Plasma Fractionation Market Insights :

Plasma fractionation market was valued at USD 27.40 Billion in 2021, registering a CAGR of 7.3% during the forecast period (2022-2030), and is projected to be worth USD 51.66 Billion by 2030. The COVID-19 pandemic has had an unexpected and devastating impact on the world, and demand for plasma fractionation has been lower than expected in all regions compared to pre-pandemic levels. According to our estimate, the global market grew 4.9% less slowly in 2020 than it did in 2019. Major market players have launched several R&D projects to develop new plasma-derived medicines in response to the rising demand for goods derived from plasma.

Additionally, to facilitate the availability of plasma for the development of new products, these major market participants concentrated heavily on owning and purchasing new plasma collection sites. For instance, Grifols, S.A. bought all the shares of Prometic Plasma Resources Inc. in 2021 via its subsidiary, Grifols Canada Therapeutics Inc. Correspondingly, Terumo Blood, CSL Plasma, and Cell Technologies announced their agreement in April 2021 to create and deliver an innovative plasma collection platform at the CSL Plasma Collection Centers in the United States. Therefore, it is anticipated that the strategic efforts of the main corporations will fuel the expansion of the global market.

Plasma Fractionation Market Dynamics:

Fractionation is a technique used to isolate specific amounts of a mixture. Additionally, blood’s fluid component, plasma, is fractionated to produce several plasma derivatives comprising immunoglobulins and albumin. These plasma-derived complexes are employed to treat several blood plasma-related illnesses and have beneficial effects. Consider the plasma derivative coagulation factor VIII, which is used to prevent and treat hemophilia. Additionally, it is used to prevent excessive blood loss during surgery. Immunoglobulins are used in a similar way to treat both primary and secondary immunological deficiencies.

Driver:

Globally, there has been a significant increase in demand for plasma-derived medicines. Strong growth in immunoglobulin demand resulted in positive market expansion on a global scale. The increase in the incidence of various immunodeficiency illnesses around the world is the cause of the rising demand.

Restraint:

For many plasma-driven therapies, various recombinant substitutes have been created recently. Recombinant products are employed as preventative measures and are less immunogenic than those made from plasma. Significant advantages of the medicines include less frequent administration and improved prophylactic performance. Thus, a significant factor restricting the utilization of plasma products is the expanding usage of recombinant factors and their greater use in preventative therapy.

COVID-19 Analysis of Plasma Fractionation Market:

To treat sick people, several organizations tested plasma-based medicines in response to the COVID-19 outbreak. To tackle COVID-19, several businesses started a variety of R&D projects. For instance, in 2020, Biotest AG collaborated with other businesses throughout the sector through the COVID-19 Plasma Alliance, including Takeda Pharmaceutical Company Limited, LFB, CSL Behring, and Octapharma AG. Together, the businesses developed a new polyclonal hyper immunoglobulin medication to combat SARS-CoV-2. However, as a result of disruption to the plasma collecting procedure, the market grew slowly. Plasma collection was affected despite being referred to as an important infrastructure due to the rise in cases and COVID-19 regulations, such as social distance and stay-at-home orders. For instance, the volume of plasma collected was reduced as a result of COVID-19, while the cost of collection in terms of donor remuneration increased, according to the annual report for the years 2020–2021 released by CSL Limited.

Plasma Fractionation Market Report Cover:

| Report Attributes | Report Details |

| Study Timeline | 2016-2030 |

| Market Size in 2030 (USD Billion) | 51.66 Billion |

| CAGR (2022-2030) | 7.3% |

| By Product | Albumin, Immunoglobulins, Coagulation factor VIII, Coagulation factor IX |

