Robo Advisor Market Insights

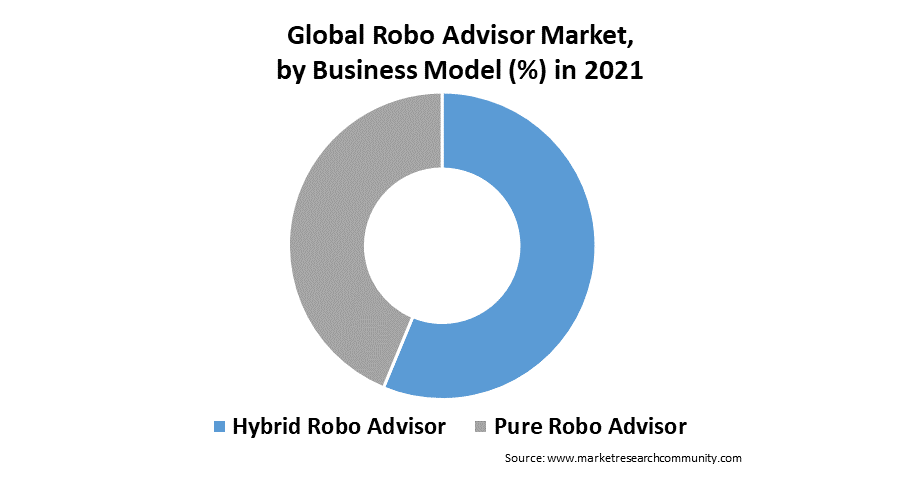

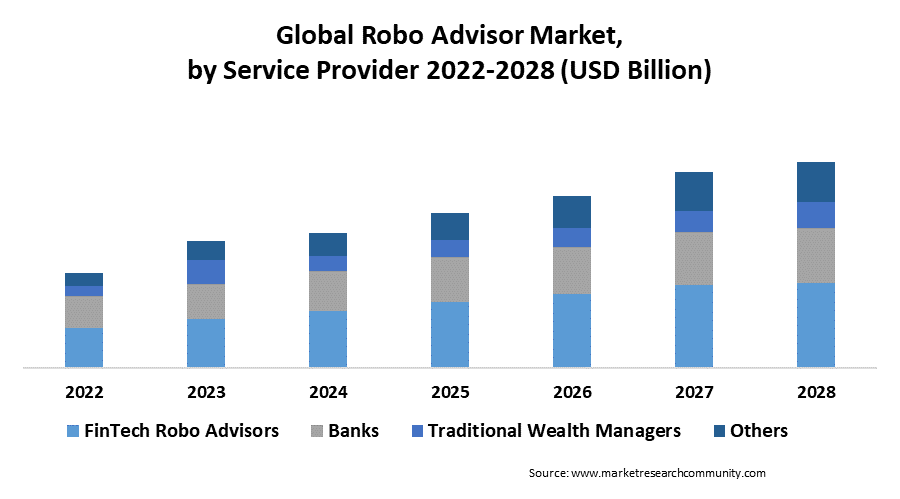

Robo Advisor Market is projected to be worth USD 72.41 Billion by 2028, registering a CAGR of 37.9% CAGR during the forecast period (2022-2028), the market was valued at USD 8.08 Billion in 2021. The hybrid robo advisor is dominating the business model segment as it provides financial guidance services along with the presence of a human advisor. The fintech robo advisors segment led the market due to the adoption of robo advisors by the fintech industry drives the market growth. North America dominated the robo advisory market due to the adoption of advanced technology for managing and controlling the financial assets.

A robo advisor is a software that assists investors in managing their funds, portfolios, and investments online with minimal human intervention. Through an online questionnaire, it collects all relevant information from clients such as investment timeline, risk tolerance, and returns on savings. Robo advisors use algorithm calculations to analyze data and provide a comprehensive asset allocation strategy that meets the investor’s objectives.

Robo Advisor Market Dynamics

Driver:

Rapid digitalization of financial services, preference for robot advisory over traditional investment services, and demand for cost-effective investment advisory are the factors driving the market growth.

