Next-generation Sequencing Market Insights

Next-generation Sequencing Market is projected to be worth USD 11.37 Billion by 2028, registering a CAGR of 11.7 % CAGR during the forecast period (2024-2028), The market was valued at USD 5.24 Billion in 2024. Since NGS sequencing is the most crucial step in the workflow, it holds the largest market share. The oncology segment is estimated to dominate the growth of the market due to the rising application of NGS technology in precision medicine. North America is estimated to lead the regional market, due to development of WGS in the region is anticipated to play a crucial role in the growth of the market in North America

The next-generation sequencing (NGS) refers to a group of interconnected technologies that allow for massively parallel or deep sequencing coverage of a chosen area or the whole genome of an organism. Sequencing technologies are fundamental to the field of genomics-based research and have been around for many years. However, as NGS or massively parallel DNA and RNA sequencing technology continue to progress, researchers now have access to more affordable, quickly improving genome-wide sequencing coverage and data processing tools. NGS has uses that go beyond whole-genome analysis because it has substantial effects on recent developments in basic genomics and disease research.

Next-generation Sequencing Market Dynamics

Driver:

Global adoption of the novel NGS technologies has been significantly enhanced by the low cost of genome sequencing combined with the availability of high-end, effective, and accurate NGS devices. This factor is projected to drive the Next-generation Sequencing market growth.

Restrain:

The shortage of trained experts and ethical and legal limitations associated with Next-generation Sequencing (NGS) is expected to limit the market expansion during the forecast period.

Opportunity:

NGS tools are used in personalized medicine to identify gene expressions, assisting in the development of precision medicine based on the patient’s characteristics. Therefore, the application of NGS tools in precise medicines is estimated to boost opportunities in the market.

COVID-19 Impact on Next-generation Sequencing Market:

The detrimental effects of COVID-19’s global expansion on numerous countries have shocked governments around the world, prompting them to act decisively to stop COVID-19. The first strain of Coronavirus was identified in Wuhan, China in December 2019 which affected the entire world. On a rise in infection across various nations, around 212 countries were infected by the pandemic. Most companies in numerous nations have been severely impacted by the global crisis COVID-19 pandemic. Further, the pandemic development of vaccines and therapeutic drugs has boosted the demand for precise medicines. Moreover, growing concern over fast-spreading, novel variants of the SARS-CoV-2 coronavirus, such as the Alpha has increased the demand for NGS technologies in virus identification.

Next-generation Sequencing Market Report Coverage

| Report Attributes | Report Details |

| Study Timeline | 2016-2028 |

| Market Size in 2028 (USD Billion) | 11.37 |

| CAGR (2024-2028) | 11.7% |

| By Technology | WGS

Whole Exome Sequencing Targeted Sequencing & Resequencing – DNA-based, RNA-based |

| By Workflow | Pre-sequencing – NGS Library Preparation Kits, Semi-automated Library Preparation, Automated Library Preparation, Clonal Amplification

Sequencing NGS Data Analysis- NGS Primary Data Analysis, NGS Secondary Data Analysis NGS Tertiary Data Analysis |

| By Application | · Oncology

o Diagnostics and Screening § Oncology Screening Sporadic Cancer, Inherited Cancer § Companion Diagnostics § Other Diagnostics o Research Studies · Clinical Investigation o Infectious Diseases o Inherited Diseases o Idiopathic Diseases o Non-communicable/Other Diseases · Reproductive Health o NIPT § Aneuploidy § Microdeletions o PGT o Newborn Genetic Screening o Single Gene Analysis HLA Typing/Immune System Monitoring, Metagenomics, Epidemiology & Drug Development, Agrigenomics & Forensics, Consumer Genomic |

| By End-use | Academic Research, Clinical Research, Hospitals & Clinics, Pharma & Biotech Entities, Other Users |

| By geography | North America: U.S., Canada, Mexico

Europe: Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe Asia Pacific: China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile, Rest of Latin America The Middle East and Africa: GCC, Turkey, Israel, Rest of MEA |

Next-generation Sequencing Market Segmentation:

