Medical Gloves Market Insights

The global medical gloves market was valued at USD 7,805.1 Million in 2021 and is expected to rise with a CAGR of 8.2% % from 2022-to 2028 during the forecast period.

Medical gloves are used to protect users from cross-contamination and infection during medical surgeries, examinations, and other procedures. The major factors that drive the market are the growing knowledge of health, awareness regarding diseases, and safety measures to stop further contamination of diseases. Patients and medical professionals have recognized the increasing need for gloves globally due to the Covid pandemic and its spread worldwide. Hence, the market for medical gloves was in high demand during the Covid pandemic.

The medical gloves market is expected to be driven by the rapid increase in the prevalence of chronic diseases and the rising patient population. Governments in several countries have increased healthcare spending to build a well-constructed healthcare infrastructure and provide advanced treatment options to patients. Further, the growing demand for higher-quality medical gloves and their application in the healthcare industry is boosting the market growth. The production of gloves has been steadily growing with the existing prominent players and has become essential items of the healthcare industry in the prevention of contamination and infectious diseases. Further, increased healthcare standards in emerging economies, growing government investments in medical facilities and healthcare developments, and increasing awareness of the public in health-related issues are the factors that continue to drive the market growth.

COVID-19 Impact on Medical Gloves Market

The growing demand for medical gloves as a result of Covid-19 has had a direct impact on the market. Covid-19 had a significant impact on the whole medical devices industry in 2020, with different segments of the market having a variety of implications. Though, the pandemic forced non-essential and optional treatments to be postponed or canceled. During the pandemic’s deadliest months, from March to April 2020, manufacturers specializing in medical gloves used in such elective treatments suffered financial losses.

In addition, the FDA issued an Emergency Use Authorization (EUA) for the import of medical gloves to minimize any delays in shipments caused by long paperwork. Further, the post-Covid market for medical gloves has a high potential to grow during the forecast period. For instance, the policy adopted by FDA on Conventional Capacity Strategies (supply levels are adequate to provide patient care without any change in routine practice) has been boosting the smooth supply of medical gloves. In addition, FDA is working with medical glove manufacturers to better understand the current supply chain difficulties around the Covid-19 outbreak and to help prevent significant shortages of these goods. The FDA published Enforcement Policy for Gowns, Other Apparel, and Gloves During the Coronavirus Disease (Covid-19) Public Health Emergency on March 25, 2020. During the Covid-19 public health emergency, this advice outlines a policy to help improve the availability of surgical clothing for health care personnel. Hence, Covid-19 has a positive impact on the medical gloves market.

Medical Gloves Market Report Coverage

The global medical gloves market is segmented by Product, Form, Sterility, End-Users, and Region. By product, the market is bifurcated into Latex gloves and Nitrile Gloves. By form, the market is segmented into Powder-free Gloves, Powdered Gloves. By sterility, the market is segmented into Sterile Gloves and Non-sterile Gloves. By End-Users the market is segmented into Hospitals, Clinics, and Ambulatory Surgical Centers. The report also covers the market size and forecasts for the Global Medical Gloves Market in 26 countries across major regions.

| Report Attributes | Report Details |

| Study Timeline | 2015-2028 |

| Market Size in 2028 (USD Million) | 13,041.1 |

| CAGR (2022-2028) | 8.2% |

| By Product | Latex Gloves, Nitrile Gloves, Other |

| By Form | Powder-free Gloves, Powdered Gloves |

| By Sterility | Sterile Gloves, Non-sterile Gloves |

| By Usage | Disposable Gloves, Reusable Gloves |

| By Application | Examination Gloves, Surgical Gloves |

| By End-Use | Hospitals, Clinics, Diagnostic centers, Ambulatory Surgical Centers, Others |

| By geography | North America: U.S., Canada, Mexico

Europe: Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe Asia Pacific: China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile, Rest of Latin America The Middle East and Africa: GCC, Turkey, Israel, Rest of MEA |

Global Medical Gloves Market Segment Analysis

Market Research Community provides an extensive analysis of the size, share, and major trends in each sub-segment of the Global medical gloves Market, along with forecasts at the global, regional, and country levels from 2022-to 2028.

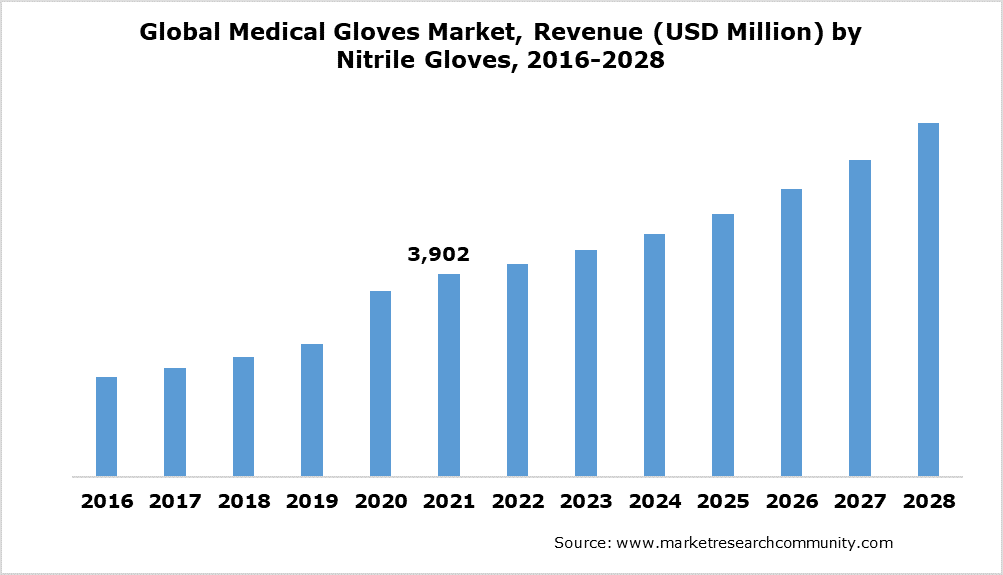

The Nitrile Gloves segment holds the major share in Global Medical Gloves Market

The Nitrile Gloves segment accounted for a market revenue of USD 3,902 Million during the year 2021 of the Medical Gloves Market. This segment is anticipated to grow at a CAGR of 8.8% during the forecast period to reach USD 6,472.3 million by 2028. Nitrile gloves came to popularity as a leading latex alternative in the year the 1990s. Nitrile gloves are significantly more durable and chemically resistant and are ideal for handling corrosive or hazardous chemicals. Further, due to their nonallergic nature, they are highly preferred in most medical environments.

