Carbon Black Market Insights

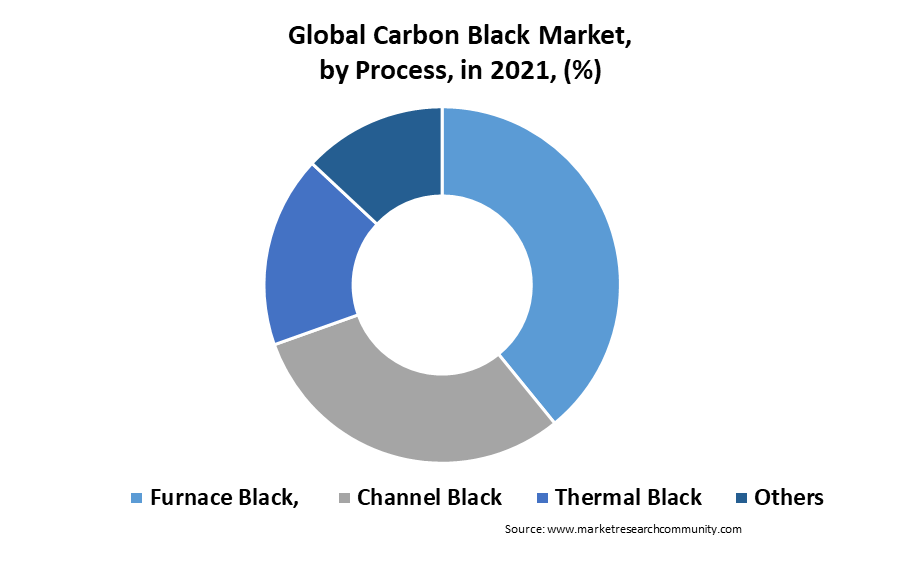

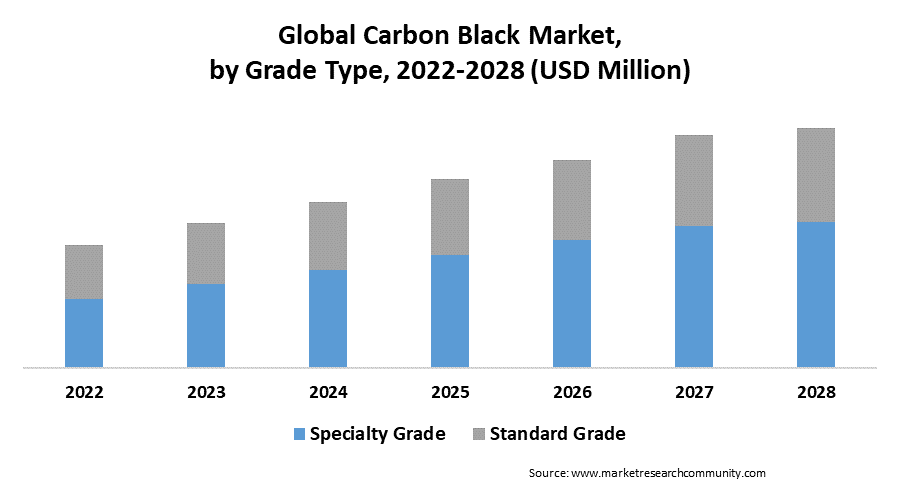

Carbon Black Market is projected to be worth USD 23.19 Billion by 2028, registering a CAGR of 4.54% CAGR during the forecast period (2024-2028), the market was valued at USD 16.1 Billion in 2024. The furnace black sub-segment held the largest share in the process segment due to its high production capacity. Specialty carbon black held the largest share due to its rising use in the inks & coatings and plastic industries. The Asia Pacific is the global market’s leader, owing to high economic growth, rapid industrialization, and urbanization in the regions.

Carbon black is elemental carbon that is produced by partial combustion or decomposition of hydrocarbons such as oil and natural gas under controlled temperature and pressure. It mainly consists of carbon along with small amounts of hydrogen, oxygen, sulfur, and nitrogen. Carbon black is commonly produced by the furnace method that provides high yield and substantial control over the particle structure and size, making it ideal for mass production. It finds wide application across various industries such as automotive and paint. It is also used as a filler and a strengthening agent in tires and several rubber products.