By Technology

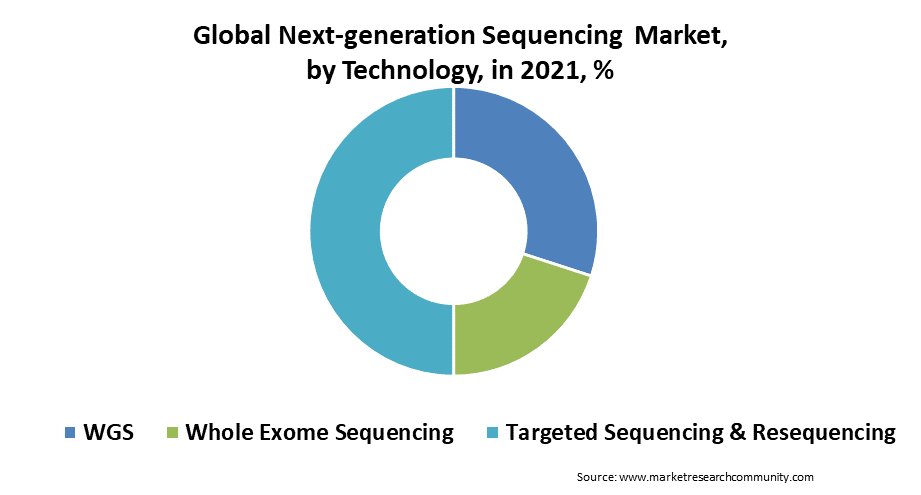

The type segment is divided into WGS, whole-exome sequencing, and target sequencing & resequencing market. The targeted sequencing and resequencing segment accounted for the largest market share in 2024. The availability of a huge number of whole-genome data will be required to be evaluated at specific gene sites and isolated genetic expressions, hence this market is predicted to experience growth in demand after the growth of whole-genome sequencing.

By Workflow

The workflow segment is divided into pre-sequencing, sequencing, NGS data analysis, and NGS tertiary data analysis. Since NGS sequencing is the most crucial step in the workflow, it holds the largest market share. These systems can deliver a precise liquid amount, which is crucial for NGS. Additionally, the device performs tasks like replacing tubes and microtiter plates, which speeds up workflow.

By Application

The oncology segment is estimated to dominate the application segment. The factors responsible for the growth of the segment are the prevalence of cancer and the application of technologies in the treatment. Further, high market share is attributed to the use of NGS for DNA and RNA sequencing, epigenetics, and the analysis of chromosomal abnormalities, which together account for almost three-fourths of the global sequencing data. Hence, the above-mentioned factors are estimated to boost the growth of the next-generation sequencing market.

By End-use

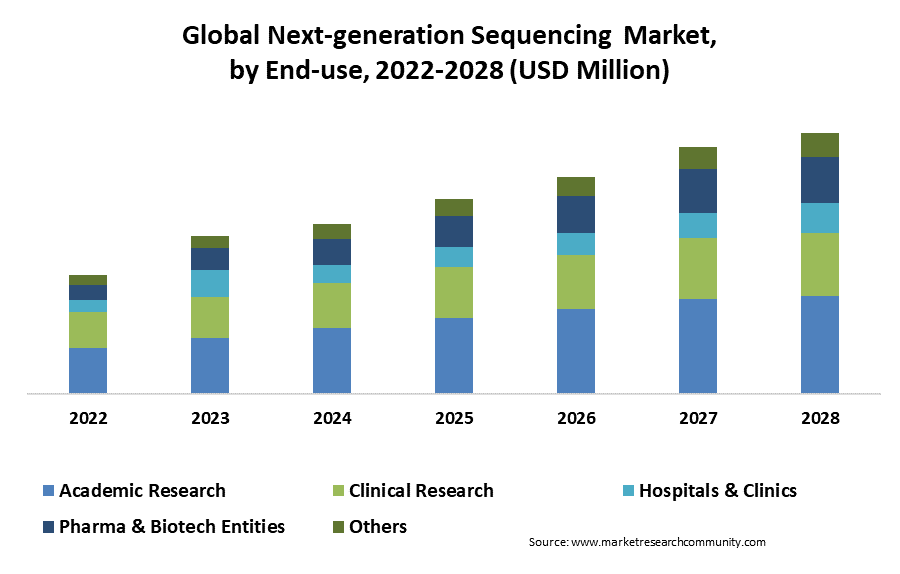

In 2024, the academic research market category had the biggest market share. The largest market share in this category can be attributable to the use of NGS technologies in research initiatives conducted in universities and research facilities. Furthermore, it is projected that the availability of scholarships for Ph.D. research in NGS will increase demand for NGS goods and services, leading to profitable growth during the forecast period.

