Atherectomy Devices Market Insights:

Atherectomy Devices Market is projected to be worth USD 6.35 Billion by 2032, registering a CAGR of 4.7% CAGR during the forecast period (2024-2032), the market was valued at USD 4.20 Billion in 2024. Directional atherectomy devices dominated the market in 2024 due to their early introduction and market penetration. It also

has benefits such as being available in a range of sizes and having the capacity to debulk plaque. The hospital and surgical center segment is expected to dominate the growth of the market due to increased knowledge of the identification and treatment of peripheral coronary disease. In the regional segment, North America dominated by atherectomy device market share in 2024. The main drivers of this dominance are a favorable reimbursement environment and a large number of FDA-approved devices.

Atherectomy Devises Market Dynamics:

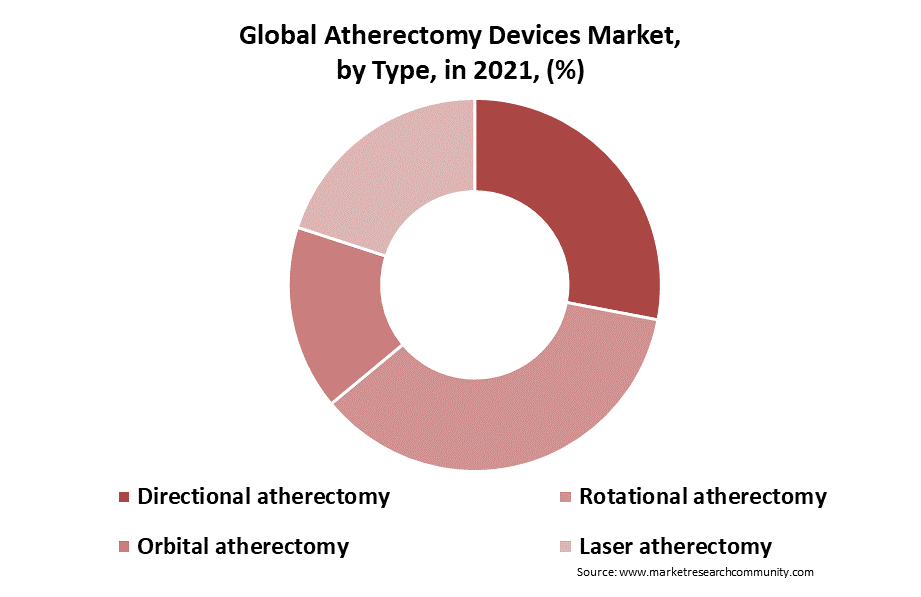

A treatment called an atherectomy is used to remove atherosclerotic plaque from ailing arteries. According to the texture of the plaque, atherosclerotic plaques can be found in the coronary or peripheral artery vasculature and can have a variety of characteristics. Both coronary and peripheral artery disease has been successfully treated by atherectomy. Atherectomy devices come in four different varieties directed, orbital, rotational, and laser. The interventionist decides the technology to deploy depending on a variety of considerations.

Driver:

The preference for minimally invasive procedures is a major factor driving the market for atherectomy devices. Unlike traditional open surgery, which causes more damage to the body, minimally invasive surgery uses a range of techniques to operate. Minimally invasive procedures typically result in less discomfort, a shorter hospital stay, and fewer complications. A minimally invasive surgery called atherectomy is frequently performed to treat arteries. Due to several characteristics, such as reduced pain, a shorter hospital stay, less scarring, less tissue damage, and a greater accuracy rate, this procedure is in very high demand.

Restraint:

Due to a lack of skilled workers with the knowledge to operate such devices, the minimally invasive devices category is unable to make use of this potential. This is anticipated to restrict the market’s growth along with other elements including strict regulations.

COVID-19 Analysis of Atherectomy Devices Market:

Medical supplies are becoming more and more in demand as a result of the afflicted populace. Among the most common medical devices used in first-line clinical care are respiratory system maintenance devices such as life support machines, atomizers, oxygen generators, and monitors. Additionally, COVID-19 has caused a significant increase in demand for medical goods such as gloves, masks, and protective eyewear. The need for medical supplies continues to grow among the general public and healthcare professionals due to the increase in COVID-19 cases around the world. The producers of these goods have the opportunity to take advantage of the rising demand for medical supplies to guarantee a sufficient and ongoing supply of personal protective equipment on the market.

Atherectomy devises Market Report Coverage:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 (USD Billion) | 6.35 Billion |

| CAGR (2024-2032) | 4.7% |

| By Type | Directional atherectomy, Rotational atherectomy, Orbital atherectomy, Laser atherectomy |

| By End Use | Hospitals and Surgical Centers, Ambulatory Care Centers, Other End Users |

| By geography | North America– (U.S., Canada, Mexico)

Europe- (Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe) Asia Pacific- (China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific) Latin America- (Brazil, Argentina, Chile, Rest of Latin America) The Middle East and Africa- (GCC, Turkey, Israel, Rest of MEA) |

| Key Players | Boston Scientific Corporation, Cardiovascular Systems Inc., Medtronic (Covidien), Spectranetics, VOLCANO CORPORATION, Avinger Inc., Koninklijke Philips N.V, Straub Medical AG, ST. JUDE MEDICAL, BARD Peripheral Vascular, Cardinal Health (Cordis), and Terumo IS. |

Atherectomy Devises Market Segment Analysis:

By Type

The segment types include directional, rotational, orbital, and laser atherectomy devices. Due to its early introduction and atherectomy devices market penetration, directional atherectomy devices dominated the market in 2024. It also has benefits such as being available in a range of sizes and having the capacity to debulk plaque.