Due to increased safety and hygiene concerns, the use of medical gloves has grown over the years. Furthermore, an increase in the number of end-users, associated with technological advancements, is expected to aid in market growth. for example, in 2013 the Globus Ltd company, launched GREEN-DEX as the world’s first biodegradable nitrile disposable gloves. GREEN-DEX biodegrades in biological active dumps, making it a cost-effective and environmentally responsible single-use hand protection option. Therefore, the aforementioned factors, the use of nitrile gloves, as well as manufacturer technical improvements, are expected to increase at a healthy rate.

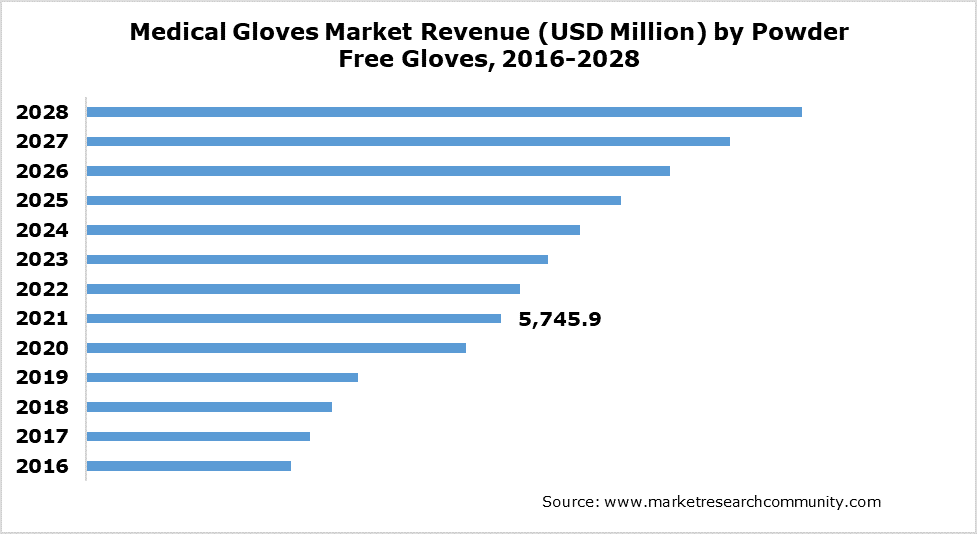

The powder-free segment is dominating by form segment of the Medical Gloves market

Powder-free accounted for a revenue of USD 5,745.9 million of the global Medical Gloves market in 2021 and is expected to grow at a CAGR of 8.7% during the forecast period of, 2022 – 2028. Growing stringent regulations on the utilization of powdered gloves by various governments around the world are expected to boost the powder-free gloves market growth. Due to the high risk of disease and infection to users, the US Food and Drug Administration has decided to restrict powdered gloves, which may diminish demand. The FDA regularly monitors medical gloves, which are categorized as Class I restricted medical equipment.

Powder-free gloves are chlorinated, making them less form-fitting and eliminating the need for powder for simple donning and removal. Since the powder-free gloves do not leave a residue on the skin, allergic responses are less likely to occur. As a result, powder-free gloves’ enhanced strength and lower incidence of allergic responses will fuel expansion in the future years. The powder-free section of the worldwide Medical Gloves market is being driven by all of the above-mentioned factors.

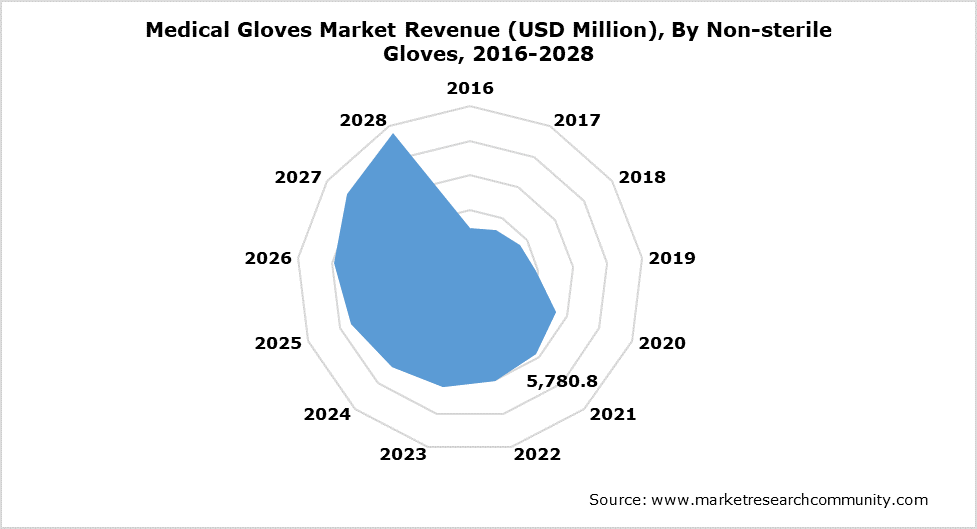

A non-sterile segment to grab a dominant share in the Medical Gloves market

Non-sterile accounted for the revenue of USD 5,780.8 Million of the global Medical Gloves market in 2021 and is expected to grow at a CAGR of 7.8% during the forecast period of, 2022 – 2028. Non-sterile gloves, often known as medical or examination gloves, are FDA-regulated and require certification before being used in medical settings. Their main function is to serve as a physical barrier against bacteria, viruses, or microorganisms. They prevent germs on a patient or medical practitioner from spreading to other people. While they are not sterilized by the manufacturer, they can be sanitized afterward at a healthcare institution.

Non-sterile nitrile gloves are used in a variety of medical settings. They are a latex-free material that has the same feel, strength, and comfort as latex. The glove’s body is three times more puncture resistant than latex and is more resistant to chemicals, oils, and acids than natural rubber. Many medical procedures call for them, especially if the patient or healthcare provider has a latex allergy. Several applications of non-sterile gloves are projected to generate lucrative prospects during the forecast period.

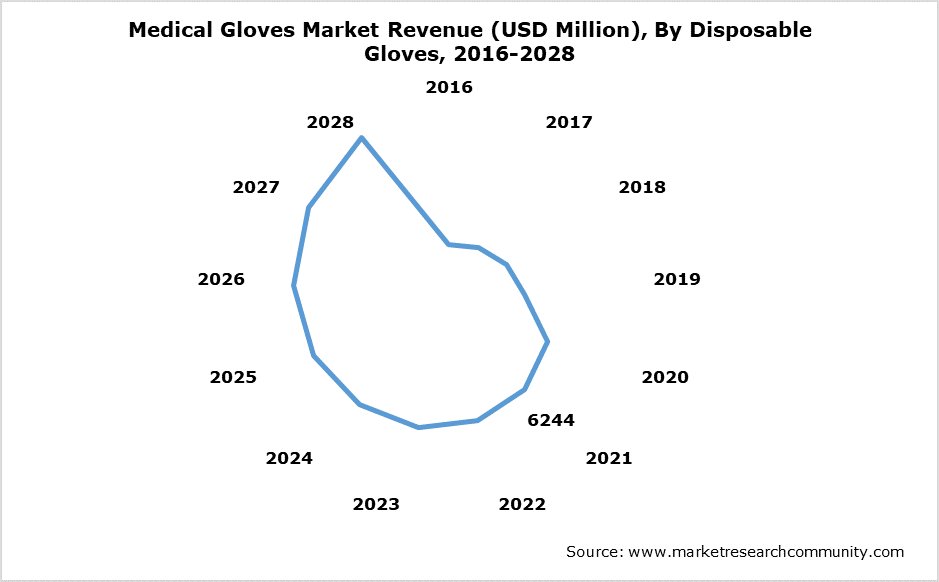

The Disposable Gloves segment has attracted the market with the highest revenue in the Usage segment.