Restrain:

Robo-advisors are software that runs on hardware and can be accessed via the internet and devices. This enables hackers and thieves to gain access to consumers’ accounts. Thus, restraining the market growth.

Opportunity:

Increased consumer expectations for higher returns on lower investments, rising awareness about the benefits of robo advisory are expected to provide lucrative opportunities in Asia Pacific market expansion.

COVID-19 Analysis of Robo Advisor Market:

The detrimental effects of COVID-19’s global expansion on numerous countries have shocked governments around the world, prompting them to act decisively to stop COVID-19. The first strain of Coronavirus was identified in Wuhan, China in December 2019 which affected the entire world. On a rise in infection across various nations, around 212 countries were infected by the pandemic. Most of companies in numerous nations have been severely impacted by the global crisis COVID-19 pandemic. Although the COVID-19 outbreak harmed the global economy, SMEs, stock markets, and entire wealth management services. The robo advisory market has seen a massive surge as a result of increased demand for optimized wealth management during this pandemic.

Robo Advisor Market Report Coverage

| Report Attributes | Report Details |

| Study Timeline | 2016-2028 |

| Market Size in 2028 (USD Billion) | 72.41 |

| CAGR (2022-2028) | 37.9% |

| By Business Model | Pure Robo Advisors, Hybrid Robo Advisors |

| By Service Provider | FinTech Robo Advisors, Banks, Traditional Wealth Managers, Others |

| By Service Type | Direct Plan-Based, Comprehensive Wealth Advisory, other |

| By End-Use | Retail Investor, High Net Worth Individuals |

| By geography | North America: U.S., Canada, Mexico

Europe: Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe Asia Pacific: China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile, Rest of Latin America The Middle East and Africa: GCC, Turkey, Israel, Rest of MEA |

Robo Advisor Market Segmental Analysis:

By Business Model

The segment is bifurcated into hybrid robo advisor and pure robo advisor. The hybrid robo advisor sub-segment is expected to dominate the business model segment. As it provides financial guidance, financial planning, and professional account management services. Many hybrid robo advisors provide guidance and planning services via phone or video calls with human financial advisors. Meeting over the phone and via computer or app-based video conferencing can be less expensive than meeting in person with a traditional financial advisor. Thus, the hybrid robo advisors sub-segment is contributing to the robo advisors market growth.

By Service Provider

The service provider segment is divided into fintech robo advisors, banks, traditional wealth managers, and others. The fintech robo advisors segment led the robo advisory market by the service provider and is expected to maintain its dominance throughout the forecast period. The adoption of robo advisors by the fintech industry to increase revenue opportunities drives the market growth. Moreover, banks are expected to grow at the fastest rate, owing to the rise in digitization in the banking sector and growing need among banks to support and improve consumer needs.

By Service Type

The service type segment is divided into direct plan-based, and comprehensive wealth advisory. The comprehensive wealth advisory sub-segment has the largest share in the service type segment. It provides access to multiple services such as customized investment solutions, asset management, retirement income planning, financial planning, and household budget management. Comprehensive wealth management is like financial intermediaries where they try to meet consumers’ financial management needs. Hence, the comprehensive wealth management sub-segment is contributing significantly to market growth.

End-Use

The End-use segment is categorized into retail investors and high net worth individuals. High Net worth Individuals (HNWI) are expected to dominate the market in the forecast period. A growing number of HNWIs demonstrated measurable interest and desire for improved digital and personalized financial planning offerings.

Personal capital, betterment, vanguard personal advisor, and many other robo advisors are available in the market for HNI. The growing population of HNIs around the world and need for robo advisors to make decisions such as business funding or succession planning, have boosted market demand globally.

By Region

The region segment is divided into Asia Pacific, Europe, North America, Middle East, and Africa, Latin America. North America dominated the robo advisory market and is expected to maintain its position throughout the forecast period. The adoption of advanced technology for managing and controlling financial assets in the region is contributing in the market growth. The presence of major key players such as Wealthfront Corporation in the United States, are the major factors driving the market in this region.,

Robo Advisor Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, surge in Research and Development (R&D), product innovation, and various business strategies have accelerated the growth of the market. Some of these players in Robo Advisory Market are as follows.

