Electrophoresis Market Insights

Electrophoresis market is projected to be worth USD 4.81 Billion by 2028, registering a CAGR of 6.2% during the forecast period (2022-2028), The market was valued at USD 3.16 Billion in 2021. Electrophoresis reagent dominates the product segment due to the increasing use of consumables in various applications. The research segment led the growth of the market due to the growing application of electrophoreses such as drug discovery, NGS, and others. The Asia Pacific is expected to grab a larger market share in the market due to high investment in the pharmaceutical and biotechnology sector.

Electrophoresis is a technique used to separate proteins and nucleic acids and is primarily used in the analysis of DNA and RNA. The technique is also used in the separation of molecules based on charge, size, and affinity. The ease of handling this technique enables its use in various applications such as vaccine analysis, antibody analysis, diagnosis of hemoglobinopathies, and drug quality control.

Global Electrophoresis Market Dynamics

Driver:

Increasing demand for next-generation sequencing (NGS) and funding from government and private organizations act as major drivers of the electrophoresis market.

Restraints:

High cost of the process and side effects of components for electrophoresis act as restraints to the electrophoresis market.

Opportunity:

Increasing demand for personalized medicine is anticipated to create lucrative opportunities for the electrophoresis market.

COVID-19 Analysis of Electrophoresis Market

The electrophoresis market has been positively impacted since the COVID-19 epidemic in many different parts of the world. With the occurrence of the global pandemic COVID-19, the demand for the electrophoresis technique enhanced due to its application in drug discovery and protein mapping. Further, launch of vaccines in treatment of coronavirus further boosted the demand of electrophoresis market. Therefore, during the pandemic and post-pandemic, the electrophoresis market has seen positive growth.

Electrophoresis Market Report Coverage

| Report Attributes | Report Details |

| Study Timeline | 2016-2028 |

| Market Size in 2028 (USD Billion) | 4.81 |

| CAGR (2022-2028) | 6.2% |

| By Product | Electrophoresis Reagents, Protein Electrophoresis Reagents, Nucleic Acid Electrophoresis Reagents, Electrophoresis Systems, Gel Electrophoresis Systems, Capillary Electrophoresis, Gel Documentation Systems, Electrophoresis Software |

| By Application | Research, Diagnostics, Quality Control & Process Validation |

| By End Use | Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Hospitals, Other End Users |

| By geography | North America: U.S., Canada, Mexico

Europe: Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe Asia Pacific: China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile, Rest of Latin America The Middle East and Africa: GCC, Turkey, Israel, Rest of MEA |

Electrophoresis Market Segment Analysis

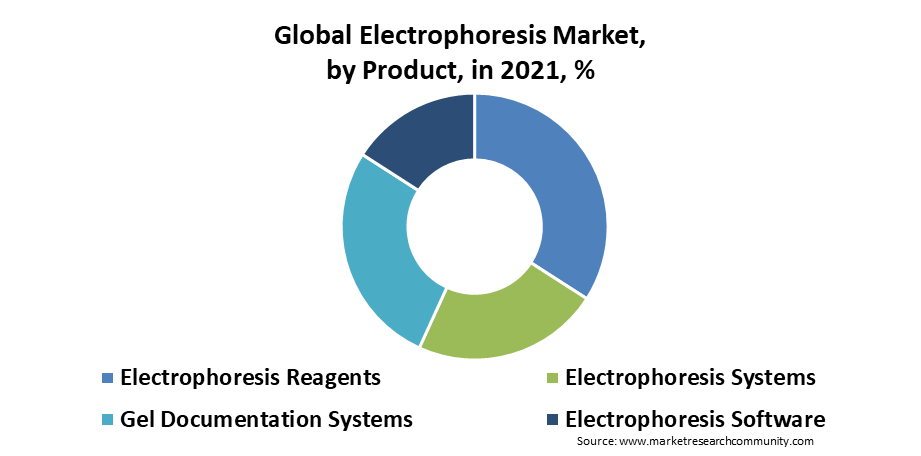

By Product

The product segment is categorized into electrophoresis systems, electrophoresis reagents, electrophoresis software, gel documentation systems. The electrophoresis reagents segment leads the growth of the product segment in the electrophoresis market. Due to the increasing use of consumables and the demand for electrophoresis in drug discovery, antibody development, personalized medicines, and others.

