Feller Bunchers Market Overview:

The Feller Bunchers Market size was valued at USD 3,784.65 Million in 2021, registering a CAGR of 4.9% during the forecast period (2022-2030), and the market is projected to be worth USD 5,348.00 Million by 2030.

A feller buncher is a machine that performs the function of cutting and stacking trees. The feller bunchers are available in mainly two categories including tracked feller bunchers and wheeled feller bunchers with different specifications. The tracked feller buncher is used on muddy and slippery areas where wheeled feller bunchers are not used. Rising global population is leading to the increased demand for wood which in turn drives the demand for feller bunchers. The global population is rapidly increasing and has reached over 8 billion in 2022. As per United Nation, the population is expected to reach 9.7 billion by 2050. The increased population needs greater resources including wood. This is leading to an increased demand for wood. Also, urbanization trends across the world are leading to the increased population of cities which is resulting in a rising rate of deforestation. In addition to population growth, infrastructure development in emerging economies is further spurring the demand for feller bunchers. Emerging economies such as India, China, and Vietnam are investing much in structural development. This includes highways & expressways, railways, and energy power plants among others. The growing infrastructure development is enhancing the demand for feller bunchers in emerging economies

Market Dynamics:

Driver:

The feller bunchers are widely used for forestry logging applications to extract timber from forests, owing to factors such as high efficiency, high seed, cost-effectiveness, and several others. In the construction industry, timber is used in the construction of both small and large buildings, along with making doors, windows, and so on. The key factors driving the demand for timber in the construction industry are lightweight, better thermal insulation, and superior strength, thus fueling the demand for feller bunchers for cutting timber trees. In addition, the feller bunchers are also widely used to clear the land for construction projects, which is anticipated to be another factor that is positively impacting the market growth.

Furthermore, the surge in trend toward fire-resistant building construction materials is driving the demand for mass timber in the construction sector. In addition, the mass timber is also considered to withstand earthquakes, hence it is widely used in buildings across earthquake-prone regions such as Japan, California, China, and several others. Moreover, the timber-constructed buildings are considered to be more sustainable as compared to the buildings constructed from the traditional materials. For instance, according to Architecture 2030, a non-profit organization, buildings tend to generate approximately 40% of global CO2 emissions annually, out of which 28% is due to the building operations and 11% is due to traditional building materials. On the contrary, in the buildings constructed from timber, the carbon is majorly sequestered within the structure, which reduces the negative impact of the construction of the greenhouse gas emissions. This is considered to be one of the key factors driving the demand for mass timber, in turn fueling the adoption of feller bunchers.

Additionally, the use of timber in the construction sector also increases the life of buildings, as the ability to absorb the moisture content is below 20% in the timber, thus reducing the risk of fungal or mold growth in the structures. Therefore, owing to the aforementioned factors, timber is widely used in the construction industry. According to the Mass Timber Report by FOREST BUSINESS NETWORK LLC, in 2019 estimated 78 buildings in the United States were constructed using timber, accounting for approximately 4 million square feet of space. The report projects the number of mass timber buildings to double every two years, resulting in demand for 12.9 billion board feet of timber in the U.S. alone by 2034. Similarly, according to the Wood Products Council, around 600 commercial timber buildings were built in the U.S. and as of December 2021, the number has doubled to 1,303 projects constructed or in the construction phase.

Restraint:

Deforestation is most defined as a decrease in forest areas due to activities such as urbanization, logging, mining, agriculture, and several others. Deforestation is considered one of the major environmental challenges faced globally. According to the Food and Agriculture Organization of the United Nations, as of 2020, the area of primary forests worldwide has been reduced by more than 80 million hectares. Similarly, according to Worldwide Forum’s Living Planet report, the present levels of deforestation are anticipated to make the species living in rainforests the most endangered. Agriculture and logging for fuel and wood are considered to be the key factors driving deforestation globally. Therefore, several governments worldwide are implementing regulations and forming partnerships to reduce deforestation.

For instance, at the UN’s Climate Change Conference- COP26 held in October-November 2021, approximately 100 countries committed to halt and reverse deforestation by 2030. Similarly, in November 2021, the EU proposed regulation for deforestation-free products, requiring domestic operators and importers to ensure that products free from deforestation are sold in the EU market. Furthermore, the rising use of recycled timber is also anticipated to restrain the market growth. Timber wood recycling involves tailoring timber that has been used in the past. The use of recycled timber for furniture making is considered to be one of the most environmentally friendly forms of manufacturing.

