Key Market Overview:

Generic drugs market size was worth USD 412.2 Billion in 2024 and is projected to reach around USD 667.3 Billion by 2032, growing at a CAGR of 5.5% during the forecast period (2024-2032).

The increased expenditures by the governments of major countries on the healthcare infrastructure especially the development and availability of mass medications. For instance, according to the Commonwealth Fund, the U.S. spent over 17.1% of the GDP on healthcare followed by Switzerland with a contribution of over 12.3% to healthcare. Thus, the rising emphasis on healthcare improvements by major governing and regulatory bodies in terms of the production of medical interventions is expected to boost industry growth during the forecast period.

Furthermore, the growing prevalence of chronic ailment among the population is anticipated to witness significant growth owing to the rising sedentary lifestyle due to hectic schedules. For instance, as per the research conducted by the Centre for Disease Control and Prevention in coalition with the U.S. Department of Health & Human Services, around 51.9% of the US adult patients are diagnosed with a minimum of 1 out of 10 chronic conditions like cancer, arthritis, coronary heart diseases, chronic obstructive pulmonary diseases, diabetes, stroke, hypertension, hepatitis, weak or failing kidneys. Thus, the rising consumption of generic drugs for the treatment of such ailments among the population is anticipated to witness significant growth during the projected period. In the context of the region, North America is estimated to contribute the largest share to the industry growth owing to the growing consumption of medicinal drugs for the treatment of chronic diseases, the large presence of the market players, and high disposable income among the population.

Market Dynamics:

A generic drug is a medication produced to be similarly marketed as the brand-name drugs in terms of safety, route of administration, strength, performance characteristics, quality, intended use, and dosage form. Such similarities help to validate bioequivalence, which confirms that the generic medicine works identically while providing the same medical benefit as the intended brand-name medicine.

Driver:

The growing rate of chronic diseases such as cardiovascular disease, cancer, respiratory disease, and diabetes is the major factor that boosts the generic drugs market statistics owing to the increased consumer need for therapeutic interventions. Furthermore, the availability of generic drugs at lower costs as compared to the branded counterparts and growing government initiatives for easy access to the generics fuels the market growth during the forecast period due to the surging expenditure on manufacturing facilities.

Restraint:

The stringent regulatory protocols for the launching of new medical drug interventions hamper the market growth during the forecast period owing to the growing concerns related to patient safety. Additionally, the presence of drug duplicates or copies also hampers the market growth due to the increased risks of adverse effects coupled with the growing consumer awareness in terms of consumption of the clinically prescribed medicines.

Opportunities:

The growing research and development spending on the production of new medical interventions in terms of innovative formulations that are cost-effective treatments and have fixed dosages are expected to provide lucrative opportunities for market growth during the forecast period. Also, the growing emergence of partnering and licensing strategies among market players for the launches of new products at competitive prices is expected to create profitable opportunities for the market growth owing to the favorable government reimbursements for the mass availability of medicinal drugs.

COVID-19 Impact:

The generic drugs market has been significantly impacted especially during the COVID-19 pandemic. The disruptions in pharmaceutical supply chains coupled with the temporary shutdowns of doctor clinics and. However, the medical supply chains that are imperative to delivering medicines for the treatment of COVID-19 and related diseases, such as normal fever, cold, cardiovascular, and others experienced a sudden rise in sales as the result of overwhelming end-use demand. However, the pandemic caused the termination of elective procedures, which led to the consumption of the prescribed medicines. Post covid-19, the market growth is anticipated to grow consistently due to the growing consumption of prescribed generic drugs as preventive and therapeutic interventions for the treatment of chronic diseases such as high blood pressure, diabetes, arthritis, and others.

