Clinical Laboratory Service Market :

The Clinical Laboratory Service market is projected to be worth USD 303.09 Billion by 2032, registering a CAGR of 4.6% CAGR during the forecast period (2024-2032), the market was valued at USD 202.20 Billion in 2024. A large number of clinical chemistry tests, the introduction of new technologies, alternative sampling techniques, and the development of point-of-care testing methods all contributed to the clinical chemistry segment’s dominance of the clinical laboratory services market. In 2020, the hospital-based laboratories sector held the biggest revenue share of 52.3% and dominated the market for clinical laboratory services. In 2020, North America held a 42.3% revenue share, dominating the market for clinical laboratory services.

Clinical Laboratory Service Market Dynamics:

Clinical laboratories are a type of medical service frequently employed in clinical practice to enhance patient diagnosis and care. This involves a public health function in communicable illness identification, prevention, and control.

Driver:

High-impact market growth drivers include the rising prevalence of chronic infections and the rising demand for early diagnostic tests. The demand for early disease detection has increased due to the release of precise and cutting-edge devices including biochips, companion diagnostics, and microarrays. This is mostly caused by rising healthcare costs as a result of the rising incidence of chronic illnesses.

Opportunity:

There is a growing demand for the storage and administration of enormous volumes of data due to the rising investments in research laboratories and the expanding penetration of research centers around the world. Additionally, the market is projected to develop as automated technologies are being adopted to boost production and cut costs. These factors are expected to provide profitable opportunities for the market.

COVID-19 Analysis of Clinical Laboratory Service Market:

Several industries were negatively impacted by the COVID-19 epidemic. Additionally, it had a substantial influence on clinical laboratory service treatments. Market demand has been hampered by lockdowns and other restrictions imposed by governments all over the world. To stop the virus from spreading, governments have also put regulations in place that postpone elective and non-urgent medical procedures.

Clinical Laboratory Service Market Report Coverage:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 (USD Billion) | 303.09 Billion |

| CAGR (2024-2032) | 4.6% |

| By Type | · Human & Tumor Genetics

· Clinical Chemistry · Medical Microbiology & Cytology · Other Esoteric Tests |

| By Service Provider | · Hospital-Based Laboratories

· Stand-Alone Laboratories · Clinic-Based Laboratories |

| By Application | · Bioanalytical & Lab Chemistry Services

· Toxicology Testing Services · Cell & Gene Therapy Related Services · Preclinical & Clinical Trial Related Services · Drug Discovery & Development Related Services · Others |

| By geography | North America– (U.S., Canada, Mexico

Europe- (Germany, France, U.K., Russia, Italy, Spain, BENELUX, Rest of Europe) Asia Pacific- (China, Japan, India, South Korea, Australia, ASEAN, Rest of Asia Pacific) Latin America- (Brazil, Argentina, Chile, Rest of Latin America) The Middle East and Africa- (GCC, Turkey, Israel, Rest of MEA) |

| Key Players | Qiagen; Quest Diagnostics, Inc.; OPKO Health, Inc.; Abbott; Charles River Laboratories; International, Inc.; Cinven; Arup Laboratories; Sonic Healthcare; Laboratory Corporation of America Holdings (LabCorp); NeoGenomics Laboratories, Inc.; Fresenius Medical Care; DaVita, Inc.; Siemens Healthcare GmbH; Viapath Group LLP; SGS SA; Almac Group |

Clinical Laboratory Service Market Segment Analysis:

