Immunotherapy Drugs Market:

Immunotherapy Drugs market was valued at USD 109.00 Billion in 2024, registering a CAGR of 6.6% during the forecast period (2024-2032), and is projected to be worth USD 193.75 Billion by 2032. The global increase in the prevalence of chronic diseases is the main factor driving the market. According to the International Diabetes Federation, an estimated 537 million people between the ages of 20 and 79 would have diabetes in 2024. Furthermore, it is anticipated that by 2045, this figure will reach 783 million. To improve research in the field of immunotherapy medications, major players in the market are concentrating on new product discoveries and forming strategic alliances.

For instance, in March 2024, Nextera AS and Zelluna Immunotherapy AS deliberately worked together to produce optimal TCRs for cancer immunotherapy. Additionally, Biomunex Pharmaceuticals and Institut Curie joined forces in February 2024 to develop an immunotherapy medication candidate for the treatment of hematological malignancies using Biomunex Pharmaceuticals’ BiXAR technology. Furthermore, Boehringer Ingelheim International GmbH and Enara Bio entered into a licensing deal in January 2024 to use Enara Bio’s Dark Antigen discovery platform to develop novel cancer immunotherapies.

Immunotherapy Drugs Market Dynamics:

A type of cancer treatment is called immunotherapy. It makes use of chemicals produced by the body or in a lab to strengthen the immune system and assist the body in locating and eliminating cancer cells. Numerous forms of cancer can be treated using immunotherapy. The drugs are also used alone or in conjunction with other cancer treatments such as chemotherapy.

Driver:

This market’s expansion is primarily attributable to the increased prevalence of the target diseases, rising demand for biosimilars and monoclonal antibodies, rising preference for immunotherapy medications over traditional treatments, and an approval environment.

Restraint:

Immunotherapy drugs market expansion is anticipated to be hampered by government regulation, adverse impacts, manufacturing complexity, and a high attrition rate in the product development cycle during the forecast period.

Immunotherapy Drugs Market Report Cover:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 (USD Billion) | 193.75 Billion |

| CAGR (2024-2032) | 6.6% |

| By Drugs Type | Monoclonal Antibodies, Immunomodulators, Vaccines |

| By Indication | Cancer, Autoimmune Diseases, Infectious Diseases, Others |

| By geography | North America– (U.S., Canada, Mexico)

Europe- (Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe) Asia Pacific- (China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific) Latin America- (Brazil, Argentina, Chile, Rest of Latin America) The Middle East and Africa- (GCC, Turkey, Israel, Rest of MEA) |

| Key Players | Amgen, Inc., Novartis AG, AbbVie, Inc., Pfizer, Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson Services, Inc., AstraZeneca, GSK, Sanofi, Bayer AG |

Immunotherapy Drugs Market Segment Analysis:

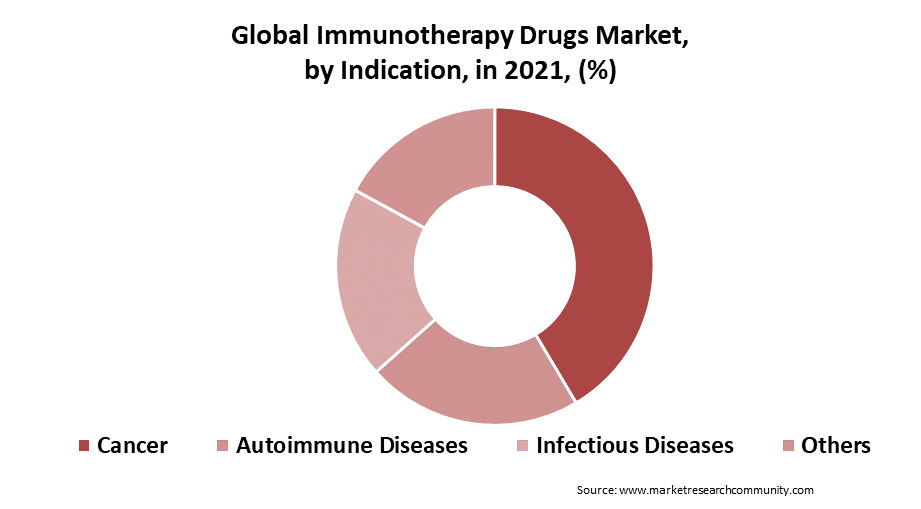

By Indication

The indication segment is divided into cancer, autoimmune illnesses, infectious diseases, and other diseases based on drug kinds in the immunotherapy drug market. Due to a growth in cancer prevalence and the introduction of additional cancer immunotherapies, the cancer category had the highest revenue share of above 90.10% in 2024. Breast cancer and lung cancer have prevalence rates of approximately 11.7% and 11.4%, respectively, according to Globocan 2020. Additionally, the FDA authorized the use of Opdivo (nivolumab) in combination with chemotherapy for people with stomach cancer in April 2024. Hence, these factors are fueling the growth of the immunotherapy drug market.