Carbon Black Market Dynamics

Driver:

Growth in the global rubber industry and increasing application of carbon black in plastic and coating industries are likely to drive the carbon black Market.

Restraints:

Stringent environmental regulation related to CO2 emission from carbon black production may restrain North American and European Market.

Opportunity:

A thriving automotive industry fuels demand for tires and rubber in Asia Pacific countries such as India and China, creating enormous opportunities in the carbon black market.

COVID-19 Analysis of Carbon Black Market:

The global spread of the COVID-19 pandemic in 2020 put a significant halt in the growth curve of total global demand for Carbon Black. Numerous restrictions imposed by the governments of various developing nations such as India, China, the United States, and others to contain the severe disease spread. This has resulted in a shortage of raw materials as a result of lockdowns and trade restrictions, resulting in a significant drop in the overall Carbon Black market across nations. Due to COVID-19 crisis, a marginal year-on-year decline in overall Carbon Black demand has been observed in 2020. However, overall global Carbon Black demand is expected to recover in the forecast period. The factors responsible for the growth are the resumption of downstream industry processes following the lifting of restrictions imposed across several nations to prevent disease spread.

Carbon Black Market Report Coverage

| Report Attributes | Report Details |

| Study Timeline | 2016-2028 |

| Market Size in 2028 (USD Billion) | 23.19 |

| CAGR (2024-2028) | 4.54% |

| By Process |

Furnace Black, Channel Black, Thermal Black, Others |

| By Grade Type | Standard Grade, Specialty Grade |

| By Application | Tires, Non-Tire Rubber, Coating, Plastics, Printing Inks, Toners, Others |

| By geography | North America: U.S., Canada, Mexico

Europe: Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe Asia Pacific: China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile, Rest of Latin America The Middle East and Africa: GCC, Turkey, Israel, Rest of MEA |

Carbon Black Market Segmental Analysis:

By Process

The process segment is divided into furnace black, channel black, thermal black, and others. The furnace black sub-segment held the largest share in the process segment. Due to its high production capacity, furnace black is the most commonly used method. It is produced industrially by combining heavy petroleum products, such as coal tar and fluid catalytic cracking (FCC) tar, with vegetable oil. This method enables the mass production of carbon black in a variety of structures and sizes. This type is also widely used as a strengthening agent in rubber production. Furthermore, the rapid adoption of advanced technologies in tire production is also expected to fuel market growth.

Grade Type

The grade type segment is bifurcated into specialty grade and standard grade. Specialty carbon black held the largest share due to its rising use in the inks & coatings and plastic industries. Specialty carbon black is a high-end refined carbon black made from the furnace, channel, acetylene, and lamp black processes. Hydrocarbon is burned in a limited air supply to produce specialty carbon black. The increasing use of specialty carbon blacks in pigmenting, UV stabilizing, and conductive agents are expected to drive market growth.

Application

The application segment is categorized into tires, non-tire rubber, coating, plastics, printing inks, toners, and others. The tires sub-segment contributed the most to the market; however, the plastics segment is expected to grow at the fastest CAGR during the forecast period. The most well-known application of carbon dark is as a pigment and reinforcing phase in vehicle tires. Carbon black allows heat to be conducted away from the tread and belt area of the tire, reducing thermal damage and increasing tire service life. The automotive market is expected to grow significantly as vehicle demand rises. This factor is expected to increase demand for carbon black, especially in tires and seat belts.

By Region

The region segment is divided into Asia Pacific, Europe, North America, Middle East and Africa, Latin America. The Asia Pacific is the global market’s leader, followed by Europe and North America. High economic growth, rapid industrialization, and urbanization in Asia Pacific’s emerging regions have increased regional demand for carbon black. Rising foreign investment and favorable regulatory policies are also contributing to market expansion. The region is rapidly becoming a manufacturing hub, which has surged the demand for the material in recent years. Major manufacturers are shifting manufacturing facilities to countries such as India, China, and Vietnam, which have lower labor costs and government support. Over the forecast period, the rising automotive production is also expected to drive product demand. Initially, the chemical was exported to developing countries such as China, but as their production capacities increased, exports decreased.

Carbon Black Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, a surge in Research and Development (R&D), product innovation, and various business strategies have accelerated the growth of the market. Some of these players in the Carbon Black Market are as follows.