By Type

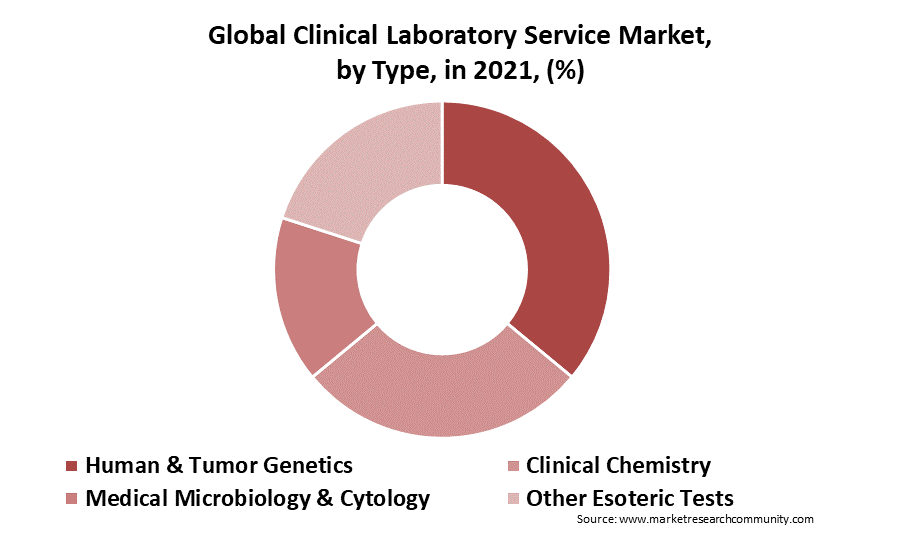

A large number of clinical chemistry tests, the introduction of new technologies, alternative sampling techniques, and the development of point-of-care testing methods all contributed to the clinical chemistry segment’s dominance of the clinical laboratory services market and its contribution of 51.5% of total revenue in 2020. For instance, Ortho Clinical Diagnostics introduced a clinical chemistry system in February 2020 to complete its integrated Vitros XT range, which is intended to accommodate the majority of common lab assays. The maximum throughput was calculated by the company to be 755 tests for single-test slides and 1,130 tests for dual-test slides per hour. Additionally, the business’s XT 3400 system obtained CE certification and is offered in the United States, Canada, Europe, India, Japan, and a few Middle Eastern nations.

By Service Provider

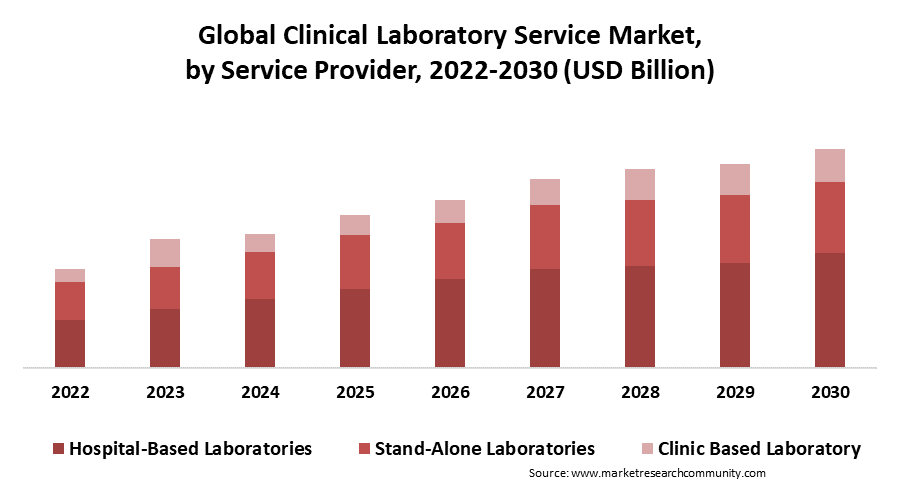

In 2020, the hospital-based laboratories sector held the biggest revenue share of 52.3% and dominated the market for clinical laboratory services. This is a result of the high turnaround times for patient tests, particularly for disorders with complex and serious diseases that are considerably more expensive. Due to attempts to improve patient outcomes by offering diagnostic facilities at the retail level, stand-alone laboratories are predicted to be the segment with the quickest growth throughout the projection period.

Additionally, rising not of hospitals and their capability for SARS-CoV-2 testing. Hospitals employed a variety of methods to secure required equipment, maintain appropriate personnel, and improve hospital facilities, according to the National Pulse Survey carried out in March 2020. Hospitals’ need for COVID-19 testing kits is anticipated to rise as a result.

By Application

The clinical laboratory services market is dominated by the bioanalytical and lab chemistry services sub-segment, which in 2024 had the biggest revenue share of 49.5%. More unique therapeutic candidates are being tested in clinical trials for a growing number of experimental pharmaceuticals. In bioanalytical and lab chemistry applications, mass spectroscopy, chromatography, molecular biology, immunochemistry, and ELISA are the most often utilized technologies. This in turn is expected to boost the demand for bioanalytical and lab chemistry services in the clinical laboratory service market.

By Region

The regional segment includes regions such as Asia Pacific, North America, Europe, the Middle East, Africa, and Latin America. In 2020, North America held a 42.3% revenue share, dominating the market for clinical laboratory services. US, Mexico, and Canada are the leading countries in the North American regional market. Due to the high prevalence of chronic diseases in the country and the necessity for clinical laboratory services for effective patient care, the U.S. is expected to experience significant growth within the area. For instance, the NCBI estimates that in 2018, 133 million Americans, or 45.0% of the population, had at least one chronic condition.

Clinical Laboratory Service Market Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Further, the surge in Research and Development (R&D), product innovation, various business strategies, and Type launches have accelerated the growth of the clinical laboratory service market. Key players in the market include-

- Qiagen

- Quest Diagnostics, Inc.

- OPKO Health, Inc.

- Abbott

- Charles River Laboratories International, Inc.