By usage, the segment is bifurcated into disposable gloves and reusable gloves. Disposable Gloves accounted for a revenue of USD 6244 Million of the global Medical Gloves market in 2021 and are expected to grow at a CAGR of 7.8% during the forecast period of, 2022 – 2028.

In the medical glove market, disposable gloves have taken a significant share of the market. The market is predicted to develop due to rising demand for disposable gloves, particularly from the healthcare industry in light of the ongoing COVID-19 outbreak, as well as increased awareness of healthcare-associated illnesses. Several reasons, including increased investments in both the private and public medical sectors, rising population, the high influx of migrants during Covid, and the growing senior population, are expected to drive significant expansion in the healthcare industry. Furthermore, increased healthcare spending and rising awareness of the relevance of raw materials in delivering high heat resistance, comfort, elasticity, and lightweight qualities are expected to enhance major market players’ research and development initiatives resulting in the growth of the market.

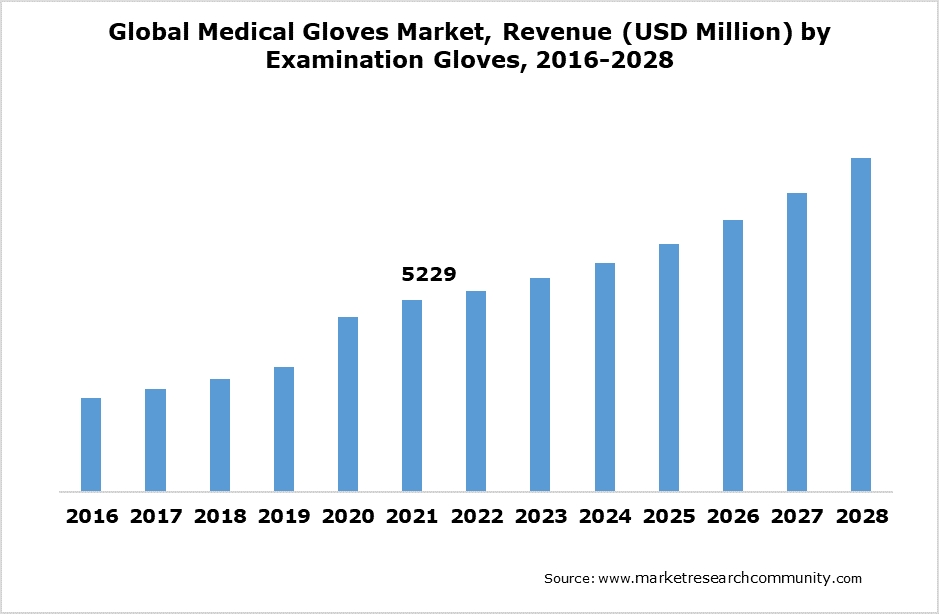

The examination gloves segment is anticipated to boost the growth of the medical gloves market.

By Application, the segment is bifurcated into examination gloves and surgical gloves. The examination gloves segment was estimated as USD 5229 Million of in 2021. The growth of the segment is contributed due to widespread use and wide range of utility. For non-invasive physical examinations of patients, examination gloves are used in healthcare settings and other care provider facilities. This helps to reduce cross-contamination between healthcare workers and patients. The demand for examination gloves is projected to rise as the number of people suffering from infectious and contagious diseases grows. Moreover, during Covid-19 the demand for examination gloves was higher to avoid the transition of the virus from an infected individual to a healthy person. Also, concerns regarding personal and medical hygiene have substantially increased over the past few years. Further, the popularity of disposable gloves supplemented the demand for examination gloves worldwide. Hence, examination gloves are estimated to rule the application segment of the medical gloves market.

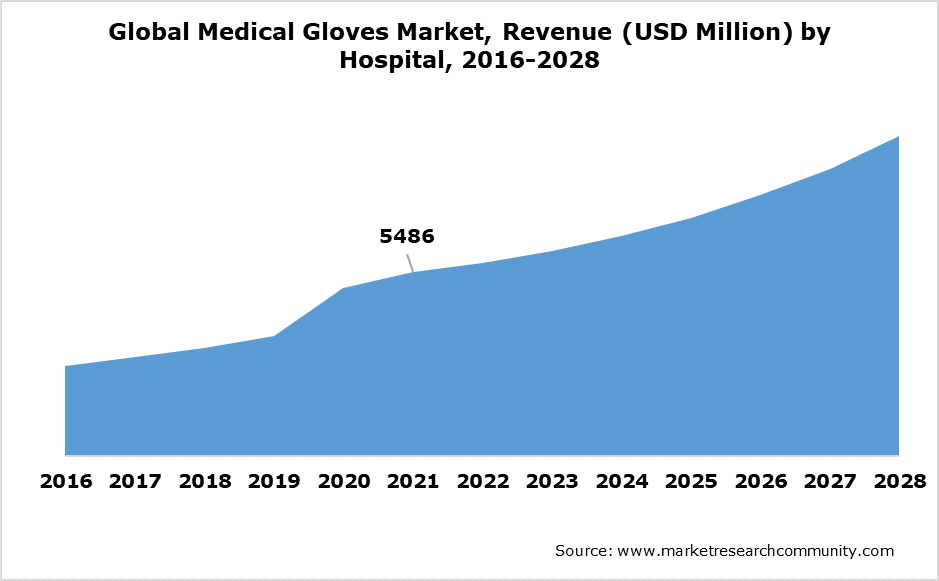

The hospital segment is projected to fuel the growth of the Medical Gloves Market

In 2021, hospitals accounted for the revenue of USD 5486 Million of the global medical glove market, which is predicted to increase at a CAGR of 6.8 % from 2022 to 2028. Hospitals are the most common setting for treatment. Patients also prefer hospitals to other treatment centers because of the constant availability of doctors and a huge inventory of medical instruments.