The huge demand is also a result of numerous clinical trials that demonstrate the effectiveness of the gadget. Trials like EASE (Endovascular Atherectomy Safety and Effectiveness) and DEFINITIVE LE (determination of the effectiveness of the SilverHawk peripheral plaque excision system for infrainguinal vessels/lower extremities treatment) showed success rates of more than 90%, demonstrating the efficacy of the relevant devices.

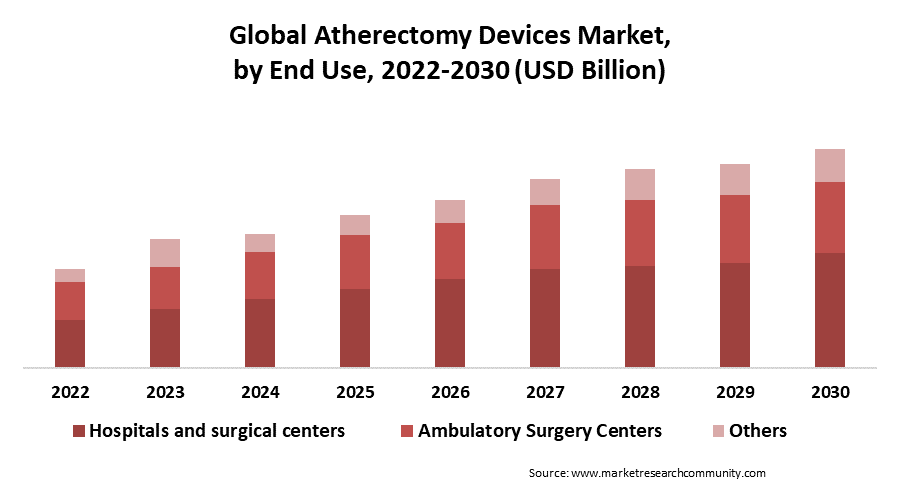

By End Use

The end-user segment of the atherectomy device market is divided into hospitals and surgical centers, ambulatory care centers, and others. The hospital and surgical centers segment is expected to dominate the growth of the market. The use of gadgets on the market is growing as cardiac disorders including coronary artery disease are becoming more common. The use of atherectomy devices in the hospital sector is expected to grow due to increased knowledge of the identification and treatment of peripheral coronary disease. Further, an increase in the patient pool and advanced healthcare facilities provided by hospital authorities are expected to boost the growth of the atherectomy device market. Further, segments such as ambulatory care centers, and others are expected to fuel the growth of the atherectomy device market.

By Region

In the regional segment, North America dominated by atherectomy device market share in 2024. The main drivers of this dominance are a favorable reimbursement environment and a large number of FDA-approved devices. For instance, the Pantheris SV (Small Vessel) image-guided atherectomy system from Avinger, Inc. was granted 510(k) approval by the FDA in April 2019. Pantheris expects to increase its atherectomy devices market position in the worldwide atherectomy devices market by 50% as a result of a product line extension of its Lumivascular image-guided atherectomy platform.

In the area, there is a clear preference for minimally invasive techniques. While the number of endovascular operations has multiplicatively increased since 2006, the rate of bypass surgery has declined by 43%. Additionally, this has been seen in the rate of amputations, which decreased by about 28% over the

Atherectomy Devises Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and product launches have accelerated the growth of the atherectomy devices market. Key players in the market include-

- Boston Scientific Corporation

- Cardiovascular Systems Inc.

- Medtronic (Covidien)

- Spectranetics

- VOLCANO CORPORATION

- Avinger Inc.

- Koninklijke Philips N.V

- Straub Medical AG

- JUDE MEDICAL

- BARD Peripheral Vascular

- Cardinal Health (Cordis)

- Terumo IS.

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Type Picture of Atherectomy Devices

- Global Atherectomy Devices Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief

- Parent Market Overview

- Overall Atherectomy Devices Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews

- AverEnd Use primary breakdown ratio

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces on market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Therapeutic

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Type Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global Economy

- Covid-19 impact on Atherectomy Devices Market demand

- Post-Covid Impact on Atherectomy Devices Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Atherectomy Devices Market Segmentation, Revenue (USD Billion), (2022-2030)

- By Type

- Directional atherectomy

- Rotational atherectomy

- Orbital atherectomy

- Laser atherectomy

- By Type

- By Global Atherectomy Devices Market Overview, By Region

- North America Atherectomy Devices Market Revenue (USD Billion), by Countries, (2022-2030)

- US

- By Type

- Canada

- Mexico

- US

- Europe Atherectomy Devices Market Revenue (USD Billion), by Countries, (2022-2030)

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Atherectomy Devices Market Revenue (USD Billion), by Countries, (2022-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- North America Atherectomy Devices Market Revenue (USD Billion), by Countries, (2022-2030)

- Latin America Atherectomy Devices Market Revenue (USD Billion), by Countries, (2022-2030)

- Brazil

- Argentina

- Chile

- Middle East and Africa Atherectomy Devices Market Revenue (USD Billion), by Countries, (2022-2030)

- GCC

- Turkey

- South Africa

- Global Atherectomy Devices Market Revenue: Competitive Analysis, 2021

- Key strategies by players

- Revenue (USD Billion and %), By manufacturers, 2021

- Player Positioning by Market Players, 2021

- Competitive Analysis

- AbbVie, Inc.

- Business Overview

- Business Financials (USD Billion)

- Type Category, Source, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- Swot Analysis

- Boston Scientific Corporation

- Cardiovascular Systems Inc.

- Medtronic (Covidien)

- Spectranetics

- VOLCANO CORPORATION

- Avinger Inc.

- Koninklijke Philips N.V

- Straub Medical AG

- JUDE MEDICAL

- BARD Peripheral Vascular

- Cardinal Health (Cordis)

- Terumo IS.

- AbbVie, Inc.

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.