Key Players

- Wealthfront Corporation

- Fincite

- Betterment

- Charles Schwab & Co., Inc.

- Ellevest

- Ginmon Vermögensverwaltung GmbH

- SigFig Wealth Management

- Social Finance, Inc.

- Wealthify Limited

- THE VANGUARD GROUP, INC.

Recent Development:

- May 2020 – UOBAM launches Robo-advisory services, UOBAM Invest, which provides customized investment portfolios online to assist businesses in meeting their investment objectives. UOBAM Invest will be available to corporate investors with a minimum investment of RM 500,000.

- February 2020 – Grab Holdings acquires Bento Invest, a Singapore-based Robo-advisory start-up that will provide retail wealth management solutions to the company’s clients. The acquisition’s goal is to reach out to Southeast Asia’s underbanked population, which does not have easy access to investment tools.

FAQ

What is the valuation of Robo Advisor Market ?

The Robo Advisor Market is projected to be worth USD 72.41 Billion by 2028.

Who are the key players operating in this industry?

Wealthfront Corporation, Fincite, Betterment, Charles Schwab & Co., Inc., Ellevest are the major players operating in this industry.

Which region contributed the largest share of the market growth?

North America contributed the largest share of the market growth.

What is the leading market-driving factor?

Rapid digitalization of financial services, preference for robot advisory over traditional investment services, and demand for cost-effective investment advisory.

Which is the major product segment in this market?

Hybrid Robo Advisors are anticipated to contribute the largest share to the product segment.

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Product Picture of Robo Advisor

- Global Robo Advisor Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief:

- Parent Market Overview

- Overall Robo Advisor Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews:

- Average primary breakdown ratio

- Executive Summary

- Business Trends

- Regional Trends

- Business Model Trends

- Service Provider Trends

- Service Type Trends

- End-Use Trends

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces for market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Distribution Channel

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Technology Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global economy

- Covid-19 impact on Robo Advisor demand

- Post Covid Impact on Robo Advisor Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Robo Advisor Market Analysis Forecast by Business Model

- Global Robo Advisor Segment by Business Model

- Global Robo Advisor Market Revenue Share (%), by Business Model, 2021

- Global Robo Advisor Market Revenue (USD Billion), by Business Model, 2016 – 2028

- Global Robo Advisor Market Revenue (USD Billion), by Business Model, 2016 – 2028

- Pure Robo Advisors

- Hybrid Robo Advisors

- Global Robo Advisor Segment by Business Model

- Global Robo Advisor Market Analysis Forecast by Service Provider

- Global Robo Advisor Segment by Service Provider

- Global Robo Advisor Market Revenue Share (%), by Service Provider, 2021

- Global Robo Advisor Market Revenue (USD Billion), by Service Provider, 2016 – 2028

- Global Robo Advisor Market Revenue (USD Billion), by Service Provider, 2016 – 2028

- FinTech Robo Advisors

- Banks

- Traditional Wealth Managers

- Others

- Global Robo Advisor Segment by Service Provider

- Global Robo Advisor Market Analysis Forecast by Service Type

- Global Robo Advisor Segment by Service Type

- Global Robo Advisor Market Revenue Share (%), by Service Type, 2021

- Global Robo Advisor Market Revenue (USD Billion), by Service Type, 2016 – 2028

- Global Robo Advisor Market Revenue (USD Billion), by Service Type, 2016 – 2028

- Direct Plan-Based

- Comprehensive Wealth Advisory

- Global Robo Advisor Segment by Service Type

-

- North America

- North America Robo Advisor Market Size by Countries

- North America Revenue (USD Billion) by Countries (2016-2021)

- North America Revenue (USD Billion), by Business Model, 2016 – 2028

- North America Revenue (USD Billion), by Service Provider, 2016 – 2028

- North America Revenue (USD Billion), by Service Type, 2016 – 2028

- North America Revenue (USD Billion), by End-Use, 2016 – 2028

- United States

- S. Revenue (USD Billion), by Business Model, 2016 – 2028

- S. Revenue (USD Billion), by Service Provider, 2016 – 2028

- S. Revenue (USD Billion), by Service Type, 2016 – 2028

- S. Revenue (USD Billion), by End-Use, 2016 – 2028

- Canada

- Mexico

- North America Robo Advisor Market Size by Countries

- Europe

- Europe Robo Advisor Market Size by Countries

- Europe Size, by Business Model, 2016 – 2028

- Europe Size, by Service Provider, 2016 – 2028

- Europe Size, by Service Type, 2016 – 2028

- Europe Size, by End-Use, 2016 – 2028

- Germany

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Europe Robo Advisor Market Size by Countries