Key Players

- Birla Carbon

- Jiangxi Black Cat Carbon Black Inc. Ltd.

- Cabot Corporation

- Tokai Carbon Co. Ltd

- OCI Company Ltd.

- Bridgestone Corporation

- Himadri Chemicals & Industries Limited

- Orion Engineered Carbons

- Shandong Huadong Rubber Materials

- Phillips Carbon Black Ltd.

Recent Development:

- April 2024- ECORAX Nature, a new renewable carbon black product for rubber applications, has been introduced by Orion Engineered Carbons S.A. This product is made with industrial-grade plant-based oils that are non-fossil derived and renewable.

- June 2024- The Cellforce Group, a joint venture between Porsche and Customcells, has chosen BASF, the world’s leading materials company, to develop the company’s next-generation lithium-ion battery. As part of the collaboration, BASF will provide high-energy HED NCM cathode active materials to produce high-performance and high-energy-density batteries.

FAQ

What is the valuation of Carbon Black Market?

The Carbon Black Market is valued at a USD 23.19 Billion by 2028.

Who are the major players functioning in this industry?

Birla Carbon, Jiangxi Black Cat Carbon Black Inc. Ltd., Cabot Corporation, Tokai Carbon Co. Ltd, OCI Company Ltd. are the major players operating in this industry.

Which region dominated growth of market in 2021?

The Asia Pacific contributed the largest share of the market growth.

What factors are estimated restrain the market growth?

Growth in the global rubber industry and increasing application of carbon black in plastic.

Which is the key process segment in this market?

Furnace Black are anticipated to contribute the largest share to the process segment.

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Product Picture of Carbon Black

- Global Carbon Black Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief:

- Parent Market Overview

- Overall Carbon Black Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews:

- Average primary breakdown ratio

- Executive Summary

- Business Trends

- Regional Trends

- Process Trends

- Grade Type Trends

- Application Trends

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces for market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Distribution Channel

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Technology Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor 81

- Covid-19 impact on Global economy

- Covid-19 impact on Carbon Black demand

- Post Covid Impact on Carbon Black Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Carbon Black Market Analysis Forecast by Process

- Global Carbon Black Segment by Process

- Global Carbon Black Market Revenue Share (%), by Process, 2021

- Global Carbon Black Market Volume (Kilo Tons), by Process, 2016 – 2028

- Global Carbon Black Market Revenue (USD Billion), by Process, 2016 – 2028

- Global Carbon Black Market Volume (Kilo Tons) & Revenue (USD Billion), by Process, 2016 – 2028

- Furnace Black

- Channel Black

- Thermal Black

- Others

- Global Carbon Black Segment by Process

- Global Carbon Black Market Analysis Forecast by Grade Type

- Global Carbon Black Segment by Grade Type

- Global Market Revenue Share (%), by Grade Type, 2021

- Global Market Volume (Kilo Tons), by Grade Type, 2016 – 2028

- Global Market Revenue (USD Billion), by Grade Type, 2016 – 2028

- Global Carbon Black Market Volume (Kilo Tons) & Revenue (USD Billion), by Grade Type, 2016 – 2028

- Standard Grade

- Specialty Grade

- Global Carbon Black Segment by Grade Type

- Global Carbon Black Market Analysis Forecast by Application

- Global Carbon Black Segment by Application

- Global Market Revenue Share (%), by Application, 2021

- Global Market Volume (Kilo Tons), by Application, 2016 – 2028

- Global Market Revenue (USD Billion), by Application, 2016 – 2028

- Global Carbon Black Market Volume (Kilo Tons) & Revenue (USD Billion), by Application, 2016 – 2028

- Tires

- Non-Tire Rubber

- Coating

- Plastics

- Printing Inks

- Toners

- Others

- Global Carbon Black Segment by Application

- Carbon Black by Regions

- Global Carbon Black Market Overview, By Region

- Global Market Revenue, By region

- Global Carbon Black Market Volume (Kilo Tons) & Revenue (USD Billion), 2016-2028

