Connected Mining Market Insights

Connected Mining Market is projected to be worth USD 21.7 Billion by 2028, registering a CAGR of 12.5% CAGR during the forecast period (2022-2028), The market was valued at USD 9.51 Billion in 2021. The solution segment is anticipated to grow with a high market share as they reduce the threats and liabilities and enhance analytics-based decision-making. Cloud computing is influencing the industries with the most useful technologies by increasing effortless workflow. Further, in the Asia Pacific, China is the most promising contributor in terms of smart mining initiatives due to its advanced infrastructure, and high investment in technologies.

To manage industrial mining operations more efficiently, connected mine is a multi-value solution that coordinates mobile, tracking, analytics, and cloud technology. To control actionable insights and provide a real-time comprehensive view of mining operations, provided via mobile devices to the people who need it. Further, real-time device data (OT) is combined with context data (IT) and applied to industry-specific analytics models.

Connected Mining Market Dynamics

Driver:

A key factor driving the connected mining market is the increase in the need for data management and analytics. As several suppliers combine this data with machine learning, artificial intelligence, smart analytics, and automation to make businesses safer and more productive.

Restraints:

The shortage of skilled workforce is expected to hamper the growth of the market as experts are needed to supervise the transfer of massive amounts of essential data from remote locations.

Opportunity:

Increasing adoption of digitalized solutions such as IoT, AI, and cloud technologies by mining companies to survive and boost high productivity targets in this competitive era is probable to bring good opportunities.

COVID-19 Analysis of Connected Mining Market

The connected mining market has been severely impacted since the COVID-19 epidemic in many different parts of the world. Shipments were impacted during the initial lockdown due to a labor shortage and the closure of a manufacturing facility. The pandemic’s initial effects in China were tremendous. However, the nation’s circumstances have stabilized, and all product and service production rates have increased. Further, post-covid-19, innovation and products launch, mergers, and acquisitions are some of the business expansion strategies employed by the market players to boost market presence. As a result, it is determined that COVID-19’s overall impact on the connected mining market is moderate.

Connected Mining Market Report Coverage

| Report Attributes | Report Details |

| Study Timeline | 2016-2028 |

| Market Size in 2028 (USD Billion) | 21.7 |

| CAGR (2022-2028) | 12.5% |

| By Components | Solution, Services |

| By Solution | Asset Tracking and Optimization, Fleet Management, Other |

| By Services | Professional, Managed |

| By Mining Type | Surface, Underground |

| By Deployment Mode | On-premises, Cloud |

| By Application | Exploration, Processing and Refining, Transportation |

| By geography | North America: U.S., Canada, Mexico

Europe: Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe Asia Pacific: China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile, Rest of Latin America The Middle East and Africa: GCC, Turkey, Israel, Rest of MEA |

Connected Mining Market Segmental Analysis

By Components

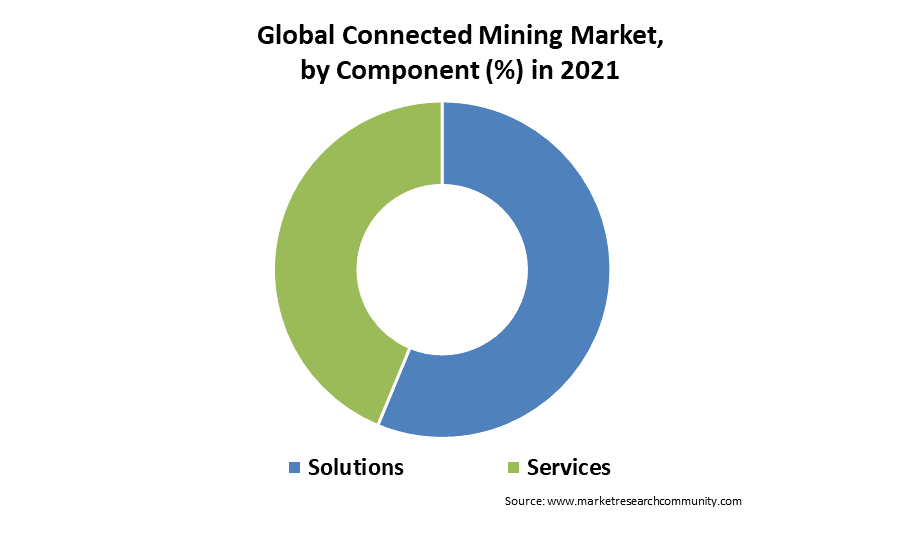

By component, the segment is divided into Solutions, and Services sub-segment. The solution segment is estimated to record the highest market share in the connected mining market during the forecast period. As these solutions enhance analytics-based decision-making and reduce the threats and liabilities in connected mining using efficient tools and techniques.

By Solution

By solution, the segment is divided into asset tracking & optimization, and fleet management, and others. The asset Tracking and Optimization segment is projected to grab a larger market share in the connected mining market. These solutions help in constant tracking, ensure productivity, and track mining vehicles in real-time with GPS location, engine hour, mileage, and fuel consumption.

