Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market Insights

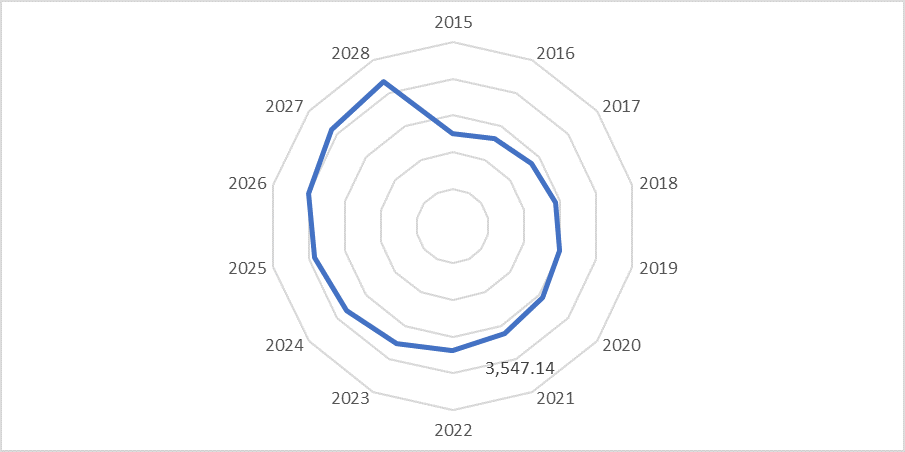

Europe, Asia & North America Long Fiber Thermoplastics (LFT) market garnered market revenue of USD 3,547.14 Mn in 2024 and expected to rise with a CAGR of 8.9% from 2024-2028. The market growth is attributed to the rising demand for lightweight and high-performance solutions for various end-use industries. Automotive is the major end-use industry in the long fiber thermoplastics market. Demand for LFT-D, in the automotive sector, is growing at a faster rate than LFT-G and the trend is expected to continue till 2028 in Long Fiber Thermoplastics (LFT) market.

Long fiber-reinforced thermoplastic (LFT) composites possess superior specific modulus and strength, excellent impact resistance, ease of processability, recyclability, and excellent corrosion resistance. These properties make LFT composites as one of the most advanced lightweight engineering materials and enable their increasing use in various applications.

LFT-D offers a more cost-effective option, than LFT-G and GMT which drives its demand in end use industries. Additionally, most automakers are shifting towards carbon fiber reinforced thermoplastic composites (CFRTP). The Japanese government has been funding projects to establish CFRTP technology in the country. Mitsubishi Chemical Corporation, in January of 2024, announced their plans to construct a pilot compounding plant for carbon fiber–reinforced thermoplastic (CFRTP) compounds in Fukui Prefecture, Japan, in collaboration with the Industrial Technology Center of Fukui Prefecture. Growing demand for lighter automotive and aircraft bodies, coupled with increasing stringency of environmental laws, is driving such demand in Long Fiber Thermoplastics (LFT) market.

COVID-19 Analysis of Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market

Covid-19 has impacted the use of long fiber thermoplastics (LFT) to the decline in various end-use industries such as automotive, aerospace, consumer electronics, and others. They saw a major decline during the first quarter of the Covid-19 pandemic owing to the lockdown. Also, demand for LFT in the market dropped significantly due to disruption in the value chain of the market and low demand for end consumer-based products such as vehicles, electronic consumer goods and others.

In 2020 owing to the pandemic, the global automotive industry saw a decline of 16% in automotive sales compared to 2019. As per the International Organization of Motor Vehicle Manufacturers, U.S. automotive manufacturing declined by 19%, Europe saw a decline of 21% on average, Latin America’s market declined by more than 30%, the African region saw a decline by 35% while the Asia region saw a decline of 10% in production, further, suppressing the demand of LFTs. According to a study of NCBI in 2024, consumer electronics was the most affected industries by the COVID-19 pandemic. Europe, and the United States were impacted more than other commerce because they rely primarily on China for resilient manufacturing and supply chains capabilities.

Post-COVID, the Europe, Asia and North America Long Fiber Thermoplastics (LFT) market gained positive results owing to the increased sales and demand worldwide. LFT market gained a good pace in industries such as automotive, industrial equipment, aerospace & defence, electronics, and others owing to the movement and necessities of people. Also, advancement in Industry 4.0 revolution and rapid launch of new electric vehicles has significantly increased the demand of LFTs. Further, opening of global The LFT market is also expected to boost its growth post-pandemic with the growing consumer electronics industry, other applications, and industries.

Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market Report Coverage

Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market is segmented by Nature, resin type, fiber type, by vertical, and Region. by Type the market is segmented into LFT-G and LFT-D. By resin type, the market is segmented into Glass Fiber and Carbon Fiber. by fiber type the market is segmented into Polypropylene, Polyamide, Thermoplastic polyurethane, Polybutylene terephthalate and Others. by vertical the market is segmented into Automotive, Aerospace & Defense, Electronics, Sports Leisure, Construction and Others. The report also covers the market size and forecasts for the Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market in 17 countries across major regions.

| Report Attributes | Report Details |

| Study Timeline | 2016-2028 |

| Market Size in 2028 (USD Million) | 6,324.71 |

| CAGR (2024-2028) | 8.9% |

| By Type | LFT-G, LFT-D |

| By Resin Type | Polypropylene, Polyamide, Thermoplastic polyurethane, Polybutylene terephthalate, Others |

| By Fiber Type | Glass Fiber, Carbon Fiber |

| By Vertical | Automotive, Aerospace & Defense, Electronics, Sports Leisure, Construction, Others |

| By Geography | North America: U.S., Canada, Mexico

Europe: Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe Asia Pacific: China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific |

Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market Segmental Analysis

Market Research Community provides extensive analysis of the size, share , major trends in each sub-segment of the Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market, along with forecasts at the global, regional and country level from 2024-2028.

LFT-D to Grab a Dominant Share in Europe, Asia & North America Long Fiber Thermoplastics (LFT) market

Europe, Asia & North America Long Fiber Thermoplastics-D (LFT-D) market was valued at USD 2,739.87 million in 2024. LFT-D which is usually known as long fiber thermoplastic direct compounding. The advantage of this technology is high output capacity and flexibility in fiber and polymer-modification in accordance with the customer needs. The key plastics being in use for LFT technology are PP, PET, and PA as they are cost-effective in nature and are easier to obtain from a supply point of view. The key advantage of LFT-D process is the reduction of handling and manufacturing steps compared to the production of semi-finished products. It is also a cost-reducing measure.

Parts make of LFT-D are used in in heavy trucks, golf carts and HVAC components manufacturing in the automobile industry. Polypropylene remains the dominant polymer in the process, though it can handle other thermoplastic resins such as nylon 6. Furthermore, LFT D is cost-effective material composition, in which polypropylene is used as matrix material and long glass fiber as reinforcement are used to manufacture industrial products is anticipated to be propelling the demand for LFT-D in Long Fiber Thermoplastics (LFT) market.

Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market Revenue (USD Million), by LFT-D, 2016-2028

Glass Fiber will Lead Europe, Asia & North America Long Fiber Thermoplastics (LFT) market

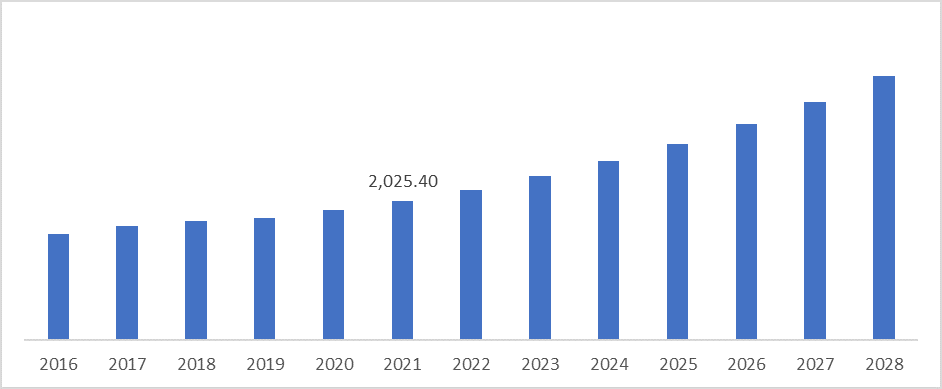

Glass Fiber will lead Europe, Asia & North America Long Fiber Thermoplastics (LFT) market which was valued at USD 2,025.40 million in 2024. Long glass fiber reinforced plastic when compared to commonly used short glass fiber reinforced plastics has triple in flexural modulus, four times the impact strength and can be -30 ℃ environment unchanged. LFRT can meet the needs of a wide range of end users. Due to its high hardness, light weight, corrosion resistance, low cost, and excellent workability, LFRT can be adapted to a variety of complex structures to make it an excellent alternative to metals. For instance, Polyram Group offers long glass fibers Polytron which is fully impregnated through pultrusion process that offers exceptional properties for weight and cost reduction.

Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market Revenue (USD Million), by Glass Fiber, 2016-2028

Asia to Grab Significant Market Share in The Long Fiber Thermoplastics (LFT) Market

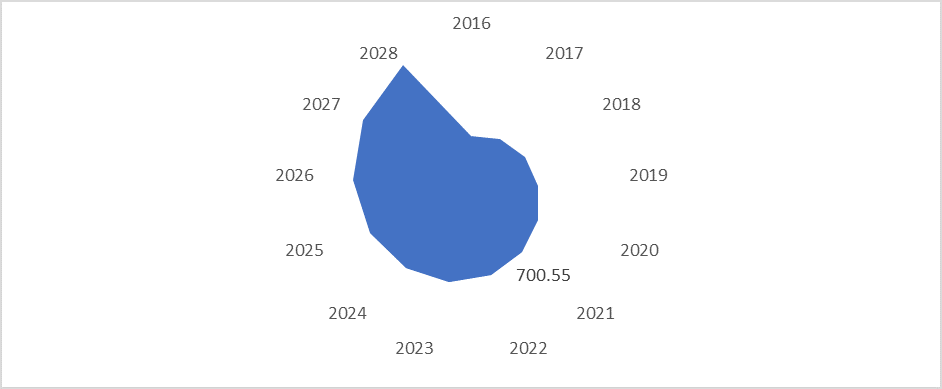

Asia region is the largest market having a market size of USD 1,559.67 million in 2024 of Long Fiber Thermoplastics (LFT) market. With China being the biggest lightweight materials producer in the region has a market size of USD 700.55 million. This is due to the presence of a large number of manufacturers and the growing automobile industry here.

Growth in energy sector positively impacting the use of lightweight materials in this region. The manufacturing of lightweight products is only possible due to the implementation of composite materials for manufacturing most of the industrial key components ranging from automobiles to consumer electronics.

China Long Fiber Thermoplastics (LFT) Market Revenue (USD Million), 2016-2028

China is experiencing a high demand for composites across industries such as aerospace, automobile, construction, and others. According to JEC Group, composite sector is experiencing a surge in demand across sectors such as pipe and tank, followed by construction and electrical and electronic industry. Furthermore, growing demand of industrial products for commercial and residential purpose is influencing the growth of Long Fiber Thermoplastics (LFT) industry size in the region.

Europe, Asia & North America Long Fiber Thermoplastics (LFT) Market Competitive Landscape

The Long Fiber Thermoplastics (LFT) Market studied have intense competition, with a considerable number of regional and Europe, Asia & North America players. The primary strategies adopted by these firms include expansions, product innovations, and mergers and acquisitions.

Key Players

- BASF SE

- Celanese Corporation

- SABIC

- Lanxess AG

- Mitsubishi Chemical Holdings

- PlastiComp, Inc.

- Daicel Polymer Ltd.

- Asahi Kasei Corporation

- RTP Company, Inc.

- Solvay

- Avient

- Technocompound GmbH

- Dieffenbacher

- Kingfa

- Sambarklft Co. Ltd.

- Toray Industries

- Sumitomo Chemical Co. Ltd.

An advanced distribution network gives a competitive edge to the principal market players. Furthermore, players need to innovate continuously, to work and grow in the market, due to the quickly evolving consumer needs and choices.

Recent Developments

- April 2024- SABIC, SABIC announced its collaboration with Mattel, as it becomes the first toy company to incorporate sabic’s certified renewable polymers. The 1st Mattel toy products to enter the market in 2024 will be using certified renewable SABIC PP (polypropylene) polymers.

- March 2024- BASF SE, Bottle manufacturer Yiwu Midi Technology (China) has decided to work with BASF’s product Ultrason P 3010 to manufacture reusable to-go mugs for the market launch of its new business segment.

- December 2024- Celanese Corporation, The Company acquired Santoprene thermoplastic vulcanizates (“TPV”) elastomers business of Exxon Mobil Corporation (“Santoprene”). Included in the acquisition the Santoprene, Dytron and Geolast trademarks and product portfolios. This allowed the company to offer wide range of product offerings to its customers.

Table of Content

To check our Table of Contents, please mail us at: [email protected]

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.