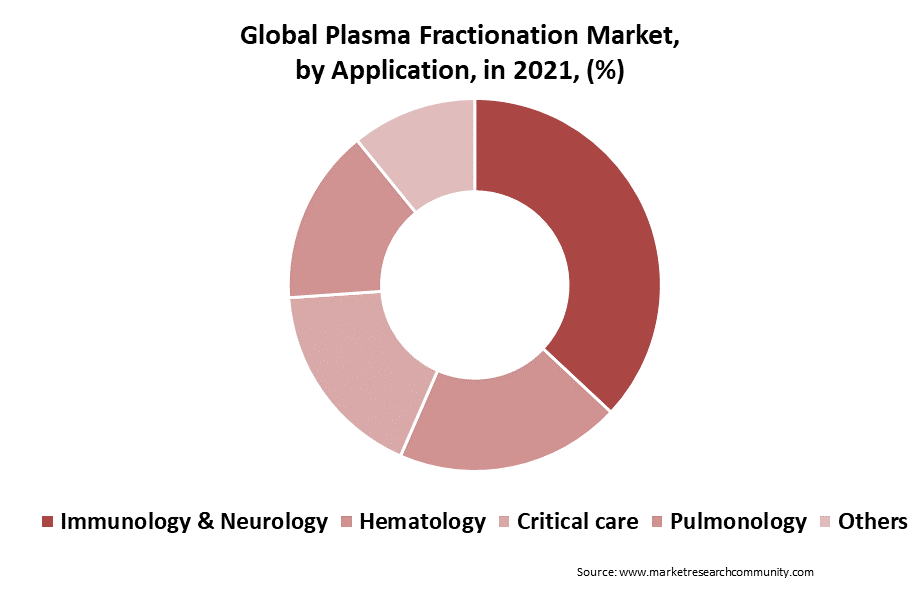

| By Application | Immunology & Neurology, Hematology, Critical care, pulmonology, Others |

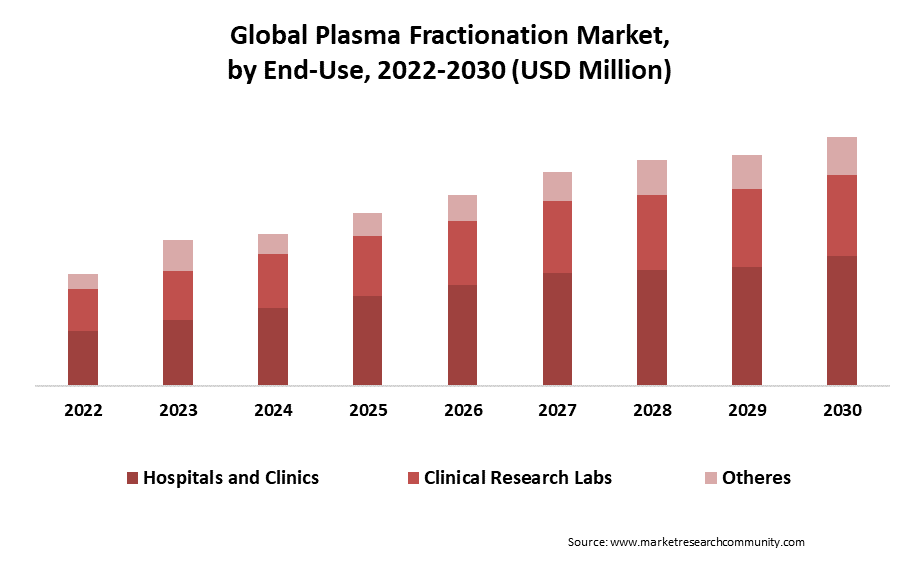

| By End-use | Hospitals, & Clinics, Clinical Research Labs, and Others |

| By geography | North America– (U.S., Canada, Mexico)

Europe- (Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe) Asia Pacific- (China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific) Latin America- (Brazil, Argentina, Chile, Rest of Latin America) The Middle East and Africa- (GCC, Turkey, Israel, Rest of MEA) |

| Key Players | Thermo Fisher Scientific Inc., Merck KGaA, GENERAL ELECTRIC, Moregate Biotech, Atlanta Biologics Inc., Gemini Bio-Products, and Bovogen BiologicsPty ltd. |

Plasma Fractionation Market Segment Analysis:

By Product

The market is divided into albumin, protease inhibitors, coagulation factors, immunoglobulin, and others based on the product. Intravenous immunoglobulin (IVIG) and subcutaneous immunoglobulin are two sub-segments of the immunoglobulin segment (SCIG). Further, factor IX, factor VIII, prothrombin complex concentrates, fibrinogen concentrates, and others are expected to boost the growth of the market.

By Application

In 2021, the immunology & neurology category is expected to have a larger market share and is expected to expand at a faster rate. Strong global demand for these medications was sparked by the rising toll of autoimmune and immunodeficiency illnesses. Plasma proteins including coagulation factors and immunoglobulins are frequently used in treatment methods due to the rising prevalence of immunological and neurological illnesses. The segment is expected to rise throughout the projected period due to the discovery of several plasma-based proteins and clinical trials for neurology and immunology applications.

