ammonium sulfate market. The agricultural sector is being forced to use ammonium sulfate products in fertilizer formulations all over the world due to the rise in demand for food goods. Over the forecast period, the medicines segment is expected to grab a profitable CAGR in the ammonium sulfate market. A vital ingredient in the pharmaceutical sector, ammonium sulfate is frequently employed as an intermediary to fractionate and precipitate protein.

By Region

During the forecast period, with a volume share of nearly 45.0% in 2021, Asia Pacific had the greatest share in the ammonium sulfate market. The demand for fertilizers used in the region’s agriculture industry is expected to rise, and is expected to increase the demand for ammonium sulfate. Several of the economies in this region, including India, Bangladesh, and Sri Lanka, have agriculture as their core industry. Although the agriculture industry is expanding and ongoing research and development are expected to open up a wide range of new opportunities for the industry in the ammonium sulfate market.

Ammonium Sulfate Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. The majority of manufacturers are concentrating on new product launches, improvements to the current product, and mergers and acquisitions. The key player in the market include-

- BASF SE

- Evonik Industries

- Lanxess Corporation

- Novus International

- Sumitomo Chemical

- Honeywell International

- Royal DSM

Royal DSM

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Product Picture of Ammonium Sulfate

- Global Ammonium Sulfate Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief

- Parent Market Overview

- Overall Ammonium Sulfate Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews

- Average Product primary breakdown ratio

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces on market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Therapeutic

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Product Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global Economy

- Covid-19 impact on Ammonium Sulfate Market demand

- Post-Covid Impact on Ammonium Sulfate Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Ammonium Sulfate Market Segmentation, Revenue (USD Billion), (2022-2030)

- By Product

- Solid

- Liquid

- By Application

- Fertilizers

- Pharmaceuticals

- Food & Feed Additives

- Water Treatment

- Others

- By Product

- By Global Ammonium Sulfate Market Overview, By Region

- North America Ammonium Sulfate Market Revenue (USD Billion), by Countries, (2022-2030)

- US

- By Product

- By Application

- Canada

- Mexico

- US

- Europe Ammonium Sulfate Market Revenue (USD Billion), by Countries, (2022-2030)

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Ammonium Sulfate Market Revenue (USD Billion), by Countries, (2022-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- North America Ammonium Sulfate Market Revenue (USD Billion), by Countries, (2022-2030)

- Latin America Ammonium Sulfate Market Revenue (USD Billion), by Countries, (2022-2030)

- Brazil

- Argentina

- Chile

- The Middle East and Africa Ammonium Sulfate Market Revenue (USD Billion), by Countries, (2022-2030)

- GCC

- Turkey

- South Africa

- Global Ammonium Sulfate Market Revenue: Competitive Analysis, 2021

- Key strategies by players

- Revenue (USD Billion and %), By manufacturers, 2021

- Player Positioning by Market Players, 2021

- Competitive Analysis

- BASF SE

- Business Overview

- Business Financials (USD Billion)

- Product Category, Source, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- Swot Analysis

- Evonik Industries

- Lanxess Corporation

- Novus International

- Sumitomo Chemical

- Honeywell International

- Royal DSM

- BASF SE

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.