By Services

By Service, the segment is bifurcated into Professional and Managed. Professional managed services are dominating the service segment of the connected mining market. Professional services include various services such as consulting services, support & maintenance services, and others. Consulting services principally focus on managing the business operation development programs and the latest technology updates to assist the client in achieving strategic business via technical and business improvements.

By Deployment Mode

The deployment Mode segment is bifurcated into on-premises and cloud. Cloud computing is influencing the industries with the most useful technologies. The cloud is used in this deployment mode to supply connected mining solutions. Scalability, speed, 24-hour service, improved IT security, affordability, operational efficiency, and flexibility. Further, low investments are benefits of implementing cloud-based mining solutions. Therefore, the cloud segment is estimated to gain high revenue in the deployment mode segment.

By Application

By Application, the segment is categorized into exploration, processing, and refining, transportation. The exploration segment is anticipated to lift the growth of the application segment in the connected mining market. The factor responsible for the growth of the market is the rapid adoption of technology, the growing automotive sector, and the use of digitalized solutions by the mining industries.

By Region

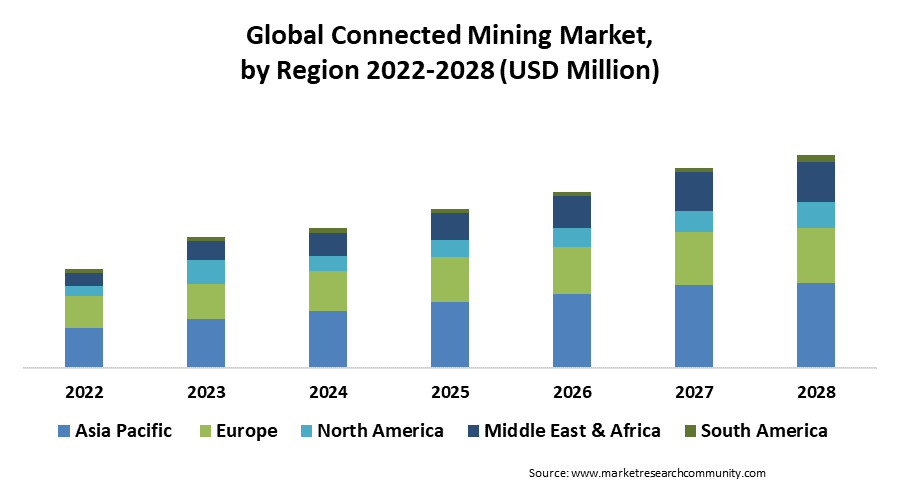

Asia Pacific is estimated to grow at the highest CAGR during the forecast period in the connected mining market. In the Asia Pacific area, China is expected to lead the region, followed by Indonesia, India, the Philippines, and Papua New Guinea (PNG). Further, China is the most promising contributor in terms of smart mining initiatives due to its advanced infrastructure, and high investment in technologies. India might be considered the next high-potential option for the top global-linked mining industry suppliers due to the country’s increasing mineral demand. The expansion of the area’s industrial capacity is being fueled by investment initiatives. In this region, there is a high level of technology adoption in fields including remote monitoring, operational analytics and data processing, and mining safety systems. Hence, Asia Pacific is estimated to dominate the connected mining market.

Connected Mining Market Competitive Landscape

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Some of these players are ABB, IBM, SAP, Cisco, Schneider Electric, Komatsu, Hexagon, Caterpillar, Rockwell Automation, Trimble, Siemens, Howden, Accenture, PTC, Hitachi, Eurotech Communication, Wipro, MST Global, GE Digital, Symboticware, Getac, IntelliSense.io, Zyfra, Axora, GroundHog, SmartMining SpA, and Applied Vehicle Analysis.

Recent Development

- In February 2022, Accenture introduced an Enterprise and Supplier Development (ESD) Marketplace Platform with a mining supply chain focus. To close the gap between mining firms and Small and Medium-sized Enterprises (SME), Adapt Digital Solutions and the Ministry of Mining, Resources, and Energy (DMRE) established the platform (SMEs).

- In 2020, IBM established a digital B2B marketplace for the mining industry. Oren provides creative, digital solutions to speed up the mining business, facilitate digital transactions around the world, and generate insightful data with professionals in the field.

FAQ

What is the Size of Connected Mining Market ?

The Connected Mining Market size is USD 21.7 Billion by 2022 - 2028.

Who are the Key players operating in this industry?

ABB, IBM, SAP, Cisco, Schneider Electric, Komatsu, Hexagon, Caterpillar, Rockwell Automation, are the major players operating in this industry.

Which region contributed the largest share of the market growth?

Asia Pacific contributed the largest share of the market growth.

What is the main market-driving factor?

A key factor driving the connected mining market is the increase in the need for data management and analytics.

Which is the leading components segment in this market?

Solution is anticipated to contribute the largest share to the components segment.

Table of Content

To check our Table of Contents, please mail us at: [email protected]

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.