- Global Market Revenue Share (%) by region, 2021

- North America

- North America Market Volume (Kilo Tons) & Revenue (USD Billion), 2016-2028

- Asia Pacific

- APAC Market Volume (Kilo Tons) & Revenue (USD Billion), 2016-2028

- Europe

- Europe Market Volume (Kilo Tons) & Revenue (USD Billion), 2016-2028

- Latin America

- Latin America Market Volume (Kilo Tons) & Revenue (USD Billion), 2016-2028

- Middle East & Africa

- Middle East & Africa Market Volume (Kilo Tons) & Revenue (USD Billion), 2016-2028

- Global Carbon Black Market Overview, By Region

- North America

- North America Carbon Black Market Size by Countries

- North America Market Volume (Kilo Tons) by Countries (2016-2021)

- North America Market Revenue (USD Billion) by Countries (2016-2021)

- North America Market Volume (Kilo Tons), by Process, 2016 – 2028

- North America Market Revenue (USD Billion), by Process, 2016 – 2028

- North America Market Volume (Kilo Tons), by Grade Type, 2016 – 2028

- North America Market Revenue (USD Billion), by Grade Type, 2016 – 2028

- North America Market Volume (Kilo Tons), by Application, 2016 – 2028

- North America Market Revenue (USD Billion), by Application, 2016 – 2028

- United States

- U.S. Market Volume (Kilo Tons), by Process, 2016-2028

- U.S. Market Revenue (USD Billion), by Process, 2016 – 2028

- U.S. Market Volume (Kilo Tons), by Grade Type, 2016 – 2028

- U.S. Market Revenue (USD Billion), by Grade Type, 2016 – 2028

- U.S. Market Volume (Kilo Tons), by Application, 2016 – 2028

- U.S. Market Revenue (USD Billion), by Application, 2016 – 2028

- Canada

- Mexico

- North America Carbon Black Market Size by Countries

- Europe

- Europe Carbon Black Market Size by Countries

- Europe Market Size, by Process, 2016 – 2028

- Europe Market Size, by Grade Type, 2016 – 2028

- Europe Market Size, by Application, 2016 – 2028

- Germany

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Europe Carbon Black Market Size by Countries

- Asia Pacific

- Asia Pacific Carbon Black Market Size by Countries

- Asia Pacific Market Size, by Process, 2016 – 2028

- Asia Pacific Market Size, by Grade Type, 2016 – 2028

- Asia Pacific Market Size, by Application, 2016 – 2028

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- Asia Pacific Carbon Black Market Size by Countries

- Latin America

- Latin America Carbon Black Market Size by Countries

- Latin America Carbon Black Market Size, by Process, 2016 – 2028

- Latin America Carbon Black Market Size, by Grade Type, 2016 – 2028

- Latin America Carbon Black Market Size, by Application, 2016 – 2028

- Brazil

- Argentina

- Chile

- Latin America Carbon Black Market Size by Countries

- Middle East and Africa

- Middle East and Africa Carbon Black Market Size by Countries

- Middle East and Africa Carbon Black Market Size, by Process, 2016 – 2028

- Middle East and Africa Carbon Black Market Size, by Grade Type, 2016 – 2028

- Middle East and Africa Carbon Black Market Size, by Application, 2016 – 2028

- GCC

- Turkey

- South Africa

- Middle East and Africa Carbon Black Market Size by Countries

- Global Carbon Black Market by Players

- Global Carbon Black Market Revenue Share (%): Competitive Analysis, 2021

- Key entry strategies adopted by market players

- Global Market Revenue (USD Billion), By Manufacturer 2021

- Global Market Revenue Share (%), By Manufacturer 2021

- Global Market Player Positioning, By Manufacturer 2021

- Global Carbon Black Market Revenue Share (%): Competitive Analysis, 2021

- Global Carbon Black Market: Recent Development

- Competitive Analysis

- Birla Carbon

- Business Overview

- Birla Carbon Business Financials (USD Billion)

- Birla Carbon Carbon Black Product Category, Type and Specification

- Birla Carbon Main Business/Business Overview

- Birla Carbon Geographical Analysis

- Birla Carbon Recent Development

- Birla Carbon Swot Analysis

- Jiangxi Black Cat Carbon Black Inc. Ltd.

- Cabot Corporation

- Tokai Carbon Co. Ltd

- OCI Company Ltd.

- Bridgestone Corporation

- Himadri Chemicals & Industries Limited

- Orion Engineered Carbons

- Shandong Huadong Rubber Materials

- Phillips Carbon Black Ltd.

- Birla Carbon

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.