By Application

By application, the segment includes research, diagnostics, quality control & process validation. In application segment and research, segment led the growth of the market due to the growing application of electrophoresis in genomics, drug discovery, proteomics, and antibody research. Moreover, the rising adoption of electrophoresis in biomarker discovery, and NGS is simultaneously supporting the growth of the electrophoresis market.

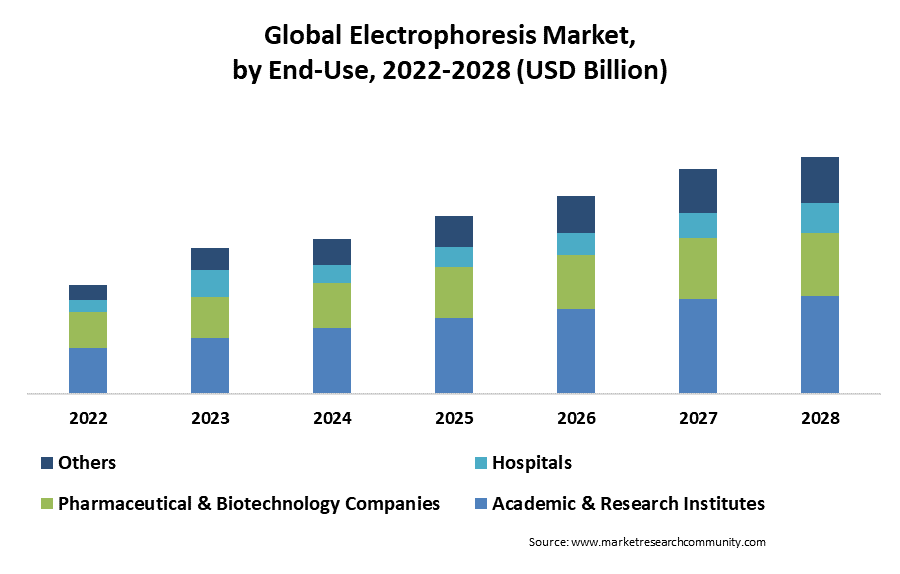

By End Use

The segment is divided into academic & research institutes, pharmaceutical & biotechnology companies, hospitals, and other end users. Academic & research institutes are projected to grab a high revenue share during the forecast period. Owing to increasing industry-academic collaboration, and rising research funding from private and government organizations. This in turn drives the growth of the electrophoresis market.

By Region

The regional segment includes Asia Pacific, Europe, North America, the Middle East, and Africa, Latin America in the electrophoresis market. The Asia Pacific is expected to be the fastest growing region in the electrophoresis market. The factors attributed to the growth of the market are increasing expenditure by pharmaceutical and biotechnology organizations. Further, upsurge in awareness of personalized medicine in the region is expected to support the growth of the electrophoresis market.

Global Electrophoresis Market Competitive Landscape

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and Application launches have accelerated the growth of the electrophoresis market.

Key Players

- Thermo Fisher Scientific Inc

- Bio-Rad Laboratories, Inc.

- Merck Group

- Agilent Technologies, Inc.

- Danaher Corporation

- GE Healthcare

- PerkinElmer Inc.

- QIAGEN N.V.

- Harvard Bioscience, Inc.

- Shimadzu Corporation

- Lonza Group Ltd.

- Sebia Group

- B.S. Scientific Company, Inc.

- Helena Laboratories, Takara Bio, Inc.

- Teledyne Technologies

- VWR International

- TBG Diagnostic Ltd.

FAQ

How much is the Electrophoresis Market valuation?

Valuation of this market is projected to be USD 4.81 Billion by 2028.

Which are the top companies to hold the market share in this market?

Thermo Fisher Scientific Inc, Bio-Rad Laboratories, Inc., Merck Group, Agilent Technologies, Inc., Danaher Corporation are the top companies to hold the market share in this market.

Which region contributed the biggest share of the market growth?

Asia Pacific contributed the biggest share of the market growth.

What is the leading market-driving factor?

Increasing demand for next-generation sequencing (NGS) and funding from government and private organizations act as major drivers of the electrophoresis market.

Which is the main product segment in this market?

The electrophoresis reagents is the main product segment in this market.

Table of Content

To check our Table of Contents, please mail us at: [email protected]

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.