Generic Drugs Report Coverage:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 (USD Billion) | 667.3 Billion |

| CAGR (2024-2032) | 5.5% |

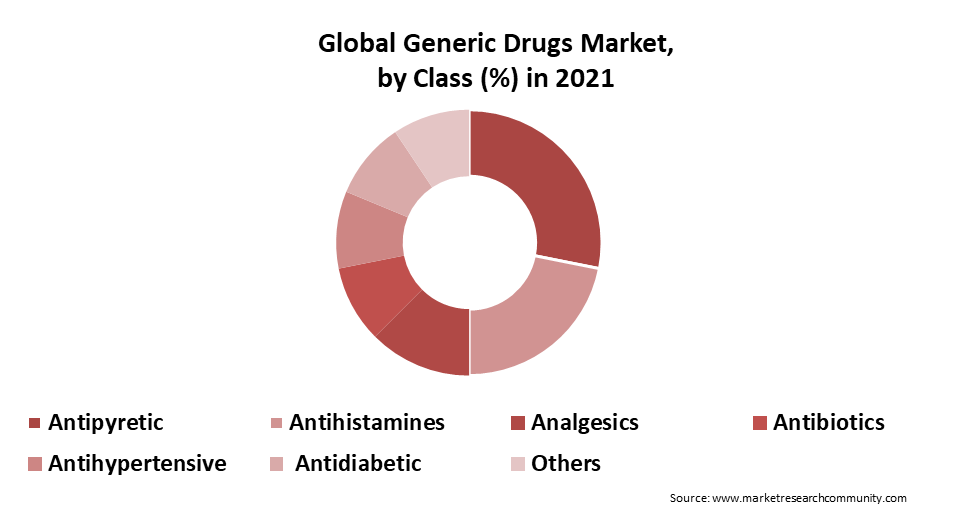

| By Class | Antipyretics, Analgesics, Antibiotics, Antidiabetic, Antihypertensive Antihistamines, and Others |

| By Route of Administration | Oral, Topical, Injectable, and Others |

| By Therapeutic Application | Central nervous system (CNS), Cardiovascular, Respiratory, Oncology, Dermatology, and Others |

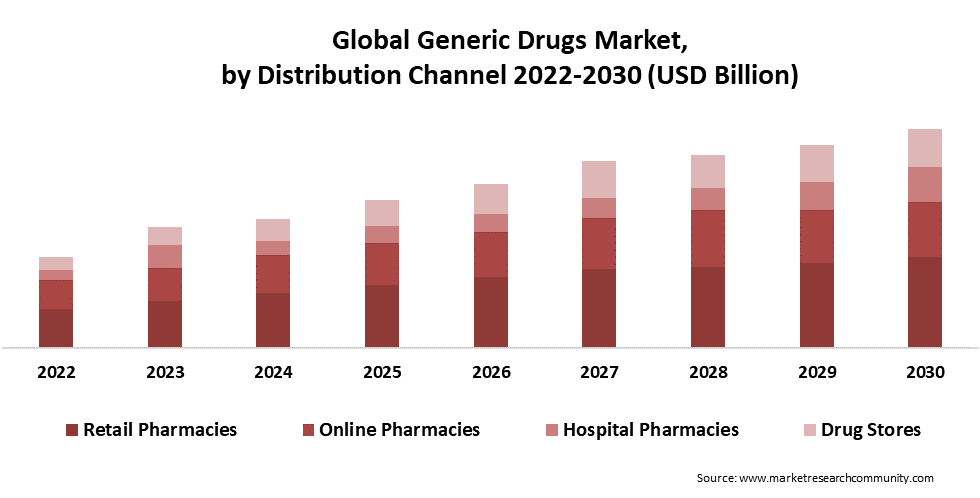

| By Distribution Channel | Hospital Pharmacies, Drug Stores, Retail Pharmacies, and Online Pharmacies |

| By Geography | North America– (U.S., Canada, Mexico)