Latex and nitrile gloves are both used in hospitals. Latex allergies are on the rise, and repeated latex exposure can result in severe dermatitis. As a result, hospitals frequently provide both nitrile and latex gloves to their employees. The hospital segment will also be driven by an increase in the use of non-sterile gloves in hospitals. Non-sterile gloves are used in hospitals to avoid physical contact with mucous membranes, skin, secretions, fluids, and potentially hazardous procedures and contaminated objects during maneuvers. This explains why nurses in many hospitals throughout the world run campaigns encouraging the use of non-sterile gloves. Non-sterile glove campaigns in hospitals strive to establish a more sensible usage of gloves in-hospital services.

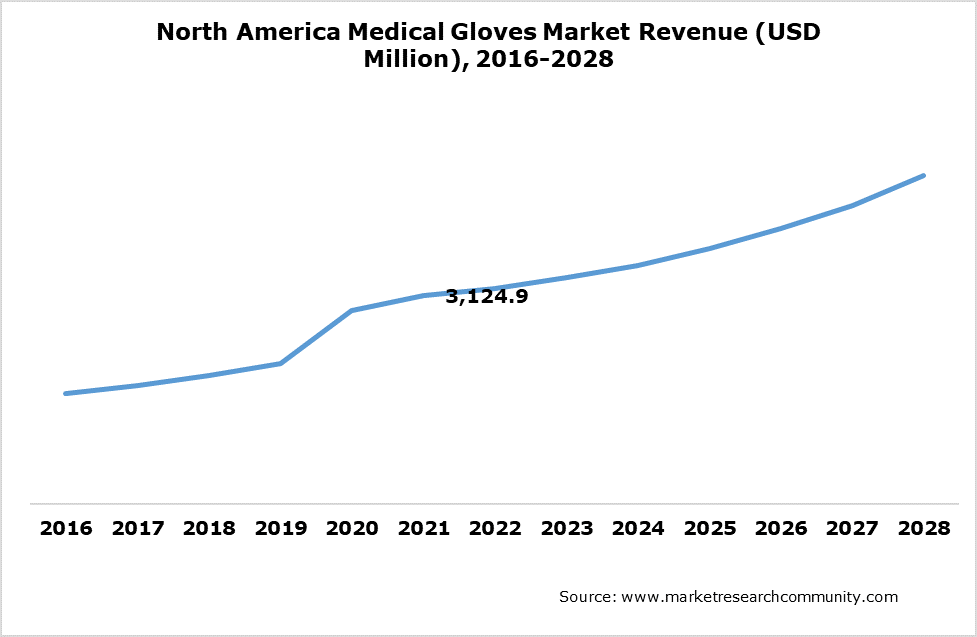

North America to lead the growth of the Medical Gloves Market in the regional segment

North America accounted for a 40% share of the global medical gloves market in 2021 and is expected to grow at a CAGR of 8% during the forecast period of, 2022 – 2028. It held the largest regional share in 2021 and is expected to do so throughout the forecast period. Increasing government policies and well-established healthcare infrastructure ensure the implementation of a high standard of hygiene and best practices in the country. In 2021, it had the greatest regional share, and it is predicted to continue to remain so for the rest of the forecast period. Increased government rules and a well-established healthcare infrastructure ensure that the country’s sanitary standards and best practices are followed. According to the Centers for Disease Control and Prevention, hospital-acquired illnesses infect one out of every 25 patients. Furthermore, according to Definitive Healthcare’s surgery center platform, there are around 9,280 ambulatory surgical facilities in the United States as of 2019. that the increased demand for nitrile gloves in the United States is allowing major nitrile glove manufacturers to expand their production capacity. The Covid-19 pandemic is currently doing havoc in the United States, with over 300,000 cases reported. Per Centre for Disease Control lists gloves as one of the critical items for COVID-19 prevention. Hence, growing high prioritization by government agencies is estimated to boost the growth of the market.

Furthermore, the United States Food and Drug Administration’s Choice to restrict powdered gloves due to a considerable threat of illness or infection to individuals may restrain demand. The FDA regularly monitors medical gloves, which are categorized as Class I restricted medical equipment. As a result, before these gloves may be sold, they must first receive a 510(k) premarket notification. The FDA oversees these devices to ensure that they meet industry standards for leak resistance, tear resistance, and biocompatibility. To limit the danger of allergic responses, the FDA also requires glove makers to include satisfactory labeling on gloves packaging. Therefore, severe compliances and time-consuming regulatory documentation may suppress industry expansion.

Global Medical Gloves Market Competitive Landscape

The Global Medical Gloves Market study is relatively competitive, with a significant number of global and regional players. The key strategies adopted by these firms include product innovations, expansions, acquisitions, and mergers.

Key Players

- Medline Industries, Inc

- Cardinal Health, Inc

- Ansell Healthcare LLC

- Dynarex Corporation

- Top Glove Corporation Berhad.

- Hartalega Holdings Berhad

- Semperit AG Holding

- Vijayalakshmi Health & Surgicals Pvt. Ltd.

- Mocare Health Co., Ltd.

- Kanam Latex Industries Pvt. Ltd.

- Supermax Corporation Berhad

- Riverstone Holdings Ltd.

- Kossan Rubber Industries Bhd

A highly developed distribution network provides a competitive edge to the primary market players. Furthermore, players need to invent constantly, to grow in the market, due to the rapidly advancing consumer needs and choices.

Recent Developments

- KOSSAN Rubber Industries introduced LOW DERMA® Technology in 2016, a remedy for glove wearers’ hypersensitivities. The company is projected to make greater income as a result of this invention.

- Supermax will invest US$350 million in its first manufacturing site in the United States in 2021. The complex will be spread out over 215 acres in Texas. It will be Supermax’s 18th production site in the world. Over the next two years, it will be able to supply a minimum of 10% to 15% of total medical glove imports yearly to the United States.

FAQ

How much is the Medical Gloves Market worth?

The Medical Gloves Market is estimated to be worth USD 13,041.1 Million by 2028.

Who are the major key players operating in this industry?

Medline Industries, Inc, Cardinal Health, Inc, Ansell Healthcare LLC, Dynarex Corporation, Top Glove Corporation Berhad are the major key players operating in this industry.

What were the impact of COVID-19 on this market growth?

The FDA issued an Emergency Use Authorization (EUA) for the import of medical gloves to minimize any delays in shipments caused by long paperwork.

Which region registered the fastest CAGR growth?

North America registered the fastest CAGR growth during the forecast period.

Which is the leading product segment in this market?

Latex Gloves is the leading product segment in this market.

