Microarray Analysis Market Insights :

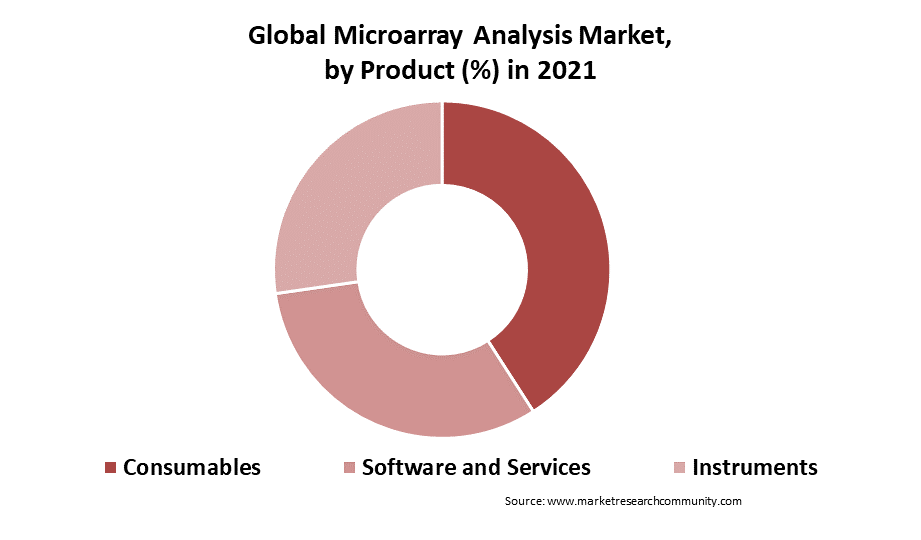

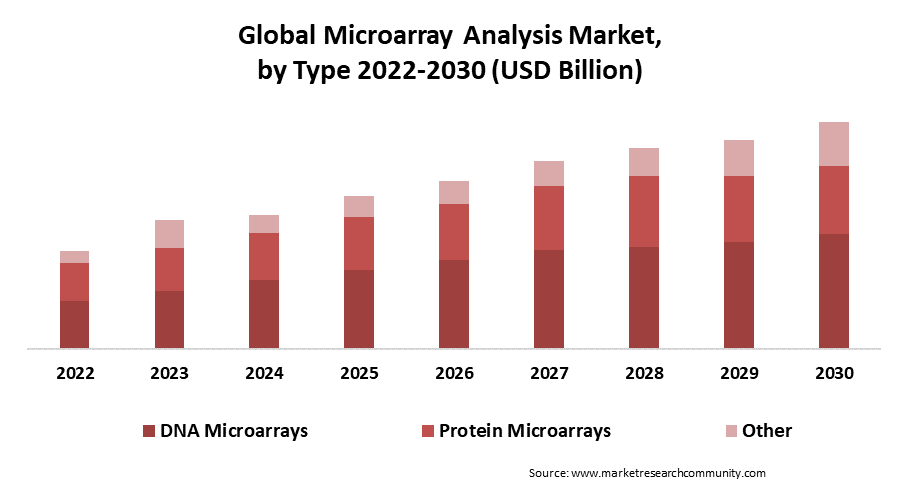

Microarray Analysis Market is projected to be worth USD 10.72 Billion by 2030, registering a CAGR of 8.6% during the forecast period (2022-2030), the market was valued at USD 5.10 Billion in 2021. The consumables segment is dominating the product segment due to repeated and bulk purchasing of consumables for varied research work. DNA microarray had the greatest market share in 2021, due to its wide range of applications in transcription binding analysis, gene expression analysis and genotyping, and others. North America had the highest revenue share in 2021 due to an increase in cancer patients in the US.

Microarray Analysis Market Dynamics:

Microarray analysis approaches are used to evaluate data generated by RNA, DNA (Gene chip analysis), and protein microarray investigations, which enable researchers to explore the expression status of a various number of genes in several cases, an organism’s whole genome and in a single experiment. These studies provide massive volumes of data, granting scientists to examine the entire status of an organism or a cell.

Driver:

The increasing prevalence of cancer is expected to fuel the growth of the microarray analysis market. As DNA microarrays are used in several types of cancers diagnosis. Further, the growing application of microarrays such as diagnosis of genetic diseases and infectious, cancer diagnostics, pharmacogenomic research, and forensic applications.