- Cinven

- Arup Laboratories

- Sonic Healthcare

- Laboratory Corporation of America Holdings (LabCorp)

- NeoGenomics Laboratories, Inc.

- Fresenius Medical Care

- DaVita, Inc.

- Siemens Healthcare GmbH

- Viapath Group LLP

- SGS SA

- Almac Group

Table of Content

- Introduction

- Market Introduction

- Market Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Data Collection Technique

- Data Sources

- Market Estimation Methodology

- Limitations of the Study

- Type Picture of Clinical Laboratory Service

- Global Clinical Laboratory Service Market: Classification

- Geographic Scope

- Years Considered for the Study

- Research Methodology in brief

- Parent Market Overview

- Overall Clinical Laboratory Service Market Regional Demand

- Research Programs/Design

- Market Breakdown and Data Triangulation Approach

- Data Source

- Secondary Sources

- Primary Sources

- Primary Interviews

- Average primary breakdown ratio

- Market Dynamics

- Drivers

- Drivers

- Restraints

- Restraints

- Opportunity

- Impact forces on market dynamics

- Impact forces during the forecast years

- Industry Value Chain

- Upstream analysis

- Downstream analysis

- Therapeutic

- Direct Channel

- Indirect Channel

- Potential Customers

- Manufacturing/Operational Cost Analysis

- Pricing Analysis by Region

- Key Type Landscape

- Regulatory Analysis

- Porter’s Analysis

- Supplier Power

- Buyer Power

- Substitution Threat

- Threat from New Entry

- Competitive Rivalry

- PESTEL Analysis

- Political Factors

- Economic Factor

- Social Factors

- Technological Factor

- Environmental Factors

- Legal Factor

- Covid-19 impact on Global Economy

- Covid-19 impact on Clinical Laboratory Service Market demand

- Post-Covid Impact on Clinical Laboratory Service Market Demand

- Impact Analysis of Russia-Ukraine Conflict

- Drivers

- Global Clinical Laboratory Service Market Segmentation, Revenue (USD Billion), (2022-2030)

- By Type

- Human & Tumor Genetics

- Clinical Chemistry

- Medical Microbiology & Cytology

- Other Esoteric Tests

- By Service provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

- By Application

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Drug Discovery & Development Related Services

- Others

- By Type

- Global Clinical Laboratory Service Market Overview, By Region

- North America Clinical Laboratory Service Market Revenue (USD Billion), by Countries, (2022-2030)

- US

- By Type

- By Service provider

- Application

- Canada

- Mexico

- US

- Europe Clinical Laboratory Service Market Revenue (USD Billion), by Countries, (2022-2030)

- France

- UK

- Spain

- Russia

- Italy

- BENELUX

- Asia Pacific Clinical Laboratory Service Market Revenue (USD Billion), by Countries, (2022-2030)

- China

- Japan

- Australia

- South Korea

- India

- ASEAN

- North America Clinical Laboratory Service Market Revenue (USD Billion), by Countries, (2022-2030)

- Latin America Clinical Laboratory Service Market Revenue (USD Billion), by Countries, (2022-2030)

- Brazil

- Argentina

- Chile

- Middle East and Africa Clinical Laboratory Service Market Revenue (USD Billion), by Countries, (2022-2030)

- GCC

- Turkey

- South Africa

- Global Clinical Laboratory Service Market Revenue: Competitive Analysis, 2021

- Key strategies by players

- Revenue (USD Billion and %), By manufacturers, 2021

- Player Positioning by Market Players, 2021

- Competitive Analysis

- Qiagen

- Business Overview

- Business Financials (USD Billion)

- Type Category, Source, and Specification

- Main Business/Business Overview

- Geographical Analysis

- Recent Development

- Swot Analysis

- Quest Diagnostics, Inc.

- OPKO Health, Inc.

- Abbott

- Charles River Laboratories International, Inc.

- Cinven

- Arup Laboratories

- Sonic Healthcare

- Laboratory Corporation of America Holdings (LabCorp)

- NeoGenomics Laboratories, Inc.

- Fresenius Medical Care

- DaVita, Inc.

- Siemens Healthcare GmbH

- Viapath Group LLP

- SGS SA

- Almac Group

- Qiagen

- Market Research Findings & Conclusion

Disclaimer

Research Methodology

The Market Research Community offers numerous solutions and its full addition in the research methods to be skilled at each step. We use wide-ranging resources to produce the best outcome for our customers. The achievement of a research development is completely reliant on the research methods implemented by the company. We always faithful to our clients to find opportunities by examining the global market and offering economic insights.Market Research Community are proud of our widespread coverage that encompasses the understanding of numerous major industry domains. Company offers consistency in our research report, we also offers on the part of the analysis of forecast across a range of coverage geographies and coverage. The research teams carry out primary and secondary research to carry out and design the data collection methods.