Table of Content

Chapter 1 Introduction

1.1 Market Introduction

1.2 Market Research Methodology

1.2.1 Research Process

1.2.2 Primary Research

1.2.3 Secondary Research

1.2.4 Data Collection Technique

1.2.5 Data Sources

1.3 Market Estimation Methodology

1.3.1 Limitations of the Study

1.4 Product Picture of Medical Gloves

1.5 Global Medical Gloves Market: Classification

1.6 Geographic Scope

1.7 Years Considered for the Study

1.8 Research Methodology in brief:

1.9 Parent Market Overview, 2021 (Mn)

1.10 Overall Medical Gloves Market Regional Demand, 2021

1.11 Research Programs/Design

1.12 Market Breakdown and Data Triangulation Approach

1.13 Data Source

1.14 Secondary Sources

1.15 Primary Sources

1.16 Primary Interviews:

1.17 Average primary breakdown ratio

Chapter 2 Executive Summary

2.1 Business Trends

2.2 Regional Trends

2.3 Product Trends

2.5 Form Trends

2.6 Sterility Trends

2.7 Usage Trends

2.8 Application Trends

2.9 End-Use Trends

Chapter 3 Market Dynamics

3.1 Drivers

3.1.1 Increase in number of contagious diseases

3.1.2 Rise in the numbers of surgeries

3.2 Restraints

3.2.1 Health effects associated with medical gloves

3.4 Opportunities

3.4.1 Growing healthcare facilities across developing nations

3.4.3 Impact forces for market dynamics

3.4.4 Impact forces during the forecast years

3.5 Industry Value Chain

3.5.1 Upstream analysis

3.5.2 Downstream analysis

3.5.3 Distribution Channel

3.5.3.1 Direct Channel

3.5.3.2 Indirect Channel

3.6 Potential Customers

3.7 Manufacturing/Operational Cost Analysis

3.8 Raw Material

3.9 Labor Cost

3.10 Manufacturing Expense

3.7 Key Technology Landscape

3.8 Regulatory Analysis

3.10 Porter’s Analysis

3.10.1 Supplier Power

3.10.2 Buyer Power

3.10.3 Substitution Threat

3.10.4 Threat from New Entry

3.10.5 Competitive Rivalry

3.11 PESTEL Analysis

3.11.1 Political Factors

3.11.2 Economic Factor

3.11.3 Social Factors

3.11.4 Technological Factor

3.11.5 Environmental Factors

3.11.6 Legal Factor

3.12 Covid-19 impact on Global economy

3.13 Covid-19 impact on Medical Glovesdemand

3.14 Post Covid Impact on Medical Gloves Market Demand

Chapter 4 Global Medical Gloves Market Analysis Forecast by Product

4.1 Global Medical Gloves Segment by Product

4.1.1 Global Medical Gloves Market Revenue Share (%), by Product, 2021

4.1.3 Global Medical Gloves Market Revenue (USD Million), by Product, 2016 – 2028

4.2 Global Medical Gloves Market Revenue (USD Million), by Product, 2016 – 2028

4.2.1 Latex Gloves

4.2.3 Nitrile Gloves

4.2.4 Others

Chapter 5 Global Medical Gloves Market Analysis Forecast by Form

5.1 Global Medical Gloves Segment by Form

5.1.1 Global Medical Gloves Market Revenue Share (%), by Form, 2021

5.1.2 Global Medical Gloves Market Revenue (USD Million), by Form, 2016 – 2028

5.2 Global Medical Gloves Market Revenue (USD Million), by Form, 2016 – 2028

5.2.1 Powder-free Gloves

5.2.3 Powdered Gloves

Chapter 6 Global Medical Gloves Market Analysis Forecast by Sterility

6.1 Global Medical Gloves Segment by Sterility

6.1.1 Global Medical Gloves Market Revenue Share (%), by Sterility , 2021

6.1.2 Global Medical Gloves Market Revenue (USD Million), by Sterility , 2016 – 2028

6.2 Global Medical Gloves Market Revenue (USD Million), by Sterility , 2016 – 2028

6.2.1 Sterile Gloves

6.2.3 Non-sterile Gloves

Chapter 7 Global Medical Gloves Market Analysis Forecast by Usage

7.1 Global Medical Gloves Segment by Usage

7.1.1 Global Medical Gloves Market Revenue Share (%), by Usage , 2021

7.1.2 Global Medical Gloves Market Revenue (USD Million), by Usage , 2016 – 2028

7.2 Global Medical Gloves Market Revenue (USD Million), by Usage , 2016 – 2028

7.2.1 Disposable Gloves

7.2.3 Reusable Gloves

Chapter 8 Global Medical Gloves Market Analysis Forecast by Application

8.1 Global Medical Gloves Segment by Application

8.1.1 Global Medical Gloves Market Revenue Share (%), by Application , 2021

8.1.2 Global Medical Gloves Market Revenue (USD Million), by Application , 2016 – 2028

8.2 Global Medical Gloves Market Revenue (USD Million), by Application , 2016 – 2028

8.2.1 Examination Gloves

8.2.3 Surgical Gloves

Chapter 9 Global Medical Gloves Market Analysis Forecast by End-Use

9.1 Global Medical Gloves Segment by End-Use

9.1.1 Global Medical Gloves Market Revenue Share (%), by End-Use , 2021

9.1.2 Global Medical Gloves Market Revenue (USD Million), by End-Use , 2016 – 2028

9.2 Global Medical Gloves Market Revenue (USD Million) by End-Use, 2016-2028

9.2.1 Hospitals

9.2.3 Clinics

9.2.4 Diagnostic centers

9.2.5 Ambulatory Surgical Centers

9.2.6 Others

Chapter 10 Global Medical Gloves Market by Players

10.1 Global Medical Gloves Market Revenue Share (%): Competitive Analysis, 2021

10.1.1 Key strategies adopted by market players

10.1.2 Global Medical Gloves Market Revenue (USD Million), By Manufacturer 2021

10.1.3 Global Medical Gloves Market Revenue Share (%), By Manufacturer 2021

10.1.4 Global Medical Gloves Market Player Positioning, By Manufacturer 2021

10.2 Global Medical Gloves Market: Recent Development

Chapter 11 Medical Gloves by Regions

11.1 Global Medical Gloves Market Overview, By Region

11.1.1 Global Medical Gloves Market Revenue, By region

11.2 Global Medical Gloves Market Revenue (USD Million), 2016-2028

11.2.1 Global Medical Gloves Market Revenue Share (%) by Region, 2021

11.3 North America

11.3.1 North America Revenue (USD Million), 2016-2028

11.5 Asia Pacific

11.5.1 APAC Revenue (USD Million), 2016-2028

11.7 Europe

