Betaine Market Insights

The Global Betaine Market exceeded USD 4.21 Billion in 2024 and is expected to rise with a CAGR of 5.9% from 2024-2028 during the forecast period, and the market is projected to be worth USD 6.29 Billion by 2028. Increase in awareness about the nutritional value of Betaine as an animal feed additive, its growing commercial usage as a surfactant, rising demand from cosmetics and personal care industry are key parameters driving the market growth.

In the 1860s, Betaine was isolated from an organic base of the sugar beet by a German chemist named Scheibler and named it betaine. Betaine molecule is composed of three methyl groups that can be easily broken allowing it to function actively as a methyl donor in metabolism. The molecular structure of betaine includes both positive and negative charges on the molecule which supports it to have good characteristics of an osmolyte. Raw materials such as sugar beet and its derivates that include molasses and vinasses are primarily used for the extraction of natural betaine. With the increasing technological advancement, the sources of betaine have been made commercially and are utilized to make synthetic betaine such as betaine hydrochloride (HCL). On a bigger note, there is no major difference in functionality between natural and synthetic betaine.

COVID-19 Analysis of Betaine Market

The spread of COVID-19 across the world has affected the whole world and all the nations had taken different measures to prevent COVID-19 in their regions. The highly infectious Coronavirus was first detected in Wuhan, China in December 2019. Since then, 212 countries and territories got infected by the virus around the world. The damage caused to the economy by the pandemic is majorly driven by a fall in demand globally. As companies reduced staff to formulate lost revenues, the economy saw a downturn as the freshly unemployed workers could no longer afford non-affected goods and services. To use retail as an example, an increase in unemployment will compound the reduction in sales that occurred from the closure of shopfronts, cascading the crisis over to the online retail segment (which has increased throughout the pandemic). It is through this dynamic that economists are contemplating whether the covid-19 pandemic could lead to a global recession on the scale of the great depression.

Betaine market is dependent on its application in cosmetics and personal care, animal feed, food & beverages and other applications such as detergents. Lockdowns disrupted consumption and demand for consumer goods. Further due to sudden restriction on movement, disruption in the supply chain was observed. Major industries consuming betaine also had a severe impact during the early COVID-19 pandemic period owing to the rumours about the potential involvement of eggs and various animal meats in the spread of COVID-19. People over the globe have observed various infections in the past that derived from animal meat consumption such as swine flu and bird flu which tragically affected the demand for animal-based products in the early quarter of 2020.

Betaine Market Report Coverage

Betaine Market is segmented by Type, Application and Region. By type the market is segmented into Natural Betaine and Synthetic Betaine. By Application, the market is segmented into Food & Beverages, Animal Feed, Cosmetics & Personal Care, Others. and others. The report also covers the market size and forecasts for the Global Betaine Market in 26 countries across major regions.

| Report Attributes | Report Details |

| Study Timeline | 2016-2028 |

| Market Size in 2028 (USD Billion) | 6.29 |

| CAGR (2024-2028) | 5.9% |

| By Type | Natural Betaine, Synthetic Betaine |

| By Application | Food & Beverages, Animal Feed, Cosmetics & Personal Care, Others |

| By Geography | North America: U.S., Canada, Mexico

Europe: Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe Asia Pacific: China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile, Rest of Latin America The Middle East and Africa: GCC, Turkey, Israel, Rest of MEA |

Betaine Market Segmental Analysis

Market Research Community provides extensive analysis of the size, share, major trends in each sub-segment of the Global Betaine Market, along with forecasts at the global, regional and country level from 2024-2028.