Restraint:

Factors to restrain market growth are standardization of microarray data, strict government regulations, and a lack of skilled professionals. Further, rising advancements in the NGS technology enable NGS to be specific with high accuracy and cost-effective alternative hindering the growth of the microarray analysis market.

Opportunity:

Increasing demand for DNA-based microarrays for assaying gene expression is most preferred. Owing to cost reduction facilitating the technology to be more accessible and standardized. Hence, the above-mentioned factors are expected to create lucrative opportunities for the microarray analysis market.

COVID-19 Analysis of Microarray Analysis Market:

The microarray analysis market has been severely impacted since the COVID-19 epidemic in many different parts of the world. Shipments were impacted during the initial lockdown due to a labor shortage and the closure of a manufacturing facility. The pandemic’s initial effects on China were tremendous. However, the nation’s circumstances have stabilized, and all product and service production rates have increased. As a result, it is determined that COVID-19’s overall impact on the microarray analysis market is moderate.

Microarray Analysis Report Coverage:

| Report Attributes | Report Details |

| Study Timeline | 2016-2030 |

| Market Size in 2030 (USD Billion) | 10.72 |

| CAGR (2022-2030) | 8.6 % |

| By Type | DNA Microarrays, Protein Microarrays, Other Microarrays |

| By Product | DNA Microarrays, Protein Microarrays, Other Microarrays |

| By Application | Research Applications, Drug Discovery, Disease Diagnostics, Other Applications |

| By End Use | Research & Academic Institutes, Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, Other End Users |

| By geography | North America– (U.S., Canada, Mexico

Europe- (Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe) Asia Pacific- (China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific) Latin America- (Brazil, Argentina, Chile, Rest of Latin America) Middle East and Africa- (GCC, Turkey, Israel, Rest of MEA) |

| Key Players | Bio-Rad Laboratories; Agilent Technologies; Inc.; Thermo Fisher Scientific Inc.; Illumina; Inc.; PerkinElmer Inc.; Merck KGaA; GE Healthcare; Molecular Devices; LLC; Arrayit Corporation; Microarrays; Inc |

Microarray Analysis Market Segment Analysis:

By Product

The product segment is divided into three categories such as instruments, consumables, software, and services. The factors contributing to the growth of the market are the repeated and bulk purchasing of consumables for varied research work. Further, due to constant use in research operations, the product segment is expected to maintain its dominance during the projection period. Leading key players in the market have launched a wide range of equipment, owing to greater acceptance. Further, Thermo Fisher Scientific Inc. markets products such as the GeneChip Scanner, employed for the scanning of next-generation high-density arrays for transcription and all-exon arrays. Moreover, the Gene Chip Hybridization Oven offers exact temperature and sample rotation effective hybridization. Hence, the surge in product launches is expected to support the growth of the microarray analysis market.

By Type

The type segment is categorized into DNA microarrays, Protein Microarrays, and others. DNA microarray had the greatest market share in 2021, due to its wide range of applications in transcription binding analysis, gene expression analysis and genotyping, and others. Protein microarrays are often made up of several support surfaces, such as microtitre plates, slides, nitrocellulose membranes, and beads that cause protein binding. The increased use of protein microarrays for drug development and toxicity research by prominent pharmaceutical and biopharmaceutical firms is expected to boost microarrays analysis market expansion.

Tissue, peptides, MM chips, and cellular microarrays were also used in research studies. Novus Biologics LLC, a life science product supplier, offers a diverse variety of tissue microarray product lines, including human lung tissue microarray, human skin tissue microarray, prostate tissue microarray, breast tissue microarray, and others, which are progressively utilized for disease diagnosis, assisting overall market growth.

By Application

The application segment is segmented into drug discovery, research applications, illness diagnostics, and other applications. Due to an increase in private and government financing for genomes and proteomics research, research applications held the biggest market share in 2021. For example, the UVic-Genome BC Proteomics Centre, a core hub of the Canadian Proteomics Centers, got USD 18 million in financing from Genome Canada and Genome British Columbia in 2018 to promote improved detection of illnesses such as cancer and Alzheimer’s disease. The funds will also be used to support emerging research in the fast-evolving field of tailored therapeutics.

Microarrays are employed in drug development by many firms as they monitor the expression levels of numerous genes, producing data on gene function and assisting in the selection of potential target patients for treatment evaluation during clinical trials. DNA microarrays are extremely useful as they allow researchers to identify individuals with similar biological patterns and build medications precisely to focus on illnesses. Microarrays are also widely employed during clinical trials to evaluate changes in gene expression induced by pharmacological treatments. Hence, above mentioned factors are driving the growth of the microarray analysis market.