Feller Buncher Report Coverage:

| Report Attributes | Report Details |

| Study Timeline | 2016-2030 |

| Market Size in 2030 (USD Million) | 5,348.00 million |

| CAGR (2022-2030) | 4.9% |

| By Type | Wheeled Feller Bunchers, Tracked Feller Bunchers |

| By End User | Private Companies, Municipal |

| By Application | Forestry Logging, Building and Maintaining Forestry Roads, Mill yard and Land Management |

| By Distribution Channel | OEM, Aftermarket |

| By Geography | North America– (U.S., Canada, Mexico)

Europe- (Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe) Asia Pacific- (China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific) Latin America- (Brazil, Argentina, Chile, Rest of Latin America) Middle East and Africa- (GCC, Turkey, South Africa, and the Rest of MEA) |

| Key Players | John Deere and Company, Komatsu America Corporation, Volvo Group, Tigercat International Inc., Weiler Forestry, Caterpillar Inc., Komatsu, Barko Hydraulics, LLC, Dougherty Forestry MFG., TimberPro Inc |

Market Segmentation:

By Type

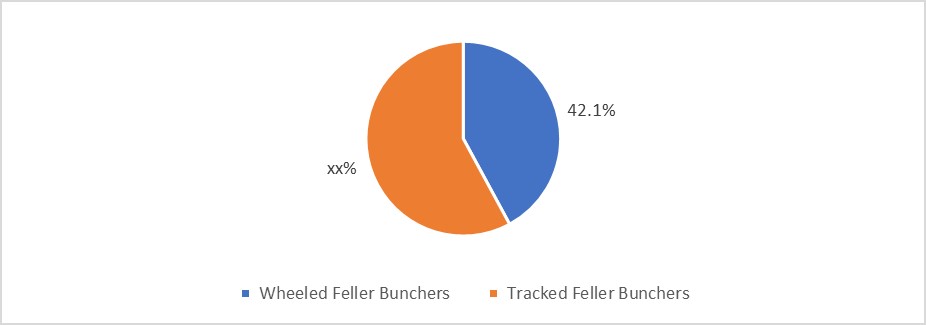

The type segment is divided into Wheeled Feller Bunchers and Tracked Feller Bunchers.

The Tracked Feller Bunchers segment is anticipated to contribute the largest revenue share of over USD 2,544.90 million in the year 2025 during the forecast period. The tracked feller bunchers can be defined as machines having self-leveling cabs that are capable of operating at slopes up to 50%. The cutting head in the tracked feller bunchers is mounted on around 20–25-foot boom. In addition, the tracked feller bunchers tend to have higher stability owing to the lower center of gravity as the heavy undercarriage is built into the machines. The surge in trend towards increasing harvest productivity and minimizing soil compaction is considered to be the key factor driving the adoption of tracked feller bunchers. Moreover, tracked feller bunchers are associated with higher mobility as the machines can swing in a circle without t requirement of backward or forward motion. This is another factor anticipated to fuel the adoption of tracked feller bunchers.

Additionally, the Wheeled Feller Bunchers segment is expected to grow at a CAGR of over 4.2% during the forecast period. The wheeled feller bunchers can be defined as rubber-tired machines. The wheeled feller bunchers can be classified into two types namely 3-wheeled feller bunchers and 4-wheeled feller bunchers. The wheeled feller bunchers are most used on flat terrains and slopes below 25%. The key factor driving the demand for wheeled feller bunchers is their high speed as compared to the tracked feller bunchers, fueling their adoption for landscape applications such as construction and road building. Further, the wheeled feller bunchers are considered to be more versatile since they can be fitted with several attachments, making them suitable for applications such as trenching, digging, material spreading, snow plowing, and several others, this in turn is fueling the market growth. Furthermore, several factors such as cost effectiveness, lower transportation cost, better lifecycle, and so on are anticipated to increase the adoption of wheeled feller bunchers.