11.7.1 Europe Revenue (USD Million), 2016-2028

11.8 Latin America

11.8.1 Latin America Revenue (USD Million), 2016-2028

11.10 Middle East & Africa

11.10.1 Middle East & Africa Revenue (USD Million), 2016-2028

Chapter 12 North America

12.1 North America Medical Gloves Market Size by Countries

12.1.1 North America Surgical Latex and Nitrile Rubber Revenue (USD Million) by Countries (2016-2021)

12.1.2 North America Revenue (USD Million), by Product, 2016 – 2028

12.1.3 North America Revenue (USD Million), by Form, 2016 – 2028

12.1.4 North America Revenue (USD Million), by Sterility, 2016 – 2028

12.1.5 North America Revenue (USD Million), by Usage, 2016 – 2028

12.1.6 North America Revenue (USD Million), by Application, 2016 – 2028

12.1.7 North America Revenue (USD Million), by End-Use, 2016 – 2028

12.2 United States

12.2.1 U.S. Revenue (USD Million), by Product, 2016 – 2028

12.2.2 U.S. Revenue (USD Million), by Form, 2016 – 2028

12.2.3 U.S. Revenue (USD Million), by Sterility, 2016 – 2028

12.2.4 U.S. Revenue (USD Million), By Usage, 2016 – 2028

12.2.5 U.S. Revenue (USD Million), by Application, 2016 – 2028

12.2.6 U.S. Revenue (USD Million), by End-Use, 2016 – 2028

12.3 Canada

12.3.1 Canada Revenue (USD Million), By Product, 2016 – 2028

12.3.2 Canada Revenue (USD Million), By Form, 2016 – 2028

12.3.3 Canada Revenue (USD Million), by Sterility , 2016 – 2028

12.3.4 Canada Revenue (USD Million), By Usage, 2016 – 2028

12.3.5 Canada Revenue (USD Million), by Application , 2016 – 2028

12.3.6 Canada Revenue (USD Million), by End-Use, 2016 – 2028

12.4 Mexico

12.4.1 Mexico Revenue (USD Million), by Product, 2016 – 2028

12.4.2 Mexico Revenue (USD Million), by Form, 2016 – 2028

12.4.3 Mexico Revenue (USD Million), by Sterility , 2016 – 2028

12.4.4 Mexico Revenue (USD Million), by Usage, 2016 – 2028

12.4.5 Mexico Revenue (USD Million), by Application, 2016 – 2028

12.4.6 Mexico Revenue (USD Million), by End-Use, 2016 – 2028

Chapter 13 Europe

13.1 Europe Size by Countries

13.1.1 Europe Revenue (USD Million) by Countries (2016-2021)

13.1.2 Europe Revenue (USD Million), by Product, 2016 – 2028

13.1.3 Europe Revenue (USD Million), by Form, 2016 – 2028

13.1.4 Europe Revenue (USD Million), by Sterility , 2016 – 2028

13.1.5 Europe Revenue (USD Million), by Usage, 2016 – 2028

13.1.6 Europe Revenue (USD Million), by Application, 2016 – 2028

13.1.7 Europe Revenue (USD Million), by End-Use, 2016 – 2028

13.2 Germany

13.2.1 Germany Revenue (USD Million), by Product, 2016 – 2028

13.2.2 Germany Revenue (USD Million), by Form, 2016 – 2028

13.2.3 Germany Revenue (USD Million), by Sterility , 2016 – 2028

13.2.4 Germany Revenue (USD Million), by Usage, 2016 – 2028

13.2.5 Germany Revenue (USD Million), by Application, 2016 – 2028

13.2.6 Germany Revenue (USD Million), by End-Use, 2016 – 2028

13.3 France

13.3.1 France Revenue (USD Million), by Product, 2016 – 2028

13.3.2 France Revenue (USD Million), by Form, 2016 – 2028

13.3.3 France Revenue (USD Million), by Sterility , 2016 – 2028

13.3.4 France Revenue (USD Million), by Usage, 2016 – 2028

13.3.5 France Revenue (USD Million), by Application, 2016 – 2028

13.3.6 France Revenue (USD Million), by End-Use, 2016 – 2028

13.4 UK

13.4.1 UK Revenue (USD Million), by Product, 2016 – 2028

13.4.2 UK Revenue (USD Million), by Form, 2016 – 2028

13.4.3 UK Revenue (USD Million), by Sterility , 2016 – 2028

13.4.4 UK Revenue (USD Million), by Usage, 2016 – 2028

13.4.5 UK Revenue (USD Million), by Application, 2016 – 2028

13.4.6 UK Revenue (USD Million), by End-Use, 2016 – 2028

13.5 Spain

13.5.1 Spain Revenue (USD Million), by Product, 2016 – 2028

13.5.2 Spain Revenue (USD Million), by Form, 2016 – 2028

13.5.3 Spain Revenue (USD Million), by Sterility , 2016 – 2028

13.5.4 Spain Revenue (USD Million), by Usage, 2016 – 2028

13.5.5 Spain Revenue (USD Million), by Application, 2016 – 2028

13.5.6 Spain Revenue (USD Million), by End-Use, 2016 – 2028

13.6 Russia

13.6.1 Russia Revenue (USD Million), by Product, 2016 – 2028

13.6.2 Russia Revenue (USD Million), by Form, 2016 – 2028

13.6.3 Russia Revenue (USD Million), by Sterility , 2016 – 2028

13.6.4 Russia Revenue (USD Million), by Usage, 2016 – 2028

13.6.5 Russia Revenue (USD Million), by Application, 2016 – 2028

13.6.6 Russia Revenue (USD Million), by End-Use, 2016 – 2028

13.7 Italy

13.7.1 Italy Revenue (USD Million), by Product, 2016 – 2028

13.7.2 Italy Revenue (USD Million), by Form, 2016 – 2028

13.7.3 Italy Revenue (USD Million), by Sterility , 2016 – 2028

13.7.4 Italy Revenue (USD Million), by Usage, 2016 – 2028

13.7.5 Italy Revenue (USD Million), by Application, 2016 – 2028

13.7.6 Italy Revenue (USD Million), by End-Use, 2016 – 2028

13.8 BENELUX

13.8.1 BENELUX Revenue (USD Million), by Product, 2016 – 2028

13.8.2 BENELUX Revenue (USD Million), by Form, 2016 – 2028

13.8.3 BENELUX Revenue (USD Million), by Sterility , 2016 – 2028

13.8.4 BENELUX Revenue (USD Million), by Usage, 2016 – 2028

13.8.5 BENELUX Revenue (USD Million), by Application, 2016 – 2028

13.8.6 BENELUX Revenue (USD Million), by End-Use, 2016 – 2028

Chapter 14 Asia Pacific

14.1 Asia Pacific Medical Gloves Market Size by Countries

14.1.1 Asia Pacific Surgical Latex and Nitrile Rubber Revenue (USD Million) by Countries (2016-2021)

14.1.2 Asia Pacific Revenue (USD Million), by Product, 2016 – 2028

14.1.3 Asia Pacific Revenue (USD Million), by Form, 2016 – 2028

14.1.4 Asia Pacific Revenue (USD Million), by Sterility , 2016 – 2028

14.1.5 Asia Pacific Revenue (USD Million), by Usage, 2016 – 2028