By End-Use

The market is divided into hospitals & clinics, clinical research laboratories, and others based on the end-user (academic institutes). The hospitals & clinics segment is anticipated to generate the largest revenue during the forecast period. The rising popularity of plasma-derived medicines around the world is credited with driving the segment’s rise. Further, several private institutions have adopted plasma-derived therapies and are recommending them to their patients who have rare immunodeficiency illnesses due to increased infrastructure and technology. For instance, the Brazilian Rare Disease Network (BRDN), which comprises 40 organizations, including 18 university hospitals, 17 reference services for rare diseases, and five reference services for newborn screening, is now being built.

By Region

The regional segment of the plasma fractionation market is North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The plasma fractionation market was dominated by North America in 2021, followed by Europe and the Asia Pacific region. Due to the growing usage of preventative treatments among diagnosed patients as well as the growing use of immunoglobulins in autoimmune and neurological illnesses. The large number of patients with hemophilia who have registered further fuels the expansion of this sector. The market for plasma fractionation in North America is also expected to be driven by the increasing adoption of coagulation factors due to the rising number of hemophilic patients.

The second-largest market share belonged to Europe, in the plasma fractionation market. As immunodeficiency and bleeding disorders are becoming more common in the area, increased investments in these systems are accelerating market growth in the area. For instance, the NCBI reported in 2021 that the prevalence of Common Variable Immunodeficiency (CVID), which affects 1 in 25,000 people, is greater in northern Europe.

Plasma Fractionation Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. The majority of manufacturers are concentrating on new product launches, improvements to current products, and mergers and acquisitions. –

- Bioproduct laboratory

- Biotest AG

- CSL Ltd.

- Grifols SA

- Kedrion S.P.A (Kedrion Biopharma Inc.)

- LFB S. A.

- Octapharma AG

- Sanquin Blood Supply Foundation

- Takeda Pharmaceutical Company Limited

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Product Picture of Plasma Fractionation

- Global Plasma Fractionation Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief

- Parent Market Overview

- Overall Plasma Fractionation Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews

- Average Type primary breakdown ratio

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces on market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Therapeutic

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Product Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global Economy

- Covid-19 impact on Plasma Fractionation Market demand

- Post-Covid Impact on Plasma Fractionation Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Plasma Fractionation Market Segmentation, Revenue (USD Billion), (2022-2030)

- By Product

- Albumin

- Immunoglobulins

- Coagulation factor VIII

- Coagulation factor IX

- By Application

- Immunology & Neurology

- Hematology

- Critical care

- Pulmonology

- Others

- By End-Use

- Hospitals, & Clinics

- Clinical Research Labs

- Others

- By Product

- By Global Plasma Fractionation Market Overview, By Region

- North America Plasma Fractionation Market Revenue (USD Billion), by Countries, (2022-2030)

- US

- By Product

- By Application

- By End-Use

- Canada

- Mexico

- US

- Europe Plasma Fractionation Market Revenue (USD Billion), by Countries, (2022-2030)

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Plasma Fractionation Market Revenue (USD Billion), by Countries, (2022-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- North America Plasma Fractionation Market Revenue (USD Billion), by Countries, (2022-2030)

- Latin America Plasma Fractionation Market Revenue (USD Billion), by Countries, (2022-2030)

- Brazil

- Argentina

- Chile

- The Middle East and Africa Plasma Fractionation Market Revenue (USD Billion), by Countries, (2022-2030)

- GCC

- Turkey

- South Africa

- Global Plasma Fractionation Market Revenue: Competitive Analysis, 2021

- Key strategies by players

- Revenue (USD Billion and %), By manufacturers, 2021

- Player Positioning by Market Players, 2021

- Competitive Analysis

- Baxter International Inc.

- Business Overview

- Business Financials (USD Billion)

- Product Category, Source, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- Swot Analysis

- Bio product laboratory

- Biotest AG

- CSL Ltd.

- Grifols SA

- Kedrion S.P.A (Kedrion Biopharma Inc.)

- LFB S. A.

- Octapharma AG

- Sanquin Blood Supply Foundation

- Takeda Pharmaceutical Company Limited

- Baxter International Inc.

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.