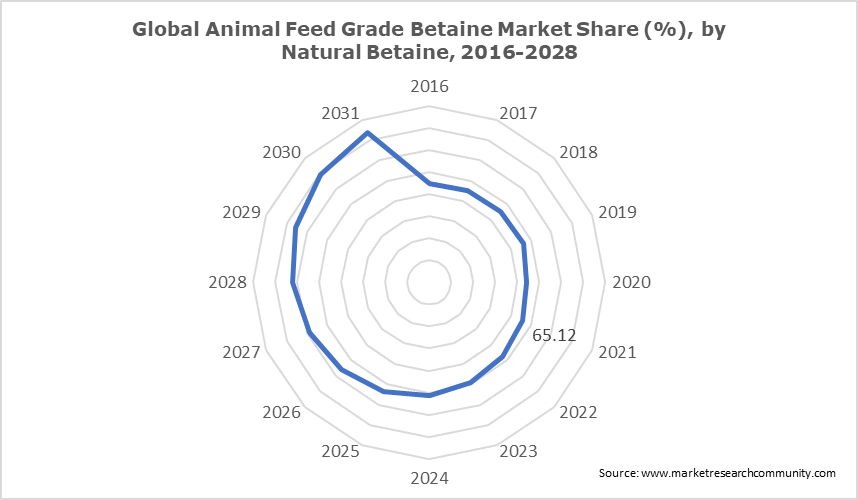

Natural Betaine Accounted for a Higher Market Share

Natural Betaine is a natural amino acid derivative obtained from naturally occurring raw materials such as sugar beet and its derivates that includes molasses and vinasses. It is available in two different forms for an in-feed application that includes liquid and dry (crystalline) forms. Natural betaine has various functions as it helps in methyl donor activity to support the metabolism of animals, helps in osmoregulation, is an attractant in fish and crustaceans, protection against heat stress, supports the gut, and carcass improvement. It is the closest alternative to choline and methionine available in the market.

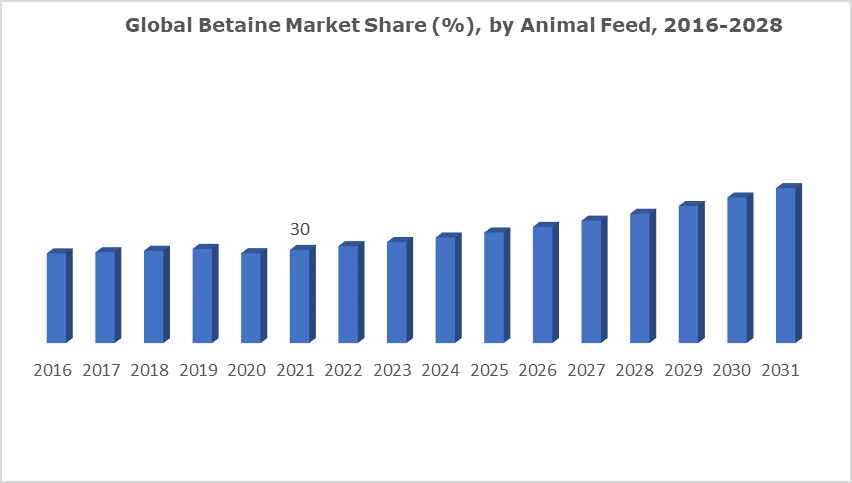

Animal Feed Application to Register a Growth Rate Between 25-30% During the Forecast Period

Betaine is commonly used in diets of broilers as it increases the laying rate, higher breast meat yield, and increases calcification of the eggshells in laying hens. Betaine is a cost-effective solution for problems such as wet litters, fatty livers, and heat stress in broilers. The addition of betaine as a nutrition additive in the feed of broilers has shown increasing laying rate percentage, better calcification of the eggshell, and better feed conversion ratio. A study (2016) published in ORFFA reported that betaine may help in solving heat stress problems in broilers. Heat stress negatively affects the process of ovulation, egg formation, body weight, and oviposition while supplementing broilers with betaine helped in heat stress management and recovery of normal body weight, and egg-laying rate. In many cases, the survival rate of the laying hens was also improved.

Animal feed grade betaine is widely used in the swine’s nutrition as a feed. Sugar beets have traditionally been known as an excellent source of betaine, and it is now being pushed for its health advantages in both food and nutrition for pigs. As per MDPI, an experiment in 2024 was carried out to show the effects of the betaine diet on growth performance to determine the effects on zootechnical performance, carcass, higher breast meat yield, and fat quality of pigs. Betaine supplementation can improve feed intake during stress situations, such as high ambient temperatures in the summer.

The UN Food and Agriculture Organization (FAO) reported that global pig meat exports were reported to reach 11.1 million tons in 2020, representing a 16 percent increase year on year. China accounted for 47 percent of worldwide pig meat imports, which are expected to increase by about 80 percent year on year to more than 5 million tons. While the global production of pigmeat has significantly increased from 103.5 million tons in 2008 to 120.9 million tons in 2018.