14.1.6 Asia Pacific Revenue (USD Million), by Application, 2016 – 2028

14.1.7 Asia Pacific Revenue (USD Million), by End-Use, 2016 – 2028

14.2 China

14.2.1 China Revenue (USD Million), by Product, 2016 – 2028

14.2.2 China Revenue (USD Million), by Form, 2016 – 2028

14.2.3 China Revenue (USD Million), by Sterility , 2016 – 2028

14.2.4 China Revenue (USD Million), by Usage, 2016 – 2028

14.2.5 China Revenue (USD Million), by Application, 2016 – 2028

14.2.6 China Revenue (USD Million), by End-Use, 2016 – 2028

14.3 Japan

14.3.1 Japan Revenue (USD Million), by Product, 2016 – 2028

14.3.2 Japan Revenue (USD Million), by Form, 2016 – 2028

14.3.3 Japan Revenue (USD Million), by Sterility , 2016 – 2028

14.3.4 Japan Revenue (USD Million), by Usage, 2016 – 2028

14.3.5 Japan Revenue (USD Million), by Application, 2016 – 2028

14.3.6 Japan Revenue (USD Million), by End-Use, 2016 – 2028

14.4 Australia

14.4.1 Australia Revenue (USD Million), by Product, 2016 – 2028

14.4.2 Australia Revenue (USD Million), by Form, 2016 – 2028

14.4.3 Australia Revenue (USD Million), by Sterility , 2016 – 2028

14.4.4 Australia Revenue (USD Million), by Usage, 2016 – 2028

14.4.5 Australia Revenue (USD Million), by Application, 2016 – 2028

14.4.6 Australia Revenue (USD Million), by End-Use, 2016 – 2028

14.5 South Korea

14.5.1 South Korea Revenue (USD Million), by Product, 2016 – 2028

14.5.2 South Korea Revenue (USD Million), by Form, 2016 – 2028

14.5.3 South Korea Revenue (USD Million), by Sterility , 2016 – 2028

14.5.4 South Korea Revenue (USD Million), by Usage, 2016 – 2028

14.5.5 South Korea Revenue (USD Million), by Application, 2016 – 2028

14.5.6 South Korea Revenue (USD Million), by End-Use, 2016 – 2028

14.6 India

14.6.1 India Revenue (USD Million), by Product, 2016 – 2028

14.6.2 India Revenue (USD Million), by Form, 2016 – 2028

14.6.3 India Revenue (USD Million), by Sterility , 2016 – 2028

14.6.4 India Revenue (USD Million), by Usage, 2016 – 2028

14.6.5 India Revenue (USD Million), by Application, 2016 – 2028

14.6.6 India Revenue (USD Million), by End-Use, 2016 – 2028

14.7 ASEAN

14.7.1 ASEAN Revenue (USD Million), by Product, 2016 – 2028

14.7.2 ASEAN Revenue (USD Million), by Form, 2016 – 2028

14.7.3 ASEAN Revenue (USD Million), by Sterility , 2016 – 2028

14.7.4 ASEAN Revenue (USD Million), by Usage, 2016 – 2028

14.7.5 ASEAN Revenue (USD Million), by Application, 2016 – 2028

14.7.6 ASEAN Revenue (USD Million), by End-Use, 2016 – 2028

Chapter 15 Latin America

15.1 Latin America Medical Gloves Market Size by Countries

15.1.1 Latin America Surgical Latex and Nitrile Rubber Revenue (USD Million) by Countries (2016-2021)

15.1.3 Latin America Revenue (USD Million), by Product, 2016 – 2028

15.1.4 Latin America Revenue (USD Million), by Form, 2016 – 2028

15.1.5 Latin America Revenue (USD Million), by Sterility , 2016 – 2028

15.1.6 Latin America Revenue (USD Million), by Usage, 2016 – 2028

15.1.7 Latin America Revenue (USD Million), by Application, 2016 – 2028

15.1.8 Latin America Revenue (USD Million), by End-Use, 2016 – 2028

15.2 Brazil

15.2.1 Brazil Revenue (USD Million), by Product, 2016 – 2028

15.2.2 Brazil Revenue (USD Million), by Form, 2016 – 2028

15.2.3 Brazil Revenue (USD Million), by Sterility , 2016 – 2028

15.2.4 Brazil Revenue (USD Million), by Usage, 2016 – 2028

15.2.5 Brazil Revenue (USD Million), by Application, 2016 – 2028

15.2.6 Brazil Revenue (USD Million), by End-Use, 2016 – 2028

15.3 Argentina

15.3.1 Argentina Revenue (USD Million), by Product, 2016 – 2028

15.3.2 Argentina Revenue (USD Million), by Form, 2016 – 2028

15.3.3 Argentina Revenue (USD Million), by Sterility , 2016 – 2028

15.3.4 Argentina Revenue (USD Million), by Usage, 2016 – 2028

15.3.5 Argentina Revenue (USD Million), by Application, 2016 – 2028

15.3.6 Argentina Revenue (USD Million), by End-Use, 2016 – 2028

15.4 Chile

15.4.1 Chile Revenue (USD Million), by Product, 2016 – 2028

15.4.2 Chile Revenue (USD Million), by Form, 2016 – 2028

15.4.3 Chile Revenue (USD Million), by Sterility , 2016 – 2028

15.4.4 Chile Revenue (USD Million), by Usage, 2016 – 2028

15.4.5 Chile Revenue (USD Million), by Application, 2016 – 2028

15.4.6 Chile Revenue (USD Million), by End-Use, 2016 – 2028

Chapter 16 Middle East and Africa

16.1 Middle East and Africa Medical Gloves Market Size by Countries

16.1.1 Middle East and Africa Surgical Latex and Nitrile Rubber Revenue (USD Million) by Countries (2016-2021)

16.1.3 Middle East and Africa Revenue (USD Million), by Product, 2016 – 2028

16.1.4 Middle East and Africa Revenue (USD Million), by Form, 2016 – 2028

16.1.5 Middle East and Africa Revenue (USD Million), by Sterility , 2016 – 2028

16.1.6 Middle East and Africa Revenue (USD Million), by Usage, 2016 – 2028

16.1.7 Middle East and Africa Revenue (USD Million), by Application, 2016 – 2028

16.1.8 Middle East and Africa Revenue (USD Million), by End-Use, 2016 – 2028

16.2 GCC

16.2.1 GCC Revenue (USD Million), by Product, 2016 – 2028

16.2.2 GCC Revenue (USD Million), by Form, 2016 – 2028

16.2.3 GCC Revenue (USD Million), by Sterility , 2016 – 2028

16.2.4 GCC Revenue (USD Million), by Usage, 2016 – 2028

16.2.5 GCC Revenue (USD Million), by Application, 2016 – 2028

16.2.6 GCC Revenue (USD Million), by End-Use, 2016 – 2028

16.4 Turkey

16.4.1 Turkey Revenue (USD Million), by Product, 2016 – 2028

16.4.2 Turkey Revenue (USD Million), by Form, 2016 – 2028

16.4.3 Turkey Revenue (USD Million), by Sterility , 2016 – 2028

16.4.4 Turkey Revenue (USD Million), by Usage, 2016 – 2028