Global Feller Bunchers Market, by Type (%), 2021

By Application

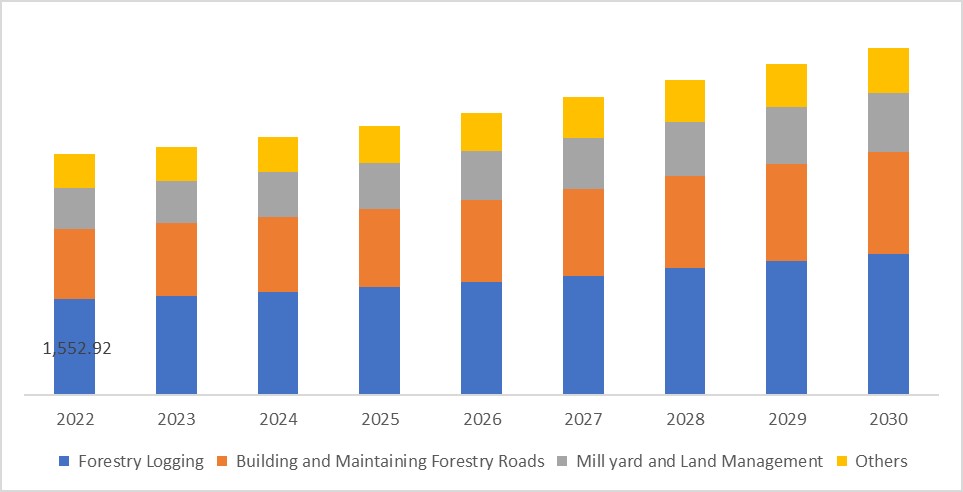

The application segment is divided into Forestry Logging, Building and Maintaining Forestry Roads, Mill yard and Land Management, and Others.

The Forestry Logging segment is expected to account for largest share of approximately 39.9% in 2021. Forestry logging involves activities such as cutting down trees in order to sell them as pulp or timber. Feller bunchers are majorly used for forestry logging applications owing to their ability to cut and gather multiple trees at once. The tracked feller bunchers are most commonly used for these applications since the weight of these machines is equally spread across the tracks having larger surface area, they tend to have a lower impact on the soil compaction. Furthermore, the tracked feller bunchers are capable of floating across the soggy and wet grounds, thus making it suitable for forestry logging applications during all the seasons. Improvements in the cab structure of the feller bunchers such as ergonomic cab designs, improved seat suspension systems, fatigue monitoring systems, increased safety and comfort, and several others are positively impacting the adoption of feller bunchers for forestry logging applications. For instance, Tigercat, one of the leading manufacturers of feller bunchers has introduced new L845E and 845E feller bunchers that tend to increase the harvest productivity and improve the operator comfort.

Global Feller Bunchers Market, by Application 2022-2030 (USD Million)

By Region:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America. In 2021, North America is considered to contribute the largest revenue share of USD 1,652.09 million. The North American region is considered to one of the leading producer and exporter of timber globally, owing to presence of vast coniferous forests in the region. For instance, according to the Food and Agriculture Organization (FAO), the forest cover in U.S. and Canada is approximately 310 million hectares and 347 million hectors. In addition, the region is dominated with presence of some of the largest timberland companies globally including Sierra Pacific Industries, Weyerheauser, Potlatch, Green Diamond Resource, Rayonier, and several others. This is one of the key factors driving the demand for feller bunchers across the region. Furthermore, the United States is one of the leading consumers of pulp and paper products globally. For instance, according to the Food and Agriculture Organization (FAO), the U.S. accounted for consumption of approximately 63.6 million metric tons of paper board and paper in 2020. Moreover, the feller bunchers are considered to be safe equipment as compared to other types of forestry equipment. According to the National Institute for Occupational Safety and Health, the use of feller bunchers has reduced the injury rates in the logging industry.

The Asia Pacific region is anticipated to witness substantial growth during the forecast period with a CAGR of 5.5%. The increasing use of wood as a construction material in countries such as Japan and China is anticipated to boost the market growth of feller bunchers. Additionally, the surge in trend towards green buildings in the region is also expected to enhance the use of feller bunchers in construction projects in APAC. According to the World Economic Forum data 2021, Asia accounts for around 50% of the global emissions and this trend is expected to continue with more construction activities. Thus, to reduce the greenhouse emissions, major countries across the region are expected to adopt the model of green buildings which is increasing the utilization of timber and wood in various projects. Moreover, a significant rise in construction projects in the region is attributed to be one of the key factors fueling the market growth. For instance, on 28th September 2021, Shibaura 1 Chome Project was started in Tokyo, Japan. The project will replace Hamamatsucho Building with two new towers of 235-meter height.

Feller Bunchers Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and application launches have accelerated the growth of the Global Feller Bunchers Market. Key players in the market include-

- John Deere and Company

- Komatsu America Corporation

- Volvo Group

- Tigercat International Inc.

- Weiler Forestry

- Caterpillar Inc.

- Komatsu

- Barko Hydraulics, LLC

- Dougherty Forestry MFG.

- TimberPro Inc.

Table of Content

To check our Table of Contents, please mail us at: [email protected]

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.