By Region

The regional segment includes Asia Pacific, Europe, North America, Middle East, and Africa, Latin America. The NGS market was led by North America, which in 2024 had a 51.7 % revenue share. Numerous clinical laboratories that use NGS to deliver genetic testing services are what is driving the regional market. Furthermore, the development of WGS in the region is anticipated to play a crucial role in the growth of the market in North America.

Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), Application innovation, various business strategies, and product launches have accelerated the growth of the market.

Key Players

- Illumina

- Roche

- QIAGEN

- Hoffman-La Roche Ltd

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

- BGI

Recent Development

- The Genomics Health Futures Mission, which will sequence the genomes of 200,000 individuals, will receive USD 372 million from the Australian government over ten years beginning in May 2018.

- In 2018, the Canadian Institute of Health Research announced a USD 162 million investment over 4 years to support 15 genome-based precision health projects. This announcement was made in partnership with Genome Canada, a non-profit organization that uses genomic-based technology.

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Product Picture of Next-generation Sequencing

- Global Next-generation Sequencing Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief

- Parent Market Overview

- Overall Next-generation Sequencing Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews

- Average primary breakdown ratio

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces on market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Distribution Channel

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Technology Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global Economy

- Covid-19 impact on Next-generation Sequencing demand

- Post-Covid Impact on Next-generation Sequencing Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Next-generation Sequencing Market Segmentation, by Revenue (USD Billion), (2022-2030)

- By Technology

- WGS

- Whole Exome Sequencing

- Targeted Sequencing & Resequencing

- DNA-based

- RNA-based

- By Workflow

- Pre-sequencing

- NGS Library Preparation Kits

- Semi-automated Library Preparation

- Automated Library Preparation

- Clonal Amplification

- Sequencing

- NGS Data Analysis

- NGS Primary Data Analysis

- NGS Secondary Data Analysis

- NGS Tertiary Data Analysis

- By Application

- Oncology

- Diagnostics and Screening

- Oncology Screening

- Sporadic Cancer

- Inherited Cancer

- Companion Diagnostics

- Other Diagnostics

- Oncology Screening

- Research Studies

- Diagnostics and Screening

- Clinical Investigation

- Infectious Diseases

- Inherited Diseases

- Idiopathic Diseases

- Non-communicable/Other Diseases

- Reproductive Health

- NIPT

- Aneuploidy

- Microdeletions

- PGT

- Newborn Genetic Screening

- Single Gene Analysis

- NIPT

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomic

- Oncology

- By End Use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

- Pre-sequencing

- By Technology

- Global Next-generation Sequencing Market Overview, By Region

- North America Next-generation Sequencing Market Revenue (USD Billion), by Countries, (2022-2030)

- US

- By Technology

- By Workflow

- By Application

- By End Use

- Canada

- Mexico

- US

- Europe Next-generation Sequencing Market Revenue (USD Billion), by Countries, (2022-2030)

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Next-generation Sequencing Market Revenue (USD Billion), by Countries, (2022-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- North America Next-generation Sequencing Market Revenue (USD Billion), by Countries, (2022-2030)

- Latin America Next-generation Sequencing Market Revenue (USD Billion), by Countries, (2022-2030)

- Brazil

- Argentina

- Chile

- Middle East and Africa Next-generation Sequencing Market Revenue (USD Billion), by Countries, (2022-2030)

- GCC

- Turkey

- South Africa

- Global Next-generation Sequencing Market Revenue: Competitive Analysis, 2021

- Key strategies by players

- Revenue (USD Billion and %), By manufacturers, 2021

- Player Positioning by Market Players, 2021

- Competitive Analysis

- Illumina

- Business Overview

- Business Financials (USD Million)

- Product Category, Type, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- Swot Analysis

- Roche

- QIAGEN

- Hoffman-La Roche Ltd

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

- BGI

- Illumina

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.