16.4.5 Turkey Revenue (USD Million), by Application, 2016 – 2028

16.4.6 Turkey Revenue (USD Million), by End-Use, 2016 – 2028

16.5 South Africa

16.5.1 South Africa Revenue (USD Million), by Product, 2016 – 2028

16.5.2 South Africa Revenue (USD Million), by Form, 2016 – 2028

16.5.3 South Africa Revenue (USD Million), by Sterility , 2016 – 2028

16.5.4 South Africa Revenue (USD Million), by Usage, 2016 – 2028

16.5.5 South Africa Revenue (USD Million), by Application, 2016 – 2028

16.5.6 South Africa Revenue (USD Million), by End-Use, 2016 – 2028

Chapter 17 Competitive Analysis

17.1 Medline Industries, Inc

17.1.1 Business Overview

17.1.2 Medline Industries, Inc Business Financials (USD Million)

17.1.3 Medline Industries, Inc Surgical Latex, and Nitrile Rubber Medical Gloves Product Category, Type, and Specification

17.1.4 Medline Industries, Inc Main Business/Business Overview

17.1.5 Medline Industries, Inc Swot Analysis

17.2 Cardinal Health, Inc.

17.2.1 Business Overview

17.2.2 Cardinal Health, Inc. Business Financials (USD Million)

17.2.3 Cardinal Health, Inc. Product Category, Type, and Specification

17.2.4 Cardinal Health, Inc. Main Business/Business Overview

17.2.5 Cardinal Health, Inc. Geographical Analysis

17.2.6 Cardinal Health, Inc. Swot Analysis

17.3 Ansell Healthcare LLC

17.3.1 Business Overview

17.3.2 Ansell Healthcare LLC Business Financials (USD Million)

17.3.3 Ansell Healthcare LLC Medical GlovesProduct Category, Type, and Specification

17.3.4 Ansell Healthcare LLC Main Business/Business Overview

17.3.5 Ansell Healthcare LLC Geographical Analysis

17.3.6 Ansell Healthcare LLC Swot Analysis

17.4 Dynarex Corporation

17.4.1 Business Overview

17.4.2 Dynarex Corporation Business Financials (USD Million)

17.4.3 Dynarex Corporation Medical GlovesProduct Category, Type, and Specification

17.4.4 Dynarex Corporation Main Business/Business Overview

17.4.5 Dynarex Corporation Swot Analysis

17.5 Top Glove Corporation Berhad

17.5.1 Business Overview

17.5.2 Top Glove Corporation Berhad Business Financials (USD Million)

17.5.3 Top Glove Corporation Berhad Medical GlovesProduct Category, Type and Specification

17.5.4 Top Glove Corporation Berhad Main Business/Business Overview

17.5.5 Top Glove Corporation Berhad Recent Development

17.5.6 Top Glove Corporation Berhad Swot Analysis

17.6 Hartalega Holdings Berhad

17.6.1 Business Overview

17.6.2 Hartalega Holdings Berhad Business Financials (USD Million)

17.6.3 Hartalega Holdings Berhad Medical GlovesProduct Category, Type and Specification

17.6.4 Hartalega Holdings Berhad Main Business/Business Overview

17.6.5 Hartalega Holdings Berhad Geographical Analysis

17.6.6 Hartalega Holdings Berhad Swot Analysis

17.7 Semperit AG Holding

17.7.1 Business Overview

17.7.2 Semperit AG Holding Business Financials (USD Million)

17.7.3 Semperit AG Holding Medical GlovesProduct Category, Type, and Specification

17.7.4 Semperit AG Holding Main Business/Business Overview

17.7.5 Semperit AG Holding Geographical Analysis

17.7.6 Semperit AG Holding Swot Analysis

17.8 Vijayalakshmi Health & Surgicals Pvt. Ltd.

17.8.1 Business Overview

17.8.2 Vijayalakshmi Health & Surgicals Pvt. Ltd. Business Financials (USD Million)

17.8.3 Vijayalakshmi Health & Surgicals Pvt. Ltd. Product Category, Type and Specification

17.8.4 Vijayalakshmi Health & Surgicals Pvt. Ltd. Main Business/Business Overview

17.8.5 Vijayalakshmi Health & Surgicals Pvt. Ltd. Swot Analysis

17.9 Mocare Health Co., Ltd.

17.9.1 Business Overview

17.9.2 Mocare Health Co., Ltd. Business Financials (USD Million)

17.9.3 Mocare Health Co., Ltd. Product Category, Type and Specification

17.9.4 Mocare Health Co., Ltd. Main Business/Business Overview

17.9.5 Mocare Health Co., Ltd. Swot Analysis

17.10 Kanam Latex Industries

17.10.1 Business Overview

17.10.2 Kanam Latex Industries Business Financials (USD Million)

17.10.3 Kanam Latex Industries Pvt. Ltd. Product Category, Type and Specification

17.10.4 Kanam Latex Industries Pvt. Ltd. Main Business/Business Overview

17.10.5 Kanam Latex Industries Pvt. Ltd. Swot Analysis

17.11 Supermax Corporation Berhad

17.11.1 Business Overview

17.11.2 Supermax Corporation Berhad. Business Financials (USD Million)

17.11.3 Supermax Corporation Berhad Product Category, Type and Specification

17.11.4 Supermax Corporation Berhad. Main Business/Business Overview

17.11.5 Supermax Corporation Berhad. Geographical Analysis

17.11.6 Supermax Corporation Berhad. Recent Development

17.11.7 Supermax Corporation Berhad. Swot Analysis

17.12 Riverstone Holdings Ltd.

17.12.1 Business Overview

17.12.2 Riverstone Holdings Ltd.. Business Financials (USD Million)

17.12.3 Riverstone Holdings Ltd. Product Category, Type and Specification

17.12.4 Riverstone Holdings Ltd. Main Business/Business Overview

17.12.5 Riverstone Holdings Ltd.. Geographical Analysis

17.12.6 Riverstone Holdings Ltd.. Recent Development

17.12.7 Riverstone Holdings Ltd.. Swot Analysis

17.13 Kossan Rubber Industries Bhd

17.13.1 Business Overview

17.13.2 Kossan Rubber Industries Bhd Business Financials (USD Million)

17.13.3 Kossan Rubber Industries Bhd Medical GlovesProduct Category, Type and Specification

17.13.4 Kossan Rubber Industries Bhd Main Business/Business Overview

17.13.5 Kossan Rubber Industries Bhd Geographical Analysis

17.13.6 Kossan Rubber Industries Bhd Recent Development

17.13.7 Kossan Rubber Industries Bhd Swot Analysis

Chapter 18 Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.