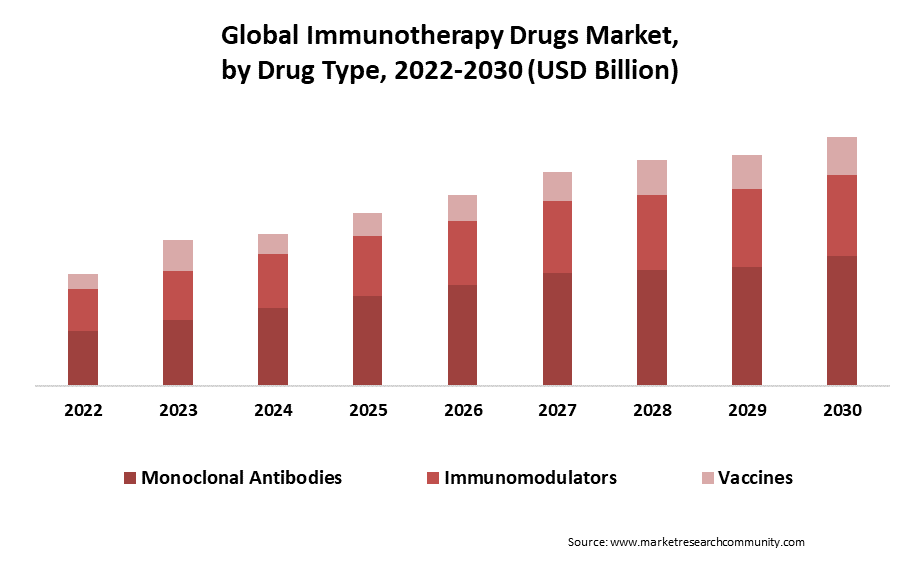

By Drug Type

The drug type segment is segmented into immunomodulators, monoclonal antibodies, and vaccines. Due to expanded R&D in therapeutic monoclonal antibodies along with helpful government measures, the monoclonal antibodies category held the greatest share of 75.30% in 2024. For instance, the U.S. FDA approved the supplementary Biologics License Application for Dupixent (dupilumab), which is indicated for the treatment of prurigo nodularis, in May 2024. During the projection period, the vaccines segment is anticipated to experience the quickest CAGR.

By Region

In 2024, North America held a disproportionately big share of the worldwide industry, contributing more than 44.90% of the total revenue. The release and regulatory approval of new immunotherapy medications as well as kind reimbursement policies are anticipated to contribute to the region’s growth. For instance, the FDA approved the use of Keytruda, a drug manufactured by Merck, in conjunction with chemotherapy to treat cervical cancer in October 2024. Additionally, the FDA approved Bristol Myers Squibb Co.’s Opdivo (nivolumab) in August 2024 for the treatment of urothelial cancer.

Chimeric antigen receptor T-cell therapy hospital inpatient care is covered by the Centers for Medicare & Medicaid Services. During the predicted period, Japan is anticipated to see a considerable CAGR in Asia Pacific. One of the main drivers of the region’s growth is the rising incidence of cancer in Japan, together with the country’s aging population, expanding spending on medical research, and a sophisticated healthcare system.

Immunotherapy Drugs Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. The majority of manufacturers are concentrating on new Drugs Type launches, improvements to current Drugs Types, and mergers and acquisitions. –

- Amgen, Inc.

- Novartis AG

- AbbVie, Inc.

- Pfizer, Inc.

- Hoffmann-La Roche Ltd.

- Johnson & Johnson Services, Inc.

- AstraZeneca

- GSK

- Sanofi

- Bayer AG

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Drugs Type Picture of Immunotherapy Drugs

- Global Immunotherapy Drugs Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief

- Parent Market Overview

- Overall Immunotherapy Drugs Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews

- Average Type primary breakdown ratio

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces on market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Therapeutic

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Drugs Type Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global Economy

- Covid-19 impact on Immunotherapy Drugs Market demand

- Post-Covid Impact on Immunotherapy Drugs Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Immunotherapy Drugs Market Segmentation, Revenue (USD Billion), (2022-2030)

- By Drugs Type

- Monoclonal Antibodies

- Immunomodulators

- Vaccines

- By Indication

- Cancer

- Autoimmune Diseases

- Infectious Diseases

- Others

- By Drugs Type

- By Global Immunotherapy Drugs Market Overview, By Region

- North America Immunotherapy Drugs Market Revenue (USD Billion), by Countries, (2022-2030)

- US

- By Drugs Type

- By Indication

- Canada

- Mexico

- US

- Europe Immunotherapy Drugs Market Revenue (USD Billion), by Countries, (2022-2030)

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Immunotherapy Drugs Market Revenue (USD Billion), by Countries, (2022-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- North America Immunotherapy Drugs Market Revenue (USD Billion), by Countries, (2022-2030)

- Latin America Immunotherapy Drugs Market Revenue (USD Billion), by Countries, (2022-2030)

- Brazil

- Argentina

- Chile

- The Middle East and Africa Immunotherapy Drugs Market Revenue (USD Billion), by Countries, (2022-2030)

- GCC

- Turkey

- South Africa

- Global Immunotherapy Drugs Market Revenue: Competitive Analysis, 2021

- Key strategies by players

- Revenue (USD Billion and %), By manufacturers, 2021

- Player Positioning by Market Players, 2021

- Competitive Analysis

- Baxter International Inc.

- Business Overview

- Business Financials (USD Billion)

- Drugs Type Category, Source, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- Swot Analysis

- Amgen, Inc.

- Novartis AG

- AbbVie, Inc.

- Pfizer, Inc.

- Hoffmann-La Roche Ltd.

- Johnson & Johnson Services, Inc.

- AstraZeneca

- GSK

- Sanofi

- Bayer AG

- Baxter International Inc.

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.