- Asia Pacific

- Asia Pacific Robo Advisor Market Size by Countries

- Asia Pacific Size, by Business Model, 2016 – 2028

- Asia Pacific Size, by Service Provider, 2016 – 2028

- Asia Pacific Size, by Service Type, 2016 – 2028

- Asia Pacific Size, by End-Use, 2016 – 2028

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- Asia Pacific Robo Advisor Market Size by Countries

- Latin America

- Latin America Robo Advisor Market Size by Countries

- Latin America Size, by Business Model, 2016 – 2028

- Latin America Size, by Service Provider, 2016 – 2028

- Latin America Size, by Service Type, 2016 – 2028

- Latin America Size, by End-Use, 2016 – 2028

- Brazil

- Argentina

- Chile

- Latin America Robo Advisor Market Size by Countries

- Middle East and Africa

- Middle East and Africa Robo Advisor Market Size by Countries

- Middle East and Africa Size, by Business Model, 2016 – 2028

- Middle East and Africa Size, by Service Provider, 2016 – 2028

- Middle East and Africa Size, by Service Type, 2016 – 2028

- Middle East and Africa Size, by End-Use, 2016 – 2028

- GCC

- Turkey

- South Africa

- Middle East and Africa Robo Advisor Market Size by Countries

- Global Robo Advisor Market by Players

- Global Robo Advisor Market Revenue Share (%): Competitive Analysis, 2021

- Key entry strategies adopted by market players

- Global Revenue (USD Billion), By Manufacturer 2021

- Global Revenue Share (%), By Manufacturer 2021

- Global Player Positioning, By Manufacturer 2021

- Global Robo Advisor Market Analysis Forecast by End-Use

- Global Robo Advisor Segment by End-Use

- Global Robo Advisor Market Revenue Share (%), by End-Use, 2021

- Global Robo Advisor Market Revenue (USD Billion), by End-Use, 2016 – 2028

- Global Revenue (USD Billion) by End-Use, 2016-2028

- Retail Investor

- High Net Worth Individuals

- Global Robo Advisor Segment by End-Use

- Robo Advisor Market by Regions

- Global Robo Advisor Market Overview, By Region

- Global Revenue, By region

- Global Robo Advisor Market Revenue (USD Billion), 2016-2028

- Global Revenue Share (%) by region, 2021

- North America

- North America Revenue (USD Billion), 2016-2028

- Asia Pacific

- APAC Revenue (USD Billion), 2016-2028

- Europe

- Europe Revenue (USD Billion), 2016-2028

- Latin America

- Latin America Revenue (USD Billion), 2016-2028

- Middle East & Africa

- Middle East & Africa Revenue (USD Billion), 2016-2028

- Global Robo Advisor Market Overview, By Region

- Global Robo Advisor Market Analysis Forecast by End-Use

- Global Robo Advisor Market Revenue Share (%): Competitive Analysis, 2021

- North America

- Global Robo Advisor Market: Recent Development

- Competitive Analysis

- Wealthfront Corporation

- Business Overview

- Wealthfront Corporation Business Financials (USD Billion)

- Wealthfront Corporation Robo Advisor Product Category, Type and Specification

- Wealthfront Corporation Main Business/Business Overview

- Wealthfront Corporation Geographical Analysis

- Wealthfront Corporation Recent Development

- Wealthfront Corporation Swot Analysis

- Fincite

- Betterment

- Charles Schwab & Co., Inc.

- Ellevest

- Ginmon Vermögensverwaltung GmbH

- SigFig Wealth Management

- Social Finance, Inc.

- Wealthify Limited

- THE VANGUARD GROUP,INC.

- Wealthfront Corporation

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.