Europe- (Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe) Asia Pacific- (China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific) Latin America- (Brazil, Argentina, Chile, Rest of Latin America) Middle East and Africa- (GCC, Turkey, Israel, and the Rest of MEA) |

| Key Players | Cipla Inc., Pfizer Inc., Sun Pharmaceutical, Viatris Inc., Teva Pharmaceutical Industries Ltd., Novartis AG, Fresenius SE & Co. KGaA, Aurobindo Pharma Limited, Lupin Ltd., Aspen Holdings, Apotex Inc., Reddy’s Laboratories |

Market Segmentation:

By Class

The class segment is separated into antipyretic, antihistamines, analgesics, antibiotics, antihypertensive, antidiabetic, and others. The antipyretic segment is expected to contribute the largest revenue share to the industry growth. The factors such as the increased usage for the reduction of a fever combined with the availability as the widely applicable medicine to the range of age groups are estimated to support the contribution of the antipyretic segment in generic drugs market growth. Furthermore, the antihistamines segment is projected to register the fastest CAGR growth during the forecast period owing to the increased demand as the first medication for relieving the allergy symptoms such as high rates of allergies among the population such as hives, hay fever, reactions to stings or insect bites and conjunctivitis combined with the growing usage as the drug interventions for the prevention of motion sickness and the short-term treatment in case of insomnia.

By Route of Administration

The route of administration segment is categorized into oral, topical, injectable, and others. The oral segment registered the largest share over 90.1% of the industry growth during the forecast period. The factors such as easy convenience of the drug administration through the oral route, growing patient preference, wide availability due to cost-effectiveness, and rising ease of the large-scale production of oral dosage forms are estimated to support the growth of the oral segment. Additionally, the topical segment is also anticipated to witness substantial growth during the projected period owing to the effective profiling for adverse effects, high concentration of the drug without affecting the overall blood circulation, and low risks of substance abuse.

By Therapeutic Application

The therapeutic application segment is divided into the central nervous system (CNS), cardiovascular, dermatology, oncology, respiratory, and others. In 2024, the oncology segment is anticipated to account for the largest contribution of over USD 46.4 billion to the generic drugs market share. The factors such as the increased consumption of medications especially for the treatment of oncology disorders combined with the rising research and development expenditures on the production of medications for oncology patients to relieve pain and discomfort are estimated to support the oncology segment growth. Furthermore, the cardiovascular segment is also expected to register the fastest CAGR growth in terms of volume owing to the improved scalability of the digital therapeutic solutions, enhanced reach to the wider customer base especially medical professionals and trainers coupled with the increased emphasis on customer-centric service provision such as improved customer support in health devices for continuous health tracking.

By Distribution Channel

The distribution channel is separated into hospital pharmacies, drug stores, retail pharmacies, and online pharmacies. Retail pharmacies are anticipated to account for the largest market share in terms of revenue. The factors such as the large stock of medicinal drugs inventory, improved emphasis on providing prescription-based medicines, and competitive medicine prices are expected to support the growth of retail pharmacies. Additionally, online pharmacies are also projected to witness significant growth during the forecast period owing to the growing customer awareness in the favor of e-commerce platforms, especially for prescription-based generic drugs such as antihistamines, antibiotics, and others combined with the rising emergence of e-pharmacy in terms of time and cost saving aspect of purchasing the generic medical drugs.

By Region

The regional segment includes Asia Pacific, Europe, North America, the Middle East, and Africa, Latin America. North America is expected to contribute the largest revenue share to the market growth. The factors such as the increased consumer awareness in terms of consumption of generic drugs as preventive and therapeutic interventions coupled with the growing government expenditures on mass availability of the medicines and the large presence of major market players are estimated to accelerate the market growth in the North American region.

Asia Pacific is also anticipated to account for the largest CAGR growth during the projected period owing to the presence of large numbers of patients with increased demand for generic drugs as interventional and therapeutic solutions, augmented expenditure on the medical infrastructure in terms of access to the large medicine inventory combined with the increased prescription-based medical routine especially of the geriatric population for treatment of multiple chronic diseases.

Generic Drugs Market Competitive Landscape:

The competitive landscape of the generic drugs industry helps in gaining a better understanding of the latest outlook of the global market coupled with the regulatory policies of the country. The research forecast also helps in assessing the future evolution of the industry by offering measurable and qualitative insights on market valuation, development trends, and size for global market segments. The key players operating in the market include-

- Cipla Inc.

- Pfizer Inc.

- Sun Pharmaceutical

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Fresenius SE & Co. KGaA

- Aurobindo Pharma Limited

- Lupin Ltd.

- Aspen Holdings

- Apotex Inc.

- Reddy’s Laboratories

FAQ

What is the projected value of the Generic Drugs Market?

The Generic Drugs Market is worth USD 667.3 Billion by 2030.

Who are the major players operating in this industry?

Cipla Inc., Pfizer Inc., Sun Pharmaceutical, Viatris Inc., Teva Pharmaceutical Industries Ltd. are the major players operating in this industry.

Which region contributed the largest share of the market growth?

North America is expected to contribute the largest share of the market growth.

What is the main market-driving factor?

The growing rate of chronic diseases such as cardiovascular disease, cancer, respiratory disease, and diabetes.

Which is the leading product segment in this market?

Antipyretics are augmented to contribute the largest share to the product segment.

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Product Picture of Generic Drugs

- Global Generic Drugs Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief

- Parent Market Overview

- Overall Generic Drugs Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews

- Average primary breakdown ratio

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces on market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Distribution Channel

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Technology Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global Economy

- Covid-19 impact on Generic Drugs demand

- Post-Covid Impact on Generic Drugs Market Demand

- Impact Analysis of the Russia-Ukraine Conflict

- Drivers

- Global Generic Drugs Market Segmentation, by Volume (Tons) & Revenue (USD Billion), (2022-2030)

- By Class

- Antipyretic

- Antihistamines

- Analgesics

- Antibiotics

- Antihypertensive

- Antidiabetic

- Others

- By Route of Administration

- Oral

- Topical

- Injectable

- Others

- By Therapeutic Application

- Central nervous system (CNS)

- Cardiovascular

- Dermatology

- Oncology

- Respiratory

- Others

- By Distribution Channel

- Hospital Pharmacies

- Drug Stores

- Retail Pharmacies

- Online Pharmacies

- By Class

- Global Generic Drugs Market Overview, By Region

- North America Generic Drugs Market Volume (Tons) & Revenue (USD Billion), by Countries, (2022-2030)

- US

- By Class

- By Route of Administration

- By Therapeutic Application

- By Distribution Channel

- Canada

- Mexico

- US

- Europe Generic Drugs Market Volume (Tons) & Revenue (USD Billion), by Countries, (2022-2030)

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Generic Drugs Market Volume (Tons) & Revenue (USD Billion), by Countries, (2022-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- North America Generic Drugs Market Volume (Tons) & Revenue (USD Billion), by Countries, (2022-2030)

- Latin America Generic Drugs Market Volume (Tons) & Revenue (USD Billion), by Countries, (2022-2030)

- Brazil

- Argentina

- Chile

- Middle East and Africa Generic Drugs Market Volume (Tons) & Revenue (USD Billion), by Countries, (2022-2030)

- GCC

- Turkey

- South Africa

- Global Generic Drugs Market Revenue: Competitive Analysis, 2021

- Key strategies by players

- Revenue (USD Billion and %), By manufacturers, 2021

- Player Positioning by Market Players, 2021

- Competitive Analysis

- Cipla Inc.

- Business Overview

- Business Financials (USD Billion)

- Product Category, Type, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- Swot Analysis

- Pfizer Inc.

- Sun Pharmaceutical

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Fresenius SE & Co. KGaA

- Aurobindo Pharma Limited

- Lupin Ltd.

- Aspen Holdings

- Apotex Inc.

- Reddy’s Laboratories

- Cipla Inc.

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.