By End-use

The market is divided into research and academic institutions, pharmaceutical and biotechnology businesses, diagnostics laboratories, and others. Research and academic institutions retained the greatest microarray analysis market share in 2021. Owing to the increased usage of microarrays in drug development and scientific applications. For example, in a 2018 NIH study, it was discovered that microarrays are employed in the process of identifying a medicine used in cancer therapy. According to research issued in 2018 by the India Brand Equity Foundation (IBEF), the hospital and diagnostic centers industry in India garnered USD 6 billion in Foreign Direct Investment (FDI) between 2000 and 2018.

By Region

The regional segment of the microarray analysis market is divided into five regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America had the highest revenue share in 2021 due to an increase in cancer patients in the US. According to the European Commission, the European Union’s government would invest USD 7.5 billion in biotechnology R&D, supporting an increase in the usage of microarrays for diverse genomic and proteomic studies in the European region. Similarly, the Danish government intends to invest USD 14.94 million from 2017 to 2020 in a new genomic research facility, encouraging increased use of microarrays.

Microarray Analysis Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and product launches have accelerated the growth of the microarray analysis market. Key players in the market include-

- Agilent Technologies; Inc.

- Thermo Fisher Scientific Inc.

- Illumina; Inc.

- PerkinElmer Inc.

- Merck KGaA

- GE Healthcare

- Molecular Devices

- LLCArrayit Corporation

- Microarrays; Inc.

- Bio-Rad Laboratories

Recent Development

- Agilent Technologies Inc. signed a multiyear supply arrangement for bespoke microarrays with SomaLogic, Inc., a Colorado-based biotechnology business, in 2019. As a result, Agilent will provide tailored oligo microarrays for use in the screening of nucleic acid using SomaLogic’s SOMAscan test, which is primarily utilized in clinical and fundamental research, pharmaceutical development and discovery, and diagnostics.

- In 2016, Thermo Fisher Scientific Inc. paid USD 1.3 billion for Affymetrix Inc., a major producer of genetics and cellular analysis tools. This purchase is expected to boost Thermo Fisher Scientific’s established product portfolio.

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Product Picture of Microarray Analysis

- Global Microarray Analysis Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief

- Parent Market Overview

- Overall Microarray Analysis Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews

- Average primary breakdown ratio

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces on market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Distribution Channel

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Product Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global Economy

- Covid-19 impact on Microarray Analysis demand

- Post-Covid Impact on Microarray Analysis Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Microarray Analysis Market Segmentation, by Revenue (USD Billion), (2022-2030)

- By Product

- Consumables

- Software and Services

- Instruments

- By Type

- DNA Microarrays

- Protein Microarrays

- Other Microarrays

- By Application

- Research Applications

- Drug Discovery

- Disease Diagnostics

- Other Applications

- By End Use

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Other End Users

- By Product

- Global Microarray Analysis Market Overview, By Region

- North America Microarray Analysis Market Revenue (USD Billion), by Countries, (2022-2030)

- US

- By Product

- By Treatment Type

- Canada

- Mexico

- US

- Europe Microarray Analysis Market Revenue (USD Billion), by Countries, (2022-2030)

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Microarray Analysis Market Revenue (USD Billion), by Countries, (2022-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- North America Microarray Analysis Market Revenue (USD Billion), by Countries, (2022-2030)

- Latin America Microarray Analysis Market Revenue (USD Billion), by Countries, (2022-2030)

- Brazil

- Argentina

- Chile

- Middle East and Africa Microarray Analysis Market Revenue (USD Billion), by Countries, (2022-2030)

- GCC

- Turkey

- South Africa

- Global Microarray Analysis Market Revenue: Competitive Analysis, 2021

- Key strategies by players

- Revenue (USD Billion and %), By manufacturers, 2021

- Player Positioning by Market Players, 2021

- Competitive Analysis

- Novartis AG.

- Business Overview

- Business Financials (USD billion)

- Product Category, Type, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- Swot Analysis

- Bayer AG

- Abbott Laboratories

- Hoffmann-La Roche Ltd

- Sanofi

- Pfizer Inc.

- GlaxoSmithKline PLC

- Focus Consumer Healthcare

- Johnson & Johnson

- Alvogen

- Novartis AG.

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.