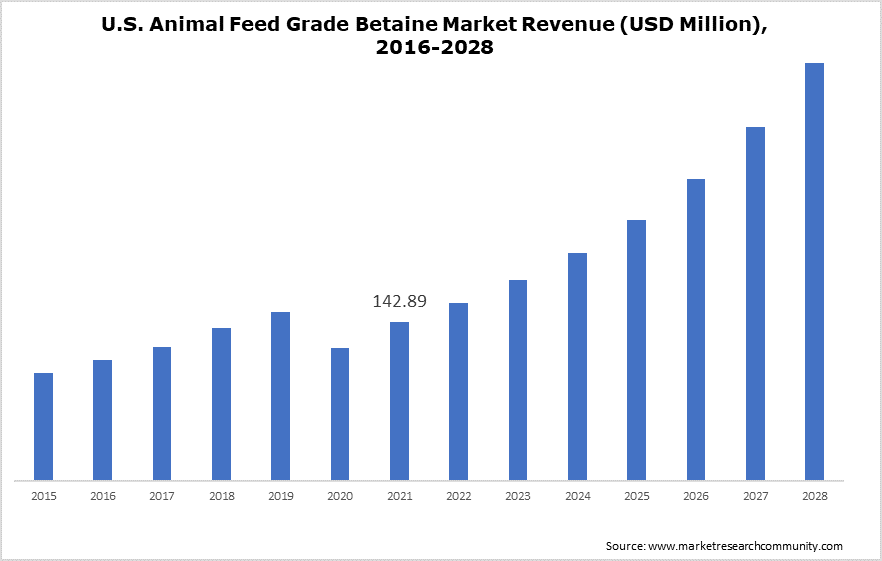

North America Region to Dominates the Market

North America dominated the betaine market globally, owing to high demand from personal care products, and food, beverage, and dietary supplements in the region.

Increased awareness for the addition of animal feeds in countries of North America such as Canada and the United States have increased the consumption of animal feed grade betaine in the region. The prevalence of heat stress and low carcass quality is common in animals in North America. It is also having high poultry and meat production and consumption owing to which meat production in North America is also high which serves as an essential market for the demand for betaine for animals to increase the production of poultry and meat products.

Global Betaine Market Competitive Landscape

The Global Betaine Market study is relatively competitive, with a significant number of global and regional players. The key strategies adopted by these firms include product innovations, expansions, acquisitions and mergers.

Key Players

- DuPont de Nemours, Inc.

- Associated British Food Plc.

- Nutreco N.V.

- American Crystal Sugar Company

- Weifang Sunwin Chemicals Co. Ltd

- Xi′an Harmonious Natural Biotechnology Co., Ltd.

- Jinan Pengbo Biotechnology Co., Ltd.

- BASF SE

- Solvay

A highly developed distribution network provides a competitive edge to the primary market players. Furthermore, players need to invent constantly, to grow in the market, due to the rapidly advancing consumer needs and choices.

Recent Developments

- June 2024 – Nutreco acquired Nutrimin, a leading Danish producer of concentrates, piglet feed and farm minerals. The deal will create more worth for cultivators in the region and increase portfolio of quality products and innovative solutions of Nutreco’s animal nutrition division Trouw Nutrition and Nutrimin.

Table of Content

Chapter 1 Introduction

1.1 Market Introduction

1.2 Market Research Methodology

1.2.1 Research Process

1.2.2 Primary Research

1.2.3 Secondary Research

1.2.4 Data Collection Technique

1.2.5 Data Sources

1.3 Market Estimation Methodology

1.3.1 Limitations of the Study

1.4 Product Picture of Betaine

1.5 Global Betaine Market: Classification

1.6 Geographic Scope

1.7 Years Considered for the Study

1.8 Research Methodology in brief:

1.9 Parent Market Overview

1.10 Overall Betaine Market Regional Demand

1.11 Research Programs/Design

1.12 Market Breakdown and Data Triangulation Approach

1.13 Data Source

1.14 Secondary Sources

1.15 Primary Sources

1.16 Primary Interviews:

Chapter 2 Executive Summary

2.1 Business Trends

2.2 Regional Trends

2.3 Type Trends

2.4 Application Trends

Chapter 3 Market Dynamics

3.1 Drivers

3.1.1 Rise in awareness about the nutritional value of Betaine in animal feed and its growing use in cosmetics & personal care industry is anticipated to drive the amrket growth

3.1.2 Increasing global demand for livestock food products consumption

3.2 Restraints

3.2.1 Increasing environmental concerns due to industrial production of consumer goods

3.3 Opportunities

3.3.1 Adoption of feed grade betaine for all animal species

3.3.2 Impact forces on market dynamics

3.3.3 Impact forces during the forecast years

3.4 Industry Value Chain

3.4.1 Upstream analysis

3.4.2 Downstream analysis

3.4.3 Distribution Channel

3.4.3.1 Direct Channel

3.4.3.2 Indirect Channel

3.5 Potential Customers

3.6 Manufacturing/Operational Cost Analysis

3.7 Key Technology Landscape

3.8 Regulatory Analysis

3.9 Porter’s Analysis

3.9.1 Supplier Power

3.9.2 Buyer Power

3.9.3 Substitution Threat

3.9.4 Threat from New Entry

3.9.5 Competitive Rivalry

3.10 PESTEL Analysis

FIG. 6 PESTEL Analysis

3.10.1 Political Factors

3.10.2 Economic Factor

3.10.3 Social Factors

3.10.4 Technological Factor

3.10.5 Environmental Factors

3.10.6 Legal Factor

3.11 Covid-19 impact on the global economy

3.12 Covid-19 impact on Betaine demand

3.13 Post-Covid Impact on Betaine Market Demand

Chapter 4 Global Betaine Market Analysis Forecast by Type

4.1 Global Segment by Type

4.1.1 Global Revenue Share (%), by Type, 2021

4.1.2 Global Revenue (USD Million), by Type, 2016 – 2028

4.2 Global Revenue (USD Million), by Type, 2016 – 2028

4.2.1 Natural Betaine

4.2.2 Synthetic Betaine

Chapter 5 Global Betaine Market Analysis Forecast by Application

5.1 Global Betaine Segment by Application

5.1.1 Global Revenue Share (%), by Application, 2021

5.1.2 Global Revenue (USD Million), by Application, 2016 – 2028

5.2 Global Revenue (USD Million), by Application, 2016 – 2028

5.2.1 Food & Beverages

5.2.2 Animal Feed

5.2.3 Cosmetics & Personal Care

5.2.4 Others

Chapter 6 Global Betaine Market by Players

6.1 Player Positioning, By Manufacturer 2020

6.2 Global Betaine Market: Recent Development

Chapter 7 Betaine by Regions

7.1 Market Overview, By Region

7.1.1 Revenue, By region

7.2 Revenue (USD Million), 2016-2028

7.2.1 Revenue Share (%) by Region, 2021

7.2.2 North America

7.2.3 North America Revenue (USD Million), 2016-2028

7.3 Asia Pacific

7.3.1 Asia Pacific Revenue (USD Million), 2016-2028

7.4 Europe

7.4.1 Europe Betaine Market Revenue (USD Million), 2016-2028

7.5 Latin America

7.5.1 Latin America Feed Grade Betaine Market Revenue (USD Million), 2016-2028

7.6 Middle East & Africa

7.6.1 Middle East & Africa Revenue (USD Million), 2016-2028

Chapter 8 North America

8.1 North America Betaine Market Size by Countries

8.1.1 North America BetaineMarket Revenue (USD Million) by Countries (2016-2021)

8.1.2 North America Revenue (USD Million), by Type, 2016 – 2028

8.1.3 North America Revenue (USD Million), by Application, 2016 – 2028

8.2 United States

8.2.1 U.S. Revenue (USD Million), by Type, 2016 – 2028

8.2.2 U.S. Revenue (USD Million), by Application, 2016 – 2028

8.3 Canada Betaine Market

8.3.1 Canada Revenue (USD Million), by Type, 2016 – 2028

8.3.2 Canada Revenue (USD Million), by Application, 2016 – 2028

8.4 Mexico Betaine Market

8.4.1 Mexico Revenue (USD Million), by Type, 2016 – 2028

8.4.2 Mexico Revenue (USD Million), by Application, 2016 – 2028

Chapter 9 Europe Betaine Market

9.1 Europe Betaine Market Size by Countries

9.1.1 Europe Revenue (USD Million) by Countries (2016-2021)

9.1.2 Europe Revenue (USD Million), by Type, 2016 – 2028

9.1.3 Europe Market Size, by Application, 2016 – 2028

9.2 Germany

9.2.1 Germany Betaine Market Size, by Type, 2016 – 2028

9.2.2 Germany Market Size, by Application, 2016 – 2028

9.3 France

9.3.1 France Betaine Market Size, by Type, 2016 – 2028

9.3.2 France Market Size, by Application, 2016 – 2028

9.4 UK

9.4.1 UK Betaine Market Size, by Type, 2016 – 2028

9.4.2 UK Market Size, by Application, 2016 – 2028

9.5 Spain

9.5.1 Spain Betaine Market Size, by Type, 2016 – 2028

9.5.2 Spain Market Size, by Application, 2016 – 2028

9.6 Russia

9.6.1 Russia Market Size, by Type, 2016 – 2028

9.6.2 Russia Market Size, by Application, 2016 – 2028

9.7 Italy

9.7.1 Italy Market Size, by Type, 2016 – 2028

9.7.2 Italy Market Size, by Application, 2016 – 2028

9.8 BENELUX

9.8.1 BENELUX Betaine Market Size, by Type, 2016 – 2028

9.8.2 BENELUX Market Size, by Application, 2016 – 2028

Chapter 10 Asia Pacific

10.1 Asia Pacific Betaine Market Size by Countries

10.1.1 Asia Pacific Market Size, by Type, 2016 – 2028

10.1.2 Asia Pacific Market Size, by Application, 2016 – 2028

10.2 China

10.2.1 China Market Size, by Type, 2016 – 2028

10.2.2 China Market Size, by Application, 2016 – 2028

10.3 Japan

10.3.1 Japan Betaine Market Size, by Type, 2016 – 2028

10.3.2 Japan Market Size, by Application, 2016 – 2028

10.4 Australia

10.4.1 Australia Market Size, by Type, 2016 – 2028

10.4.2 Australia Market Size, by Application, 2016 – 2028

10.5 South Korea

10.5.1 South Korea Betaine Market Size, by Type, 2016 – 2028

10.5.2 South Korea Market Size, by Application, 2016 – 2028

10.6 India

10.6.1 India Betaine Market Size, by Type, 2016 – 2028

10.6.2 India Market Size, by Application, 2016 – 2028

10.7 ASEAN

10.7.1 ASEAN Betaine Market Size, by Type, 2016 – 2028

10.7.2 ASEAN Market Size, by Application, 2016 – 2028

Chapter 11 Latin America

11.1 Latin America Betaine Market Size by Countries

11.1.1 Latin America Market Size, by Type, 2016 – 2028

11.1.2 Latin America Market Size, by Application, 2016 – 2028

11.2 Brazil

11.2.1 Brazil Betaine Market Size, by Type, 2016 – 2028

11.2.2 Brazil Market Size, by Application, 2016 – 2028

11.3 Argentina

11.3.1 Argentina Betaine Market Size, by Type, 2016 – 2028

11.3.2 Argentina Market Size, by Application, 2016 – 2028

11.4 Chile

11.4.1 Chile Betaine Market Size, by Type, 2016 – 2028

11.4.2 Chile Market Size, by Application, 2016 – 2028

Chapter 12 Middle East and Africa

12.1 Middle East and Africa Betaine Market Size by Countries

12.1.1 Middle East and Africa Market Size, by Type, 2016 – 2028

12.1.2 Middle East and Africa Market Size, by Application, 2016 – 2028

12.2 GCC

12.2.1 GCC Betaine Market Size, by Type, 2016 – 2028

12.2.2 GCC Market Size, by Application, 2016 – 2028

12.3 Turkey

12.3.1 Turkey Betaine Market Size, by Type, 2016 – 2028

12.3.2 Turkey Market Size, by Application, 2016 – 2028

12.4 South Africa

12.4.1 South Africa Betaine Market Size, by Type, 2016 – 2028

12.4.2 South Africa Market Size, by Application, 2016 – 2028

Chapter 13 Competitive Analysis

13.1 DuPont de Nemours, Inc.,

13.1.1 Business Overview

13.1.2 DuPont de Nemours, Inc., Business Financials (USD Million)

13.1.3 DuPont de Nemours, Inc., Betaine Product Category, Type and Specification

13.1.4 DuPont de Nemours, Inc., Main Business/Business Overview

13.1.5 DuPont de Nemours, Inc., Geographical Analysis

13.1.6 DuPont de Nemours, Inc., Recent Development

13.1.7 Swot Analysis

13.2 Associated British Food Plc.

13.2.1 Business Overview

13.2.2 Associated British Food Plc. Business Financials (USD Million)

13.2.3 Associated British Food Plc. Betaine Product Category, Type and Specification

13.2.4 Associated British Food Plc. Main Business/Business Overview

13.2.5 Associated British Food Plc. Geographical Analysis

13.2.6 Associated British Food Plc. Swot Analysis

13.3 Nutreco N.V.

13.3.1 Business Overview

13.3.2 Nutreco N.V. Business Financials (USD Million)

13.3.3 Nutreco N.V. Betaine Product Category, Type and Specification

13.3.4 Nutreco N.V. Main Business/Business Overview

13.3.5 Nutreco N.V. Geographical Analysis

13.3.6 Nutreco N.V. Recent Development

13.3.7 Nutreco N.V. Swot Analysis

13.4 American Crystal Sugar Company

13.4.1 Business Overview

13.4.2 American Crystal Sugar Company Business Financials

13.4.3 American Crystal Sugar Company Betaine Product Category, Type and Specification

13.4.4 American Crystal Sugar Company Main Business/Business Overview

13.4.5 American Crystal Sugar Company Swot Analysis

13.5 Weifang Sunwin Chemicals Co. Ltd

13.5.1 Business Overview

13.5.2 Weifang Sunwin Chemicals Co. Ltd Business Financials

13.5.3 Weifang Sunwin Chemicals Co. Ltd Betaine Product Category, Type and Specification

13.5.4 Weifang Sunwin Chemicals Co. Ltd Main Business/Business Overview

13.5.5 Weifang Sunwin Chemicals Co. Ltd Swot Analysis

13.6 Xi′an Harmonious Natural Biotechnology Co., Ltd.

13.6.1 Business Overview

13.6.2 Xi′an Harmonious Natural Biotechnology Co., Ltd. Business Financials

13.6.3 Xi′an Harmonious Natural Biotechnology Co., Ltd. Betaine Product Category, Type and Specification

13.6.4 Xi′an Harmonious Natural Biotechnology Co., Ltd. Main Business/Business Overview

13.6.5 Xi′an Harmonious Natural Biotechnology Co., Ltd. Swot Analysis

13.7 Jinan Pengbo Biotechnology Co., Ltd.

13.7.1 Business Overview

13.7.2 Jinan Pengbo Biotechnology Co., Ltd. Business Financials

13.7.3 Jinan Pengbo Biotechnology Co., Ltd. Betaine Product Category, Type and Specification

13.7.4 Jinan Pengbo Biotechnology Co., Ltd. Main Business/Business Overview

13.7.5 Jinan Pengbo Biotechnology Co., Ltd. Swot Analysis

13.8 BASF SE

13.8.1 Business Overview

13.8.2 BASF SE Business Financials (USD Million)

13.8.3 BASF SE Betaine Product Category, Type and Specification

13.8.4 BASF SE Main Business/Business Overview

13.8.5 BASF SE Geographical Analysis

13.8.6 BASF SE Recent Development

13.8.7 Swot Analysis

13.9 Solvay

13.9.1 Business Overview

13.9.2 Solvay Business Financials (USD Million)

13.9.3 Solvay Betaine Product Category, Type and Specification

13.9.4 Solvay Main Business/Business Overview

13.9.5 Solvay Geographical Analysis

13.9.6 Solvay Recent Development

13.9.7 Swot